Welcome to Daily Banking Digest, your premier source for the latest news and insights on May 09, 2024, focusing on banking, the economy, and finance. Our platform offers a comprehensive overview of the day’s most critical financial stories, market trends, and economic developments. Whether you’re a professional in the financial sector, an investor monitoring market movement, or someone interested in staying informed about the economic landscape, Daily Banking Digest provides reliable, up-to-date information.

Join our Telegram Channel for Daily PDF in your Inbox – Click Here

Table of Contents

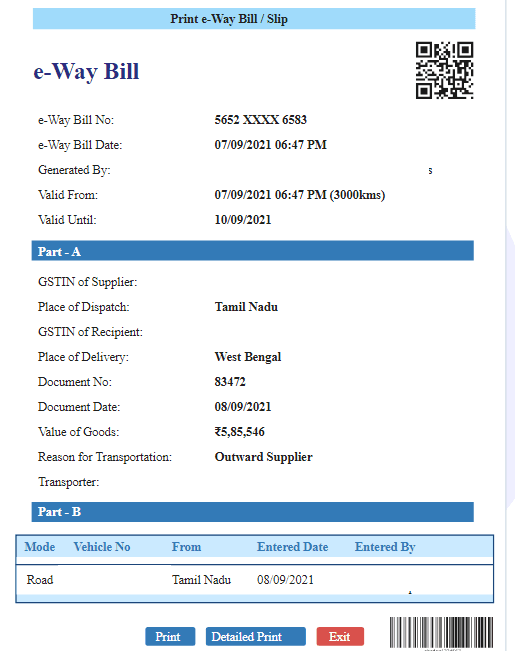

E-Way Bill Generation Declines to 9.66 Crore in April

E-way bill generation declined to 9.66 crore in April 2024, after reaching an all-time high in March. This may impact GST collection for May, which will be announced on June 1. The decline is attributed to the lower movement of goods in the first year of the fiscal year.

Key Points

E-way Bill Generation – E-way bill generation dipped to 9.66 crore in April 2024. – March 2024 recorded an all-time high of 10.35 crore e-way bills. – E-way bill generation was lower in April 2023 (8.44 crore) compared to April 2022 (9.09 crore).

GST Collection – GST collection in April 2024 reached an all-time high of ₹2.10-lakh crore. – GST collection in May 2023 slipped to ₹1.57-lakh crore due to a decline in e-way bill generation.

E-way Bill – An e-way bill is an electronic document that evidences the movement of goods and indicates tax payment. – Registered persons must generate an e-way bill for goods valued over ₹50,000.

GST-E-way Bill Linkage – The linkage between e-way bills and e-invoicing has brought more supplies under the GST net. – Technology-driven scrutiny and compliance mechanisms have contributed to the sustained growth in e-way bill generation.

CEA: High Probability of GDP Growth Reaching 8% in FY24

Chief Economic Adviser V Anantha Nageswaran predicts India’s GDP growth to reach 8% in FY24, exceeding the IMF’s projection of 7.8%. This optimism stems from robust growth in the first three quarters of FY24. However, the monsoon’s performance and the RBI’s recent guidelines on infrastructure project financing could impact growth. Beyond FY25, India is expected to grow between 6.5-7% due to improved balance sheet strength and infrastructure investments.

Key Points:

- GDP Growth Forecast: 8% growth in FY24, higher than IMF’s 7.8% projection.

- Robust Growth: GDP growth of 8.4% in Q3, 7.6% in Q2, and 7.8% in Q1 of FY24.

- RBI’s Estimate: 7.5% growth for FY24, 7% for FY25.

- IMF’s Estimate: 6.8% growth for FY25.

- Monsoon Impact: Monsoon’s performance will influence growth.

- Growth Beyond FY25: 6.5-7% growth expected due to improved balance sheet strength and infrastructure investments.

- Household Savings: Net financial savings flows lower in 2022-23 due to shift to real sector.

- RBI’s Infrastructure Project Financing Guidelines: Draft guidelines propose higher provisions for under-construction projects.

Paytm’s Loan Guarantees Potentially Invoked by Aditya Birla Finance and Others

Aditya Birla Finance has invoked loan guarantees provided by Paytm due to repayment defaults from customers. Other lending partners have also halted partnerships with Paytm, indicating stress in its lending business. Paytm’s expected credit loss for personal loans is estimated at 4.5-5.0%.

Key Points:

Loan Guarantee Invocation: – Aditya Birla Finance has invoked loan guarantees provided by Paytm. – The amount invoked is estimated to be hundreds of crores of rupees. – This will impact Paytm’s financials amid a wider clampdown on the sector by the central bank.

Expected Credit Loss: – Paytm’s expected credit loss for personal loans is estimated at 4.5-5.0%. – This indicates a high level of risk associated with Paytm’s lending business.

Lending Partners Halting Disbursals: – Piramal Finance and Clix Capital have also halted partnerships with Paytm. – This is due to stress in Paytm’s lending business and the central bank’s ban on Paytm Payments Bank.

Impact on Collections: – Halting disbursals has impacted repayments severely. – When lending partners are in the news for negative reasons, collections of loans suffer.

Paytm’s Response: – Paytm denies speculations concerning its lending business. – It claims to have resumed lending services with select partners and is actively engaged in discussions to expand with others. – Paytm does not provide a First Loss Default Guarantee (FLDG) to lenders.

Stringent Arrangements: – Sourcing arrangements between NBFCs and fintechs like Paytm are registered in the books of the lender. – Repayments are sent directly to the lender. – Fintech firms receive a commission.

NBFCs Cautious about Unsecured Consumer Lending: – NBFCs have become cautious about unsecured consumer lending due to increased risk weightage. – This has led to many NBFCs cutting back on their exposure to such products.

Paytm’s Withdrawal of Buy-Now-Pay-Later Product: – Paytm has withdrawn its buy-now-pay-later product, Paytm Postpaid. – It is focusing on longer-tenure products.

Government Considers RBI’s Proposal for Enhanced Infrastructure Funding, Raising Concerns Among Bankers and NBFCs

The Reserve Bank of India (RBI) has proposed new draft rules requiring higher provisioning for infrastructure projects. Lenders are expected to oppose these rules, citing concerns about increased interest rates and potential derailment of capital expenditure momentum. The government is evaluating the draft rules and will consult with the RBI before finalizing them.

Key Points:

Banks Set to Lobby Against Steep Increase:

- Banks will argue that the sharp increase in provisions may stall economic growth and impact project viability.

- They will likely make their views known through the Indian Banks’ Association (IBA).

State-Owned NBFCs to Communicate Concerns:

- State-owned power sector NBFCs, such as REC and Power Finance Corp, will directly communicate their concerns to the RBI.

- The Department of Financial Services will also flag any concerns raised by state-owned lenders.

Fallout:

- Private sector bank executives believe the increase is too steep and lacks justification.

- Banks will provide feedback based on their observations.

- The new norms could force banks to rethink lending to the infrastructure sector.

Proposed Guidelines:

- Lenders will be required to set aside up to 5% of outstanding exposure as provisions during the construction phase of projects.

- This will be reduced to 2.5% when the project is operational and 1% after adequate cash flow is generated.

- The provisions will be implemented in phases over three financial years.

Impact on Infrastructure NBFCs:

- Stocks of key infrastructure NBFCs have fallen in response to the proposed guidelines.

- The new norms could impact the capital adequacy ratio of infra-focused NBFCs.

Assessments Ongoing:

- The road ministry is evaluating the implications of the guidelines.

- IIFCL is studying the draft guidelines and will provide inputs accordingly.

Additional Burden:

- The new provisions may make projects more expensive and impact bank profitability.

- Banks may become more cautious about exposure to project finance.

Funding Challenges:

- The mandatory tail period accounting for 15% of a project’s economic life could restrict additional top-up loans.

- This may necessitate an increase in equity requirements for road projects.

RBI Governor Explores Strategies for Enhancing the UPI Ecosystem with Industry Leaders

Reserve Bank of India (RBI) Governor Shaktikanta Das met with stakeholders in the Unified Payments Interface (UPI) ecosystem to discuss strategies for scaling up the system, expanding products, and fostering innovation.

Key Points:

- Scaling Up UPI Infrastructure:

- Strategies to enhance the capacity and reliability of the UPI system.

- Expanding Product Portfolio:

- Exploring new products and services that can be integrated into UPI.

- Challenges and Solutions:

- Identifying and addressing challenges faced by the UPI ecosystem.

- Innovative Payment Solutions:

- Encouraging the development of innovative payment solutions to enhance user experience.

- Integration of Potential Users:

- Strategies to bring more users into the digital payments ecosystem through UPI.

- Stakeholder Input:

- Valuable inputs and suggestions were received from banks, NPCI, third-party application providers, and technology service providers.

- RBI Action:

- The suggestions will be examined, and appropriate actions will be taken by the Reserve Bank.

NBFCs Directed by RBI to Adhere to Loan Cash Disbursement Limit of Rs. 20,000

The Reserve Bank of India (RBI) has instructed non-bank finance companies (NBFCs) to strictly adhere to a cap of 20,000 rupees ($240) in cash loans to deter cash transactions. This directive follows recent action against IIFL Finance for violating rules, including disbursing and collecting loans in cash exceeding the statutory limit.

Key Points:

- Cash Loan Cap: NBFCs must not disburse cash loans exceeding 20,000 rupees.

- Legal Basis: The cap is based on Section 269SS of the Income Tax Act, 1961, which prohibits individuals from receiving more than 20,000 rupees in cash loans.

- Enforcement: The RBI has taken action against IIFL Finance for violating cash loan regulations.

- Objective: The directive aims to reduce cash transactions and promote transparency in the financial sector.

Kotak Mahindra Bank Embarks on Tech Transformation with Plans to Hire 400 Engineers

Kotak Mahindra Bank plans to hire 400 engineers this year to upgrade its technology systems after facing regulatory scrutiny for lapses. The bank has already hired over 500 engineers in the past two years and plans to achieve a “critical mass” in talent this year. The increased spending on technology aims to address the RBI’s ban on adding new customers through digital channels and issuing credit cards.

Key Points:

Hiring Plan: – Plans to hire around 400 engineers this year. – Already hired over 500 engineers in the past two years. – Aiming to achieve a “critical mass” in talent.

Technology Spending: – Boosted spending on technology by over 30% to 17 billion rupees in the year ended March 31. – Technology spending makes up about 10% of operating expenses. – Spending expected to rise as the bank deepens its technology build-out.

Regulatory Scrutiny: – RBI imposed a ban on adding new customers through digital channels and issuing fresh credit cards. – Governance and risk management in technology systems were cited as reasons for the ban. – Bank is doubling efforts and resources to address the issues.

Technology Focus: – Using artificial intelligence in fraud risk management, customer service, and sentiment analysis. – 98% of transaction volume in savings accounts is through digital or non-branch methods. – 95% of new personal loans and 99% of new credit cards sold digitally in the third quarter.

Backend Improvements: – Focusing on improving backend resiliency, uptime, and cybersecurity. – Aiming to handle exponentially growing digital transaction volumes.

Indian Banks Increase IT Investments Amidst Heightened Regulatory Oversight

Indian banks are increasing their technology spending to 10% of operating expenses to address the surge in digital transactions and meet regulatory scrutiny. The Reserve Bank of India (RBI) has intensified its focus on reducing technology-related outages, leading banks to prioritize IT investments.

Key Points:

Increased Technology Spending: – Banks plan to increase technology spending to 10% of operating expenses, up from 6%-8%. – This is in line with the global average of 10%-12%.

RBI Scrutiny: – The RBI has increased scrutiny of banks’ IT systems, imposing sanctions on Kotak Mahindra Bank for technology deficiencies. – Banks are taking the regulator’s concerns more seriously.

Core System Upgrades: – Investments will focus on upgrading core systems, which form the backbone of banking operations.

Digital Fraud Monitoring: – Banks will invest in better monitoring of digital frauds to protect customer data.

Customer Verification: – Tech-driven processes will be implemented for customer verification.

Cybersecurity: – Banks and the RBI are prioritizing cybersecurity due to increased operational risks associated with new technology integrations.

Digital Transaction Growth: – Over 40% of payments in India are now digital, leading to a surge in digital banking transactions.

Outdated Core Banking Systems: – Many banks’ core banking systems are outdated and need to be assessed for their ability to handle the rise in digital activity.

RBI Removes Restrictions on Bank of Baroda’s ‘Bob World’ App, Enables Customer Onboarding

The Reserve Bank of India (RBI) has lifted restrictions on Bank of Baroda’s Bob World app, allowing the bank to resume onboarding new customers. The decision was made after the bank implemented corrective actions to address supervisory concerns raised by the RBI.

Key Points:

- RBI Lifts Restrictions on Bob World App: The RBI has lifted restrictions on Bank of Baroda’s Bob World app, allowing it to onboard customers.

- Bank of Baroda Resumes Onboarding: The bank will now resume onboarding new customers in the Bob World application.

- Corrective Actions Implemented: Bank of Baroda has implemented corrective actions to rectify the issues raised by the RBI.

- Commitment to Compliance: The bank remains committed to ensuring adherence and compliance with regulatory guidelines.

- Previous Suspension: In October 2023, the RBI had directed Bank of Baroda to suspend onboarding of customers onto the Bob World app due to supervisory concerns.

Supreme Court Rules Interest-Free Loans to Bank Employees Taxable as Fringe Benefits

The Supreme Court has ruled that interest-free or concessional loans provided by banks to their employees are taxable as “fringe benefits” or “amenities.” The court upheld the income tax rule that classifies such benefits as “perquisites,” which are liable to taxation.

Key Points:

Definition of Perquisite: – Perquisite is a fringe benefit attached to an employee’s position, unlike profit in lieu of salary, which is a reward for past or future service. – It is an advantage or benefit provided due to employment that would not otherwise be available.

Benchmark for Interest Rate: – The fixation of SBI’s prime lending rate as the benchmark for calculating the perquisite is not arbitrary or unequal. – It prevents unnecessary litigation by establishing a clear benchmark for all banks.

Validity of Tax Provisions: – The tax provisions are not iniquitous, draconian, or harsh on taxpayers. – The complex problem of taxing interest-free loans has been solved through a “straitjacket formula” that merits judicial acceptance.

Judicial Deference to Legislative Wisdom: – Laws relating to fiscal or tax measures enjoy greater latitude than other statutes. – The legislature should be allowed flexibility in such matters, and the court is inclined to give judicial deference to legislative wisdom.

Prevention of Abuse and Certainty: – The legislation prevents possibilities of abuse and promotes certainty in the taxation of fringe benefits.

India Surges Past Japan as the Third-Largest Solar Powerhouse in 2023

India has emerged as the world’s third-largest solar power generator, surpassing Japan, due to its rapid deployment of solar energy. In 2023, solar accounted for 5.8% of India’s electricity generation, contributing to the global trend of increasing clean electricity production. India’s solar growth is crucial for meeting rising electricity demand, decoupling economic growth from emissions, and achieving its climate goals.

Key Points:

India’s Solar Power Generation: – India ranked ninth in solar energy deployment in 2015. – In 2023, India became the world’s third-largest solar power generator. – Solar produced 5.8% of India’s electricity in 2023.

Global Solar Energy Trends: – Solar is the world’s fastest-growing electricity source for 19 consecutive years. – Solar accounted for 5.5% of global electricity in 2023. – India saw the world’s fourth-largest increase in solar generation in 2023.

India’s Climate Goals: – India has committed to achieving 50% non-fossil fuel-based energy capacity by 2030. – Accelerating the transition to cleaner generation sources is crucial for meeting India’s climate goals.

Global Renewable Energy Targets: – World leaders agreed to triple global renewable energy capacity by 2030 at COP28. – Tripling global renewable energy capacity and doubling energy efficiency are crucial for limiting global temperature rise to 1.5 degrees Celsius.

India’s Renewable Energy Plans: – India is one of the few countries planning to triple renewable capacity by 2030. – India needs to significantly increase annual capacity additions to meet its renewable energy target.

SEBI Extends Settlement Window for Stock Option Cases to June 10

The Securities and Exchange Board of India (Sebi) has extended the settlement scheme period for entities involved in reversal trades in the stock options segment on BSE from May 10 to June 10, 2024. The scheme provides an opportunity for entities to settle pending adjudication proceedings related to such trades.

Key Points:

- Extension of Settlement Scheme Period: The settlement scheme period has been extended to June 10, 2024, to accommodate the interest of entities in availing the scheme.

- ISO Settlement Scheme 2024: The scheme provides a settlement opportunity for entities involved in trade reversals in the stock options segment of BSE from April 1, 2014, to September 30, 2015.

- Avoidance of Legal Proceedings: By availing the scheme, entities can settle pending proceedings and avoid further delays and legal expenses.

- Previous Settlement Schemes: Sebi has previously offered settlement schemes for similar cases in 2020 and 2022-2023.

- Number of Entities Availing Settlement: Over 10,000 entities have availed the benefit of previous settlement schemes.

- Settlement Charges: Entities settling under the scheme have paid charges ranging from Rs 1 lakh to Rs 42 lakh.

- Surveillance and Detection: Sebi’s ongoing surveillance identified instances of consistent losses in options trading on individual stocks by certain entities.

SEBI Imposes Rs. 15 Crore Penalty on Panchariya for GDR Manipulation in Winsome Yarns Case

SEBI has imposed a penalty of Rs 15 crore on Arun Panchariya for his alleged involvement in fraudulent activities related to the issuance of Global Depository Receipts (GDRs) by Winsome Yarns Ltd. The ruling comes after the Securities Appellate Tribunal (SAT) asked SEBI to re-examine the matter, affirming SEBI’s findings regarding the first leg of the transaction but questioning the connection between Panchariya and entities involved in the second leg.

Key Points:

- Penalty Imposed: SEBI has imposed a penalty of Rs 15 crore on Arun Panchariya for fraudulent activities related to GDR issuance.

- SAT Ruling: SAT affirmed SEBI’s findings regarding the first leg of the transaction but questioned the connection between Panchariya and entities involved in the second leg.

- Fraudulent Scheme: SEBI alleges that Panchariya orchestrated a fraudulent scheme in collaboration with connected entities and Winsome Yarns Ltd., defrauding Indian investors by subscribing to GDRs and selling converted equity shares in the market.

- Two-Legged Transaction: SEBI identifies two legs of the transaction: the issuance of GDRs and the liquidation of GDRs, with Panchariya allegedly playing a role in both legs.

- Manipulative Enterprise: SEBI asserts that the issuance of GDRs involved misleading investors, concealing crucial information, and distorting GDR-related information, constituting a manipulative enterprise.

- Benefit to Panchariya: SEBI believes that Panchariya benefited from the fraudulent scheme, although the extent of his involvement in the second leg of the transaction remains uncertain.

Finance Commission Invites Public Input on Mandate

The 16th Finance Commission has invited public feedback on its terms of reference, which include reviewing center-state financial relations, tax devolution, and disaster management funding. The commission, chaired by Arvind Panagariya, will submit its report by October 2025, covering the period from April 2026 to March 2031.

Key Points:

Terms of Reference: – The commission will review center-state financial relations, including tax devolution and revenue augmentation measures. – It will also examine disaster management funding arrangements under the Disaster Management Act, 2005.

Composition: – The commission is chaired by Arvind Panagariya. – Other members include Ajay Narayan Jha, Annie George Mathew, Manoj Panda, and Soumya Kanti Ghosh.

Timeline: – The commission was constituted on December 31, 2023. – It will submit its report to the President by October 31, 2025. – The report will cover the period from April 1, 2026 to March 31, 2031.

Public Feedback: – The public can submit suggestions through the commission’s website.

Previous Recommendations: – The 15th Finance Commission recommended a 41% tax devolution to states for the period 2021-22 to 2025-26.

Google Introduces Wallet App in India for Android, Excluding Payment Functionality

Google has launched the Google Wallet app in India, allowing users to store and access essential digital documents like boarding passes, gift cards, and event passes in one place. The app does not support payment features like saving credit or debit cards for on-tap payments.

Key Points:

Launch of Google Wallet in India: – Google Wallet app launched in India, enabling users to store digital documents. – Does not support payment features like saving credit or debit cards.

Features of Google Wallet: – Stores boarding passes, loyalty cards, movie tickets, and more. – Complements Google Pay, which continues to serve payment needs.

Partnerships and Availability: – Google has partnered with 20 top Indian brands, including PVR, Air India, and Flipkart. – Available for download from the Google Play Store for all Android users in India.

Security and Privacy: – Built to the highest security and privacy standards. – Users have full control over stored information and its usage.

Quotes from Google and Partners: – Google highlights the convenience and innovation of Google Wallet. – Air India, Flipkart, and PVR INOX express their excitement about the partnership and the benefits it offers to customers.

Canara Bank’s Q4 Profit Surges 18% to ₹3,757 Crore

Canara Bank reported a significant increase in its net profit for Q4 FY24, driven by higher net interest income and improved asset quality. The bank’s full-year net profit also saw a substantial rise, and it recommended a dividend of ₹16.10 per share.

Key Points

Net Profit – Q4 FY24: ₹3,757.23 crore, up 18.33% – Full FY24: ₹14,554 crore, up 37%

Net Interest Income – Q4 FY24: ₹9,580 crore, up 11.18%

Asset Quality – Gross NPAs decreased to 4.23% as of March 2024 – Provision for non-performing loans decreased to ₹2,280 crore

Outlook – Gross NPA expected to decline to 3.25% by FY25-end – Net NPA expected to reach 1% by FY25-end – NIM expected to remain in the 2.95-3% range

Business Growth – Global business increased 11.31% to ₹22,72,968 crore – Domestic deposits grew 10.98% to ₹12,14,951 crore – Domestic advances increased 11.06% to ₹9,08,182 crore – Retail lending portfolio grew 11.68% to ₹1,56,414 crore – Housing loan portfolio increased 10.81% to ₹93,482 crore – Advances to agriculture and allied sector grew 18.69% to ₹2,53,206 crore

Google Contests CCI’s Market Dominance Claim in NCLAT Appeal

Google has challenged the Competition Commission of India’s (CCI) penalty of Rs 936 crore, arguing that the regulator failed to prove that Google’s policies harmed competition. Google claims that CCI’s concerns were based on assumptions and that the company did not violate any norms.

Key Points:

1. Google’s Argument: – CCI’s penalty is “amorphous and overbearing.” – CCI failed to establish that Google’s policies eroded competition.

2. Google Play Billing System (GPBS): – GPBS only collects service fees and does not prevent other payment processors from entering the market. – CCI has not proven that GPBS has reduced competition.

3. Denial of Market Access: – CCI has claimed denial of market access but has not defined the market.

4. Preference for GPay: – Google followed rules set by the National Payments Corporation of India in giving preference to GPay. – Not all UPI apps are mature for the collect-flow system used by GPay.

5. User and Developer Choices: – Google offers choices to users and developers.

UPI Service Providers Seek Regulatory Intervention for Profitable Transactions

UPI payment service providers have requested regulatory intervention to make transactions remunerative, enabling smaller players to invest and compete with the dominant market share held by Google Pay and PhonePe. The meeting with RBI officials also discussed expanding UPI infrastructure, enhancing accessibility for senior citizens, and exploring innovative solutions to integrate potential users into the digital payment ecosystem.

Key Points:

Regulatory Intervention: – UPI service providers seek regulatory intervention to make transactions remunerative. – Smaller players propose charging a transaction fee on larger shops to cover customer acquisition costs.

Market Dominance: – Google Pay and PhonePe hold a combined 84% market share in the UPI ecosystem. – Smaller players face an uphill battle in competing with these dominant players.

Core Banking Solution: – Banks assure RBI that their core banking solution is capable of handling increased UPI transactions.

Accessibility for Senior Citizens: – Discussions focus on making UPI service more accessible and user-friendly for senior citizens.

Revenue Model: – Smaller UPI service providers emphasize the need for a revenue model to support their operations. – Government discourages charges on UPI transactions, making it financially challenging for small players.

RBI’s Focus: – RBI’s discussion with stakeholders aims to widen and deepen the adoption and usage of UPI. – RBI seeks innovative ideas to integrate potential users into the digital payment ecosystem.

NPCI’s Volume Cap: – NPCI proposed a 30% volume cap on third-party app providers by the end of 2024. – Smaller UPI service providers express concerns about their ability to scale up within the given timeframe.