Table of Contents

Understanding the camels

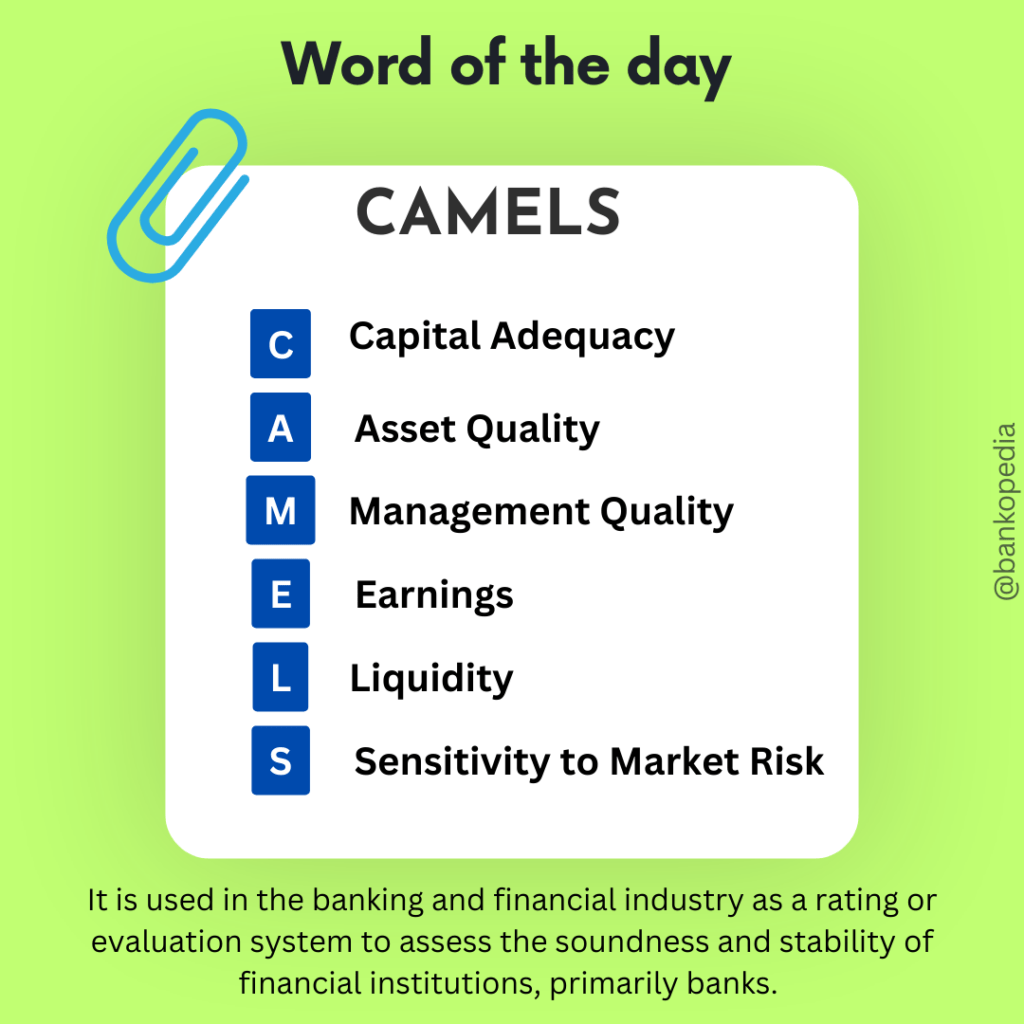

The CAMELS rating system is a widely recognized international banking supervisory tool that assesses the overall health and stability of financial institutions. Developed by regulatory agencies, it provides a systematic framework to gauge and compare the robustness of banks across several key dimensions. In this article, we will delve into the six components of the CAMELS rating system: Capital Adequacy, Asset Quality, Management Quality, Earnings, Liquidity, and Sensitivity to market risk. Understanding these components is crucial for regulators, bankers, and analysts to evaluate and ensure the stability of the banking sector.

Component 1: Capital Adequacy

Definition: Capital Adequacy measures a bank’s ability to absorb a reasonable amount of loss by maintaining a buffer of financial resources.

Significance: It protects against insolvency and ensures that banks have sufficient capital to support their operations.

Metrics: The CAMELS rating system analyzes capital adequacy through ratios such as the Tier 1 capital ratio and the total capital ratio.

Capital adequacy is a fundamental component of the CAMELS rating system. It measures a bank’s ability to absorb potential losses and maintain financial stability. A bank with higher capital adequacy ratios is better equipped to withstand economic downturns and unexpected shocks. Regulators and analysts closely monitor these ratios to ensure that banks maintain adequate capital levels.

Component 2: Asset Quality

Definition: Asset Quality evaluates the quality and condition of a bank’s assets.

Significance: It reflects the bank’s investment quality and potential loss exposure.

Metrics: Non-performing assets (NPAs), loan-to-value ratios, and the concentration of assets in particular sectors or products.

Asset quality is a critical factor in assessing a bank’s financial health. Banks with a high proportion of non-performing assets or a concentration of risky assets are more vulnerable to losses. The CAMELS rating system examines metrics such as NPAs, loan-to-value ratios, and the diversification of assets to assess asset quality. A strong asset quality rating indicates a bank’s ability to manage risks effectively and minimize potential losses.

Component 3: Management Quality

Definition: Management Quality scrutinizes the competence, experience, and performance of a bank’s management team.

Significance: Strong leadership is crucial to navigate through financial complexities and regulatory compliance.

Metrics: Strategic planning, risk management proficiency, and the effectiveness of internal controls.

Management quality plays a vital role in the overall health and stability of a bank. A capable and experienced management team ensures effective strategic planning, risk management, and regulatory compliance. The CAMELS rating system evaluates management quality through metrics like strategic planning, risk management proficiency, and the effectiveness of internal controls. Banks with strong management teams are better equipped to adapt to changing market conditions and steer the institution towards sustainable growth.

Component 4: Earnings

Definition: Earnings refer to the profitability and financial results of the bank.

Significance: Sustained earnings are pivotal for supporting operations, augmenting capital, and absorbing possible losses.

Metrics: Return on assets (ROA), net interest margin (NIM), and the efficiency ratio.

Earnings are a crucial aspect of a bank’s financial health. Sustained profitability ensures that a bank can support its operations, generate capital, and absorb potential losses. The CAMELS rating system evaluates earnings using metrics such as return on assets, net interest margin, and efficiency ratio. Banks with consistent and strong earnings are more likely to weather economic downturns and maintain financial stability.

Component 5: Liquidity

Definition: Liquidity refers to a bank’s capacity to meet its short-term obligations and operational needs.

Significance: It ensures survival during financial stress by enabling the bank to fulfill cash demands.

Metrics: Liquid assets to total assets, net loans to total deposits, and the availability of high-quality liquid assets.

Liquidity is a critical factor in the stability of a bank. Adequate liquidity ensures that a bank can meet its short-term obligations, fulfill customer demands, and withstand financial stress. The CAMELS rating system assesses liquidity through metrics such as the ratio of liquid assets to total assets, the ratio of net loans to total deposits, and the availability of high-quality liquid assets. Banks with strong liquidity profiles are better positioned to manage unexpected cash outflows and maintain market confidence.

Component 6: Sensitivity to Market Risk

Definition: Sensitivity to Market Risk assesses a bank’s vulnerability to changes in market conditions, such as interest rate shifts.

Significance: It maintains stability in fluctuating market scenarios, safeguarding against potential losses.

Metrics: The impact of changes in interest rates, currency exchange rates, and other market variables on the bank’s earnings and capital.

Sensitivity to market risk measures a bank’s ability to withstand market fluctuations and manage potential losses arising from changes in interest rates, exchange rates, and other market variables. The CAMELS rating system evaluates this component by analyzing the impact of market conditions on a bank’s earnings and capital. Banks with effective risk management strategies and robust capital buffers are better equipped to navigate market volatility and safeguard against potential losses.

Applications and Implications of the CAMELS Rating System

The CAMELS rating system serves several important purposes within the banking industry:

- Regulatory Oversight: The CAMELS rating system enables regulators to identify potential issues, enforce corrective action, and ensure the stability of the banking sector. It provides a standardized framework for assessing bank health and enables regulators to make informed decisions based on objective criteria.

- Risk Management: Banks can use the CAMELS rating system to identify and manage various risks. By evaluating the components of the rating system, banks can identify areas of weakness and implement strategies to mitigate risks. This promotes a stable and secure operational environment within the banking industry.

- Investor and Customer Confidence: A sound CAMELS rating indicates a robust financial institution, instilling confidence among investors and customers. Investors and customers often rely on the CAMELS rating system to assess the financial health and stability of banks. A strong rating can attract investment and foster trust in the banking institution.

Challenges and Criticisms

While the CAMELS rating system is globally acknowledged, it is not without its challenges and criticisms:

- Subjectivity: Although metrics are used, aspects like management quality can be somewhat subjective and prone to bias. The interpretation of qualitative factors can vary among regulators and analysts, leading to inconsistencies in ratings.

- Dynamic Financial Landscape: Rapid technological and financial innovations may present new challenges that the CAMELS model might not fully capture. The evolving nature of the financial industry requires continuous adaptation and refinement of the rating system.

- Data Privacy: The confidentiality of the ratings might impede transparency and comprehensive understanding among external stakeholders. Limited access to detailed rating information may hinder the ability of investors and the public to make informed decisions.

Conclusion

The CAMELS rating system is instrumental in evaluating the overall health and stability of banks. It ensures that banks adhere to prudent banking practices and maintain robust financial metrics. By assessing components such as capital adequacy, asset quality, management quality, earnings, liquidity, and sensitivity to market risk, regulators, bankers, and analysts can gain insights into the strengths and weaknesses of banks. Despite its challenges, the CAMELS framework continues to be a cornerstone in global banking supervision, adapting to the evolving financial landscape and promoting stability within the banking sector.