Welcome to Daily Banking Digest, your premier source for the latest news and insights on April 25, 2024, focusing on banking, the economy, and finance. Our platform offers a comprehensive overview of the day’s most critical financial stories, market trends, and economic developments. Whether you’re a professional in the financial sector, an investor monitoring market movement, or someone interested in staying informed about the economic landscape, Daily Banking Digest provides reliable, up-to-date information.

Join our Telegram Channel for Daily PDF in your Inbox – Click Here

Table of Contents

Tax Clauses in M&A Agreements to Undergo Revision Following India-Mauritius Treaty Amendment

The amendment to the India-Mauritius tax treaty necessitates a review of tax indemnity clauses in M&A deals involving foreign investors from Mauritius. Buyers will no longer be willing to assume the risk of capital gains tax liability, leading to potential renegotiations of indemnity clauses or the use of escrow accounts. The amendment also impacts tax withholding insurance products, as insurers will need to reassess their underwriting parameters.

Key Points:

Indemnity Clause:

- Buyers will no longer be willing to take the risk of capital gains tax liability.

- Indemnity clauses may be renegotiated to protect buyers from future tax liability.

- Escrow accounts may be used to hold a portion of the sale consideration until the tax liability is resolved.

Underwriting Parameters:

- The amendment will impact tax withholding insurance products.

- Insurers will need to revisit their underwriting parameters.

- The probability of a capital gains tax liability becomes a big unknown for insurers.

Principal Purpose Test:

- The amendment introduces a principal purpose test, which is a higher threshold than GAAR.

- The test may be applied to all future exits, regardless of the investment date.

- The private equity industry fears indiscriminate use of these provisions to deny tax exemption on capital gains.

States Urged to Sell Excess Electricity in Market to Optimize Power Distribution

As India enters the peak power demand season, the Power Ministry has urged states to ensure that generating companies offer surplus electricity in the market. This is to prevent unused power capacity and meet the increasing demand. The ministry has highlighted the Tariff Policy 2016 and Electricity (Late Payment Surcharge and Related Matters) Rules, which allow generators to sell un-requisitioned power in the market.

Key Points:

Power Market: – Power stations are required to be available and ready to dispatch at all times. – Generators are permitted to sell un-requisitioned power in the power market.

Peak Power Demand: – India is entering the peak power demand season, with peak demand expected to reach 260 GW. – Power demand hit a high of almost 215 GW on April 18.

Un-requisitioned Power: – The Ministry of Power issued guidelines in October 2021 for optimizing the utilization of generating stations. – Section 9 (5) of the Electricity (Late Payment Surcharge and Related Matters) Rules allows for the sale of surplus power.

Existing FSAs: – Existing Fuel Supply Agreements (FSAs) do not allow the use of linkage coal for purposes other than meeting long-term power purchase agreements (PPAs). – The Tariff Policy 2016 and Electricity (Late Payment Surcharge and Related Matters) Rules allow generators to offer un-requisitioned surplus power in the market, including those with long-term coal linkages.

RBI Urges Banks to Enhance Vigilance Against Unauthorized Forex Trading

The Reserve Bank of India (RBI) has issued an advisory to banks to enhance vigilance and prevent unauthorized forex trading. Banks are instructed to report suspicious accounts used for such activities to the Directorate of Enforcement. The advisory stems from concerns about unauthorized entities offering forex trading with excessive returns and using local agents to open accounts for collecting funds.

Key Points:

- Unauthorized Forex Trading: RBI has identified instances of unauthorized entities offering forex trading facilities to Indian residents with promises of disproportionate returns.

- Account Misuse: These entities use local agents to open accounts at different bank branches for collecting funds related to forex trading.

- Suspicious Transactions: Transactions in these accounts often do not align with the stated purpose of opening the account.

- Domestic Payment Systems: Unauthorized entities are using domestic payment systems like online transfers and payment gateways to facilitate forex transactions.

- Customer Advisory: RBI advises banks to inform customers to engage in forex trading only with authorized persons and on authorized electronic trading platforms.

FEMA Regulations Unveiled by RBI for Direct Listings on International Exchanges

The Reserve Bank of India (RBI) has introduced new regulations under FEMA to facilitate the listing of Indian companies on international stock exchanges. These regulations provide companies with greater flexibility in managing foreign exchange and utilizing funds raised through overseas listings.

Key Points:

Mode of Payment and Reporting of Non-Debt Instruments:

- Proceeds from the purchase or subscription of equity shares of Indian companies listed on international exchanges must be remitted to an Indian bank account or deposited in a foreign currency account of the Indian company.

- Sale proceeds (net of taxes) can be remitted outside India or credited to the bank account of the permissible holder.

- Transaction reporting in foreign exchange will be done by the investee Indian company through an authorized dealer.

Foreign Currency Accounts by Persons Resident in India:

- Funds raised through ECBs, ADRs, GDRs, or direct listing of equity shares on international exchanges but not yet utilized or repatriated can be held in foreign currency accounts with a bank outside India.

Flexibility in Funds Management:

- Companies can keep funds raised through overseas listings in forex until they are used, enabling efficient utilization for overseas acquisitions, expansions, and other forex purposes.

- Companies have flexibility in managing funds based on their operational needs and investment strategies.

Reporting Requirements:

- Transactions of FPIs on domestic and international exchanges must be reported to the RBI through designated channels, ensuring transparency and compliance.

Integration into Global Market:

- These regulations aim to integrate Indian businesses into the global market, allowing them to compete on an equal footing and attract foreign investments.

- Companies should align their strategies with these regulations to optimize the advantages provided and succeed in the international finance landscape.

RBI Bulletin: Favorable Conditions for Sustained Economic Growth in India, Projecting Real GDP Growth Above 8% from 2021-24

India’s economy is expected to continue its growth trajectory, with conditions favorable for an extension of the trend upshift that has seen average real GDP growth exceed 8% during 2021-24. The descent of retail inflation to the 4% target is imminent, supported by strengthening corporate credit quality, sustained domestic demand, and public capital expenditure.

Key Points

Economic Growth – India’s economy is growing at a robust pace, with an average annual growth of 8% over the last three years. – The evolution of inflation dynamics is providing a tailwind to growth impulses. – Fixed capital stock is contributing significantly to the growth of gross value added (GVA). – India must grow at a rate of 8-10% per annum over the next decade to reap the demographic dividend.

Inflation – Consumer price index (CPI) inflation has gravitated to 4.9% in March. – Core inflation has moderated to historic lows. – Food inflation remains elevated and poses a potential risk to the disinflation trajectory. – Extreme weather events and geopolitical tensions could keep crude oil prices volatile.

Labor Force – India’s working age population is expanding, providing a cutting edge for growth. – The growth strategy must focus on labor quality to harness favorable demographics.

India’s Steel Demand Projected to Grow 8-10% in Fiscal Year 2025: TV Narendran

Global steel prices, including in India, are heavily influenced by China’s production and exports. India’s steel demand is projected to grow by 8-10% in FY25, but imports remain a concern. India’s status as a net steel importer is seen as temporary, and the country’s strong consumption story is expected to continue.

Key Points:

India’s Steel Demand: – Expected to grow by 8-10% in FY25, driven by infrastructure development.

Steel Imports: – India became a net importer in FY24, but this is seen as a temporary phenomenon. – Most imported steel is commodity grade and can be produced domestically. – Government needs to address unfair imports.

China’s Influence: – China’s steel production and exports significantly impact global prices. – Production cuts in China could stabilize prices in India. – China’s real estate crisis and slowing infrastructure demand are expected to reduce its steel demand.

Steel Prices: – Indian steel prices reflect Chinese prices. – Chinese export prices have declined, putting pressure on Indian offerings. – Domestic steel prices in India have increased slightly but remain below January highs.

RINL’s Forged Wheel Plant in Raebareli Acquired by Indian Railways

The Indian Railways has acquired the forged wheel plant of RINL in Raebareli, Uttar Pradesh. The takeover includes a cash payment of ₹800-900 crore to RINL and a transfer of ₹1000 crore of RINL’s debt to the forged wheel unit. The Railways are investing in capacity ramp-up at the plant, which has the potential to produce 80,000 wheels annually. The acquisition aims to reduce India’s reliance on imported forged wheels and potentially lead to exports.

Key Points

Takeover Details – Indian Railways has taken over operations of RINL’s forged wheel plant in Raebareli. – The takeover includes a cash payment of ₹800-900 crore to RINL and a transfer of ₹1000 crore of RINL’s debt to the forged wheel unit.

Capacity and Investment – The plant has a capacity to produce 80,000 wheels annually. – The Railways are investing in capacity ramp-up to achieve full operational capacity by the end of the year.

RINL’s Financial Constraints – RINL faced financial constraints and lacked experience in forging operations. – The plant was unable to operate at full capacity due to these reasons.

Railways’ Expertise and Requirement – The Railways have an approximate requirement for 80,000 wheels annually. – The Railways have expertise in forged wheel operations.

Export Potential – The Railways plan to push for exports of forged wheels. – India currently imports forged wheels from various countries.

Overall Capacity and Offtake – The acquisition of RINL’s forged wheel plant and the upcoming manufacturing unit by Ramkrishna Forgings and Titagarh Wagons will push India’s overall forged wheel making capacity to nearly 300,000 annually. – The Ministry of Railways has assured an offtake of 80,000 wheels a year, with the remaining capacity targeted for exports.

India Disputes ILO Report Asserting High Youth Unemployment Rate

India has expressed concerns to the International Labour Organization (ILO) regarding its recent report on employment, citing inconsistencies in data, misinterpretation of youth employment data, and the omission of international mobility and gig workers.

Key Points:

Data Inconsistencies: – India claims the report used two non-comparable data sets (EUS and PLFS) with different sampling methods. – The EUS was replaced by the PLFS in 2017-18, and data cannot be extrapolated for the period between 2012 and 2017 when no survey was conducted.

Misinterpretation of Youth Employment Data: – India disputes the report’s claim that 83% of India’s unemployed workforce is youth. – The government states that youth unemployment in 2022 was only 5%, down from 7% in 2019.

Omission of International Mobility and Gig Workers: – The report did not consider international migration trends or the surge in gig and platform workers, which constitute a significant portion of India’s employed workforce.

Other Concerns: – India claims the ILO did not collaborate with the country or seek its input before releasing the report. – The government argues that 35% of India’s youth are students and 22% are involved in domestic duties, which should not be classified as unemployment.

RBI’s Comprehensive Guidelines for Asset Reconstruction Companies

The Reserve Bank of India (RBI) has issued Master Directions for Asset Reconstruction Companies (ARCs) to regulate their operations and ensure the health of the financial system. ARCs play a crucial role in resolving stressed financial assets of banks and financial institutions.

Key Points:

Minimum Net Owned Fund (NOF): – ARCs must have a minimum NOF of Rs 300 crore to commence business.

Registration and Certificate of Registration (CoR): – ARCs must apply for registration and obtain a CoR from the RBI before commencing business.

Investment Restrictions: – ARCs are prohibited from investing in land or buildings, except for their own use (up to 10% of owned funds).

Deposit Prohibition: – ARCs cannot raise money through deposits.

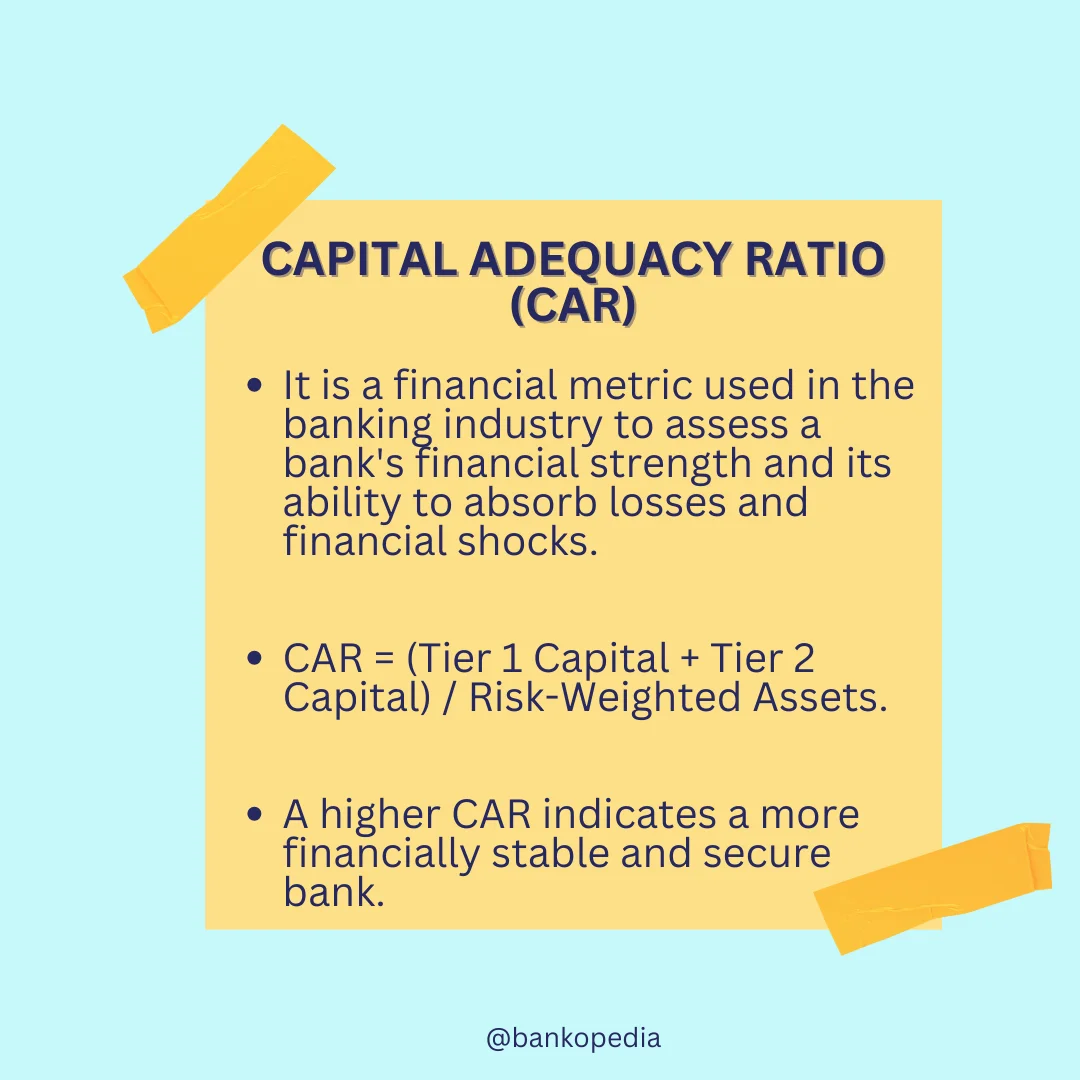

Capital Adequacy Ratio: – ARCs must maintain a capital adequacy ratio of at least 15% of total risk-weighted assets.

Leadership Age and Tenure: – MD/CEO or Whole-time Directors (WTDs) cannot continue beyond age 70. – Tenure of MD/CEO or WTDs is limited to five years at a time, with a maximum continuous tenure of 15 years.

Reporting of Irregularities: – ARCs must report chartered accountants, advocates, and valuers involved in serious irregularities to the Indian Banks Association (IBA) for inclusion in a database.

Background: – ARCs were established in India in the Union Budget 2021-22 to address Non-Performing Assets (NPAs) of banks. – ARCs acquire financial assets from banks and financial institutions and securitize or reconstruct them to improve liquidity.

RBI Deputy Governor Rabi Sankar’s Tenure Extended by One Year

The Appointments Committee of the Cabinet has extended the term of Reserve Bank of India (RBI) Deputy Governor T Rabi Sankar for one year, effective May 3, 2024. Sankar, who joined the RBI in 1990, has held various positions within the central bank, including Executive Director and Deputy Governor.

Key Points:

- Extension of Term: T Rabi Sankar’s term as RBI Deputy Governor has been extended for one year.

- Effective Date: The extension takes effect from May 3, 2024.

- Previous Appointment: Sankar was initially appointed as RBI Deputy Governor in May 2021 for a three-year term.

- RBI Career: Sankar has worked in various positions at the RBI, including Executive Director and Deputy Governor.

- Responsibilities as Executive Director: As Executive Director, Sankar oversaw the Department of Payment and Settlement Systems, the Department of Information Technology, Fintech, and the Risk Monitoring Department.

- IMF Consultant: Sankar served as an IMF Consultant from 2005 to 2011, focusing on developing government bond markets and debt management.

- Other Roles: Sankar is the Chairman of Indian Financial Technology and Allied Services (IFTAS), a member of the Board of Directors of ReBIT, and a member of the Governing Council of IDRBT.

- Education: Sankar holds a Master of Philosophy in Economics from Jawaharlal Nehru University.

RBI Restricts Kotak Mahindra Bank’s Credit Card Issuance and Mobile Banking Customer Acquisition

The Reserve Bank of India (RBI) has ordered Kotak Mahindra Bank to cease issuing new credit cards and onboarding new customers through online and mobile banking channels due to “serious deficiencies and non-compliances” in its operations. The bank can continue providing services to existing customers.

Key Points:

RBI’s Directive:

- RBI has directed Kotak Mahindra Bank to cease issuing new credit cards and onboarding new customers through online and mobile banking channels.

- The bank can continue providing services to existing customers.

Reasons for Directive:

- RBI found “significant” concerns in its IT examination for two consecutive years (2022 and 2023).

- The bank failed to address concerns regarding IT inventory management, patch and change management, user access management, vendor risk management, data security, business continuity, and disaster recovery.

Impact on Existing Customers:

- Existing customers will not be affected by the directive.

- The bank can continue to offer services to its existing customers, including credit card users.

Review of Restrictions:

- The restrictions will be reviewed upon completion of a comprehensive external audit commissioned by the bank with RBI’s approval.

- The audit will assess the remediation of deficiencies and compliance with RBI observations.

Other Actions:

- The RBI’s directive is without prejudice to any other regulatory or enforcement actions that may be taken against the bank.

Punjab National Bank’s Insolvency Resolution Plea against Arshiya Approved by Bankruptcy Court

The National Company Law Tribunal (NCLT) has initiated insolvency proceedings against Arshiya Ltd, a free zone developer, for defaulting on a loan of over Rs 193 crore to Punjab National Bank. The bank had filed an application with the NCLT after the company failed to repay its dues.

Key Points:

Initiation of Insolvency Proceedings: – NCLT admits Punjab National Bank’s application to initiate a corporate insolvency resolution process (CIRP) against Arshiya Ltd. – Nitin Vishwanath Panchal appointed as the resolution professional.

Management and Information Disclosure: – Management of Arshiya Ltd vests in the resolution professional. – Officers and managers must provide all documents and information to the resolution professional within one week.

Background of the Loan: – Arshiya Ltd provided a corporate guarantee for a loan taken by its subsidiary, Arshiya Northern FTWZ Ltd (ANFL), from Punjab National Bank. – The loan was used to construct a Free Trade Warehousing Zone (FTWZ) in Khurja, Uttar Pradesh.

Company’s Arguments: – Arshiya Ltd argued that the application was filed beyond the three-year limitation period.

NCLT’s Observation: – NCLT observed that an application under the Insolvency and Bankruptcy Code (IBC) must be admitted if debt and default are established, regardless of the limitation period.

Company’s Financial Performance: – Arshiya Ltd reported a revenue of Rs 162.18 crore and a loss of Rs 156.85 crore during FY2023.

Company’s Operations: – Arshiya Ltd is the only free zone developer operating 2 FTWZs. – It is the largest private container train operator with pan-India operations. – The company owns the only private inland container depot (ICD) with six rail loop lines.

PSU Defense Stock Surges Over 100% Post-Split in Seven Months

Hindustan Aeronautics Ltd (HAL) shares surged 5% on Wednesday, reaching a new high of Rs 3,989.30. The stock’s rise is attributed to a strong outlook and heavy volumes. HAL’s order backlog is estimated at around Rs 1 trillion, providing healthy revenue growth visibility over the next 3 years. The company is expected to receive contracts worth approximately Rs 2 trillion in the coming 3-4 years.

Key Points:

Strong Outlook: – HAL’s shares have surged 112% in the past seven months due to a strong outlook.

Stock Split: – On September 28, 2023, HAL sub-divided its equity shares from Rs 10 to Rs 5 to enhance liquidity and encourage retail investor participation.

Heavy Volumes: – Average trading volumes on HAL’s counter have jumped more than two fold.

Defense PSU: – HAL is one of the largest Defense PSUs in India, engaged in a wide range of products and services.

Tejas Fighter Jet Order: – HAL has received an order for 97 Tejas Fighter Jets from the Defence Ministry, boosting its order book.

Cochin Shipyard Contract: – HAL signed a contract with Cochin Shipyard for the supply of Gas Turbines and Auxiliaries for the Indian Navy’s Next Generation Missile Vessel project.

Mid Life Upgrade Contract: – HAL has a contract with the Ministry of Defence for the Mid Life Upgrade of 25 Dornier Aircraft for the Indian Navy.

Order Backlog: – HAL’s order backlog is estimated at around Rs 1 trillion, providing revenue growth visibility.

Future Contracts: – Approximately Rs 2 trillion worth of contracts are expected to be placed with HAL in the coming 3-4 years.

Repair & Overhaul Contracts: – RoH contracts to the tune of approximately Rs 20,000 crore are expected to be placed with HAL annually.

REITs and InvITs Raise Rs 1.3 Trillion in Funding Over the Past Four Years: RBI Report

Real Estate Investment Trusts (REITs) and Infrastructure Investment Trusts (InvITs) have raised Rs 1.3 lakh crore in the past four years, emerging as alternative investment options for high net-worth individuals. The Reserve Bank of India (RBI) expects these instruments to facilitate further pooled funds.

Key Points

Growth and Mobilization – REITs and InvITs have mobilized Rs 1.3 lakh crore since 2019-20. – The recent listing of an InvIT raised Rs 2,500 crore, attracting foreign investor interest.

Regulatory Developments – SEBI has reduced the minimum investment size and trading lot, enabling greater retail participation. – Regulations for small and medium REITs were notified in March 2024, facilitating investment in a wider range of real estate assets.

Industry Perspective – Banks are now allowed to lend to InvITs, providing additional funding options. – The conducive regulatory framework and strong pipeline of operational assets have contributed to the industry’s growth.

Retail Investor Accessibility – SEBI’s reduction in lot size has made REITs more attractive to retail investors. – The Indian REITs Association is collaborating with SEBI to enhance accessibility and liquidity.

Investment Characteristics – REITs consist of commercial real estate assets, while InvITs comprise infrastructure assets. – These instruments offer fixed income with a secured asset base and returns typically higher than other secured asset investments.

Future Outlook – The government’s focus on infrastructure development is expected to drive investment in REITs and InvITs. – Small-medium REITs are anticipated to attract significant investor interest. – The continued growth of these instruments will contribute to the development of the infrastructure and real estate sectors in India.

FCI’s Wheat Procurement Surges, Approaching 120 Lakh Tonnes

Wheat procurement in India has reached 119.26 lakh tonnes as of April 23, 2024, showing a decline compared to the previous year’s 159.23 lakh tonnes. Punjab, the major wheat-producing state, has witnessed a drop in procurement but has recently seen an uptick. The government aims to procure 210 lakh tonnes from Punjab and Haryana, while challenges remain in Rajasthan, Uttar Pradesh, and Madhya Pradesh. To address lower procurement in Madhya Pradesh and Rajasthan, the Centre has relaxed quality specifications for wheat.

Key Points:

Procurement Status: – Wheat procurement reached 119.26 lakh tonnes as of April 23, 2024. – Punjab’s procurement has increased to 34.95 lakh tonnes, but remains below last year’s level. – Haryana’s procurement has reached 48.14 lakh tonnes, slightly lower than the previous year.

Challenges and Solutions: – Lower procurement in Madhya Pradesh and Rajasthan due to quality issues. – Centre has relaxed quality specifications for wheat in these states to improve purchases.

State-Specific Targets and Progress: – Punjab: Target of 210 lakh tonnes, with 34.95 lakh tonnes procured so far. – Haryana: Target of 80 lakh tonnes, with 48.14 lakh tonnes procured. – Rajasthan: Target of 20 lakh tonnes, with 2.32 lakh tonnes procured. – Madhya Pradesh: Target of 80 lakh tonnes, with 29.71 lakh tonnes procured. – Uttar Pradesh: Target of 60 lakh tonnes, with 4.05 lakh tonnes procured.

CBDT Provides Relief to Tax Deductors: Non-Linkage of PAN-Aadhaar No Longer a Penalty

The Central Board of Direct Taxes (CBDT) has announced that tax deductors will not be penalized for failing to deduct higher taxes on transactions made between July 1, 2023, and March 31, 2024, by individuals whose PANs became inoperative due to non-linkage with Aadhaar. This relief is conditional on the PANs being linked with Aadhaar by May 31, 2024.

Key Points:

Relief for Tax Deductions: – Tax deductors will not be treated as defaulters for failing to deduct higher taxes on transactions made by individuals with inoperative PANs due to non-linkage with Aadhaar. – This relief applies to transactions made between July 1, 2023, and March 31, 2024.

Exemption from Penalty: – Tax deductors will be exempted from paying any penalty on these transactions.

Condition for Relief: – The relief is conditional on the inoperative PANs being linked with Aadhaar and becoming operative by May 31, 2024.

Reason for Relief: – Many businesses and non-resident Indians failed to link their PANs with Aadhaar due to address changes or other reasons, resulting in their PANs becoming inoperative.

Clarification from CBDT: – The clarification was issued in response to representations on the issue. – The CBDT has partially modified circular 3 of 2023 to provide this relief.

Applicability of Relief: – The relief does not apply to transactions made from April 1, 2024, onwards.

Expert Concerns: – Experts have raised concerns about the lack of clarity on how the department will handle cases where default notices have been issued. – They also question whether any demand raised pursuant to notices will be refunded if the default is rectified by May 31, 2024.

Indian Banks: Navigating the Tightrope Between Growth Ambitions and Regulatory Scrutiny

Kotak Mahindra Bank’s recent ban on acquiring new online customers and issuing credit cards by the Reserve Bank of India (RBI) has raised questions about the relationship between the two entities. However, it is important to avoid linking the ban to Kotak’s past confrontations with the RBI. The ban reflects the RBI’s heightened sensitivity towards digital banking infrastructure and KYC compliance, as online payments and mobile banking have become increasingly prevalent.

Key Points:

Kotak Mahindra Bank’s Relationship with RBI:

- Kotak’s past confrontations with the RBI may have influenced the regulator’s decision.

- The RBI is not accustomed to being defied and may have taken a stricter stance.

Financial Services Lapses:

- Kotak is not the only financial institution to face penalties for lapses.

- Other entities may also be penalized for disregarding warnings and red flags.

Digital Banking Infrastructure and KYC Compliance:

- The RBI is highly sensitive to gaps in digital banking infrastructure and KYC compliance.

- These gaps can facilitate cyber theft and money laundering.

Impact of Digital Banking Outages:

- Outages in large banks can have a disproportionate impact on urgent payments and remittances.

- Such fiascos damage the reputation of institutions and the regulator.

Investment in Technology and Compliance:

- Institutions that fail to invest adequately in people, processes, and technology will face consequences.

- Kotak Bank is a nimble and quick learner, but it may face challenges in balancing profitability, market share, and compliance.

Shareholders of Goldman Sachs and BofA Vote Against CEO-Chair Split

Shareholders of Goldman Sachs and Bank of America rejected proposals to separate the CEO and chairman roles, despite pressure from proxy advisors and large investors. The proposals received significant support, but ultimately failed to gain majority approval.

Key Points:

Shareholder Vote Results: – Goldman Sachs: 33% of shareholders voted in favor of separating the roles. – Bank of America: 31% of shareholders voted in favor of separating the roles.

Proxy Advisor Recommendations: – Institutional Shareholder Services (ISS) and Glass Lewis urged shareholders to support the proposals.

Investor Support: – Norway’s sovereign wealth fund indicated support for the plan.

Reasons for Proposal: – The National Legal and Policy Center (NPLC) argued that separating the roles would improve corporate governance and prevent excessive risk-taking.

Management Response: – Goldman Sachs’ governance committee believes the current structure with a strong lead independent director is most effective. – Bank of America did not publicly comment on the proposal.

Other Shareholder Proposals: – All management proposals, including those on executive compensation, were approved at both banks. – All shareholder proposals were rejected.

Nearly Half of Indian Women Encounter Obstacles in Accessing Credit: Tide Report

Tide’s Bharat Women Aspiration Index (BWAI) report reveals that while 52% of women entrepreneurs in Tier-II towns have access to financial credit, 47% still face challenges in obtaining it. The report also highlights a lack of awareness among women about government financial schemes and initiatives, as well as hurdles in accessing digital tools for business.

Key Points:

- Access to Credit: 47% of women entrepreneurs face challenges in obtaining credit.

- Government Schemes: 95% of women are unaware of existing government financial schemes and initiatives.

- Digital Literacy: 80% of women recognize digital literacy as an important enabler.

- Digital Tools: 51% of women entrepreneurs face hurdles in accessing digital tools for business.

- Competitive Edge: 38% of women feel that accessing customers is easier, while 31% cite first mover advantage as a competitive edge.

- Interdependence of Factors: Access to funding, mentors, and digital tools are tightly interwoven and interdependent.

- Gap in Understanding: Women entrepreneurs from small towns report access to credit, but a large gap in their understanding of financial issues remains.