Welcome to Daily Banking Digest, your premier source for the latest news and insights on April 23, 2024, focusing on banking, the economy, and finance. Our platform offers a comprehensive overview of the day’s most critical financial stories, market trends, and economic developments. Whether you’re a professional in the financial sector, an investor monitoring market movement, or someone interested in staying informed about the economic landscape, Daily Banking Digest provides reliable, up-to-date information.

Join our Telegram Channel for Daily PDF in your Inbox – Click Here

Table of Contents

Verification Mechanism in RoDTEP Ensures Payouts Align with Input Duty Remissions, Not Subsidies

The Indian government is implementing a verification process to address anti-subsidy duties imposed by the US and EU on exports under the RoDTEP scheme. The verification team will inspect manufacturers to ensure that only input duties have been remitted, establishing the connection between RoDTEP payments and input taxes paid. This measure aims to prevent future disputes and protect Indian exports from further anti-subsidy duties.

Key Points

Verification Process – Random inspections of manufacturers to verify input taxes paid against RoDTEP payments. – Team includes officials from the Department of Revenue and DGFT.

RoDTEP Scheme – Replaced the MEIS scheme in 2021. – Designed to be WTO-compatible, establishing a clear connection between refund rates and input taxes.

Anti-Subsidy Duties – US and EU imposed duties on certain Indian products under RoDTEP. – Duties imposed due to exporters’ inability to prove the connection between RoDTEP benefits and input taxes.

Verification Committee – Aims to establish the connection between RoDTEP payments and input taxes. – Expected to satisfy importing countries and prevent future anti-subsidy duties.

Exporters’ Role – DGFT and DGTR are educating exporters on documentation to prove RoDTEP payments are not export subsidies.

Indian Major Ports Experience 5% Traffic Surge in FY24, Fueled by Iron Ore Exports and Coking Coal Imports

India’s major ports experienced a 5% increase in cargo traffic to 819.3 million tonnes in FY24, driven by rising iron ore exports and increasing coking coal imports. Coking coal shipments increased by 10.24%, while iron ore shipments surged by 33%. Petroleum offerings also saw a 5% increase. Mormugao port witnessed the highest percentage increase in traffic, while Deendayal port was the only one to report a decline.

Key Points

Cargo Traffic Increase – 5% y-o-y increase in cargo traffic to 819.3 million tonnes

Coking Coal Imports – 10.24% increase to 65 million tonnes – Strong demand and increased production in India

Iron Ore Exports – 33% increase to 61 million tonnes – Increased buying from China

Petroleum Offerings – 5% increase to 246 million tonnes

Port-wise Performance – Mormugao: Highest percentage increase (19%) due to increased iron ore exports – Paradip: Highest cargo traffic (145.4 million tonnes) – Haldia: Highest coking coal shipments (21 million tonnes) – Deendayal: Only port with a traffic decline (4%)

Farmers in India Pin Hopes on Monsoon for Relief

The Solvent Extractors’ Association of India (SEA) has expressed optimism about the 2024 monsoon forecast, which predicts normal rainfall. This is expected to benefit farmers and stabilize food prices. The SEA also highlights the BJP’s focus on agriculture in its manifesto and the success of the Mustard Model Farm Project in increasing mustard production. Additionally, India has exported a record amount of oilmeals in 2023-24, and a SEA delegation will visit Brazil to study its soya complex.

Key Points:

Monsoon Forecast: – Normal rainfall forecast for 2024 (106% of long period average) – Brings relief to farmers for kharif crop sowing

BJP’s Agriculture Manifesto: – Prioritizes soil health cards, micro-irrigation, crop insurance, and PM Kisan Samman Yojana – Focus on self-sufficiency in pulses and edible oil

Mustard Model Farm Project: – Collaboration between SEA and Solidaridad Network Asia Ltd – Significant increase in mustard production and cultivation areas – Contributes to domestic edible oil supplies

Oilmeals Export: – India exported a record 48.8 lakh tonnes of oilmeals in 2023-24 – Rapeseed meal was the outstanding performer – De-oiled ricebran ban impacted exports

SEA Delegation to Brazil: – To study Brazilian soya complex and meet producers and exporters – Develop direct rapport between Brazilian exporters and Indian importers – Understand Brazil’s agricultural practices for high soyabean productivity

FPIs Diversify Holdings, Seek Resolution with Sebi after Adani Exposure

Over half a dozen foreign portfolio investors (FPIs) with significant stakes in Adani Group companies are seeking to settle securities violation matters with the Securities and Exchange Board of India (Sebi). They have agreed to pay fines to resolve allegations of failing to disclose beneficial ownership and breaching investment limits.

Key Points:

Allegations against FPIs:

- Failing to maintain and disclose information about ultimate beneficial owners

- Breaching investment limits in Adani Group companies

Settlement Applications:

- Eight FPIs have filed 16 settlement applications with Sebi

- FPIs do not admit or deny wrongdoing, a common practice in settlements

Sebi’s Process:

- Reviews settlement applications and negotiates terms

- Settlement terms are presented to an independent advisory committee

- Sebi issues settlement order or proceeds with legal action

Types of Proceedings:

- Enquiry proceedings: Non-monetary penalties, such as restrictions on market participation

- Adjudication proceedings: Monetary penalties or settlement amounts

Timeline:

- October 2020: Sebi initiates probe into Adani Group shareholding patterns

- January 2023: Hindenburg Research report reignites Sebi’s investigation

- August 2023: Sebi submits report to Supreme Court on FPI analysis

- January 2024: Supreme Court disposes of PILs but directs Sebi to complete investigations

Current Status:

- FPIs have exited or reduced their stakes in Adani Group companies

- Settlement between Sebi and FPIs could conclude the four-year inquiry

MDH and Everest Products Recalled in Hong Kong and Singapore: Reasons Explained

Hong Kong and Singapore have raised safety concerns over Indian spice products after detecting ethylene oxide, a carcinogenic pesticide, in four products from MDH and Everest. The affected products have been recalled, and authorities have instructed vendors to remove them from shelves. This incident highlights the need for stricter food safety regulations in India, as similar concerns have been raised in the past.

Key Points:

1. Ethylene Oxide Detected in Indian Spice Products: – Hong Kong’s CFS found ethylene oxide in four products from MDH and Everest. – Ethylene oxide is a Group 1 carcinogen classified by the International Agency for Research on Cancer.

2. Product Recall and Regulatory Actions: – Hong Kong and Singapore have instructed vendors to halt the sale and recall the affected products. – Failure to comply with pesticide residue regulations can result in fines and imprisonment.

3. Health Concerns: – Long-term exposure to ethylene oxide may increase the risk of cancer. – Consumers are advised to avoid consuming the implicated products.

4. Previous Scrutiny of Indian Spice Products: – Indian spice products have faced scrutiny in international markets before, including a Salmonella recall in the US.

5. Need for Stricter Food Safety Standards: – Dr. Cyriac Abby Philips expressed concern over India’s food safety standards and called for stricter regulations and accountability.

CMS Info Systems Expands into Gold Logistics and Loan Collection Services

CMS Info Systems, a cash management services company, plans to expand its business by diversifying into gold logistics and retail loan repayment collection. The company has piloted these new business lines and aims to launch them commercially soon. CMS expects incremental growth from these new ventures, leveraging its existing network, risk management framework, and operational efficiency.

Key Points:

1. Business Expansion: – CMS Info Systems plans to diversify into gold logistics and retail loan repayment collection.

2. Bullion Logistics: – The company has piloted bullion logistics with clients like Hindustan Zinc and Kalyan Jewelers. – CMS has partnered with Malca Amit and AVA Global for global storage and distribution of bullion. – It is registered with MCX for bullion warehouse services.

3. Debt Collection: – CMS aims to capitalize on the retail credit boom in India. – It has partnered with 14 banks and financial institutions for the pilot in debt collection. – The company offers an integrated tech-to-field collection solution.

4. Financial Performance: – CMS Info Systems reported over Rs 2,000 crore of revenue in fiscal 2023. – It has experienced over 20% revenue growth in the last three years. – The company targets revenue in the range of Rs 2,500-2,700 crore in fiscal 2025.

IndusInd Bank Spearheads Central Bank’s Digital Rupee Initiative for Farmers

IndusInd Bank has implemented a system to pay farmers for carbon credits using the Reserve Bank of India’s digital currency (e-rupee). This allows farmers to exchange their credits for CBDCs, expanding their options beyond fiat rupees. The project, conducted with 50 farmers in Maharashtra, aims to promote the use of CBDCs and support sustainable farming practices.

Key Points:

- IndusInd Bank Implements CBDC Payments for Carbon Credits: IndusInd Bank has executed transactions to pay farmers for carbon credits using the RBI’s digital currency.

- CBDC Platform for Farmers: IndusInd provides a platform for farmers to exchange their carbon credits for CBDCs, offering an alternative to fiat rupees.

- Pilot Project in Maharashtra: The project was conducted with 50 farmers in Maharashtra and plans to expand to other regions.

- Digital Wallet and CBDC Transfers: IndusInd Bank manages digital wallets and facilitates CBDC transfers for farmers.

- RBI’s Promotion of CBDCs: The RBI has been collaborating with lenders to introduce new features and promote the adoption of digital currency.

India’s Growth Potential: 7% Sustainable, Says RBI MPC Member Shashanka Bhide

RBI Monetary Policy Committee member Shashanka Bhide believes India can sustain economic growth of 7% in 2024-25 and beyond, supported by favorable monsoon, higher farm productivity, and improved global trade. However, he cautions that global headwinds, such as slow demand recovery and supply chain disruptions, could pose challenges.

Key Points:

Economic Growth: – India’s economy is expected to grow by 8% in 2023-24, driven by manufacturing and infrastructure sectors. – Sustaining growth of 7% in 2024-25 and beyond is feasible.

Agriculture: – Favorable monsoon and improved global trade will support agricultural growth. – Productivity improvements are crucial for long-term food price stability.

Global Headwinds: – Slow global demand recovery and supply chain disruptions are areas of concern. – Geopolitical conflicts could impact demand and input prices. – India should prepare for extreme weather events.

Food Prices: – Weather conditions have impacted perishable commodities, leading to high food inflation. – Processing and preservation of commodities, along with supply-side measures, can help reduce price spikes. – Market infrastructure investments and modernization can improve supply response.

Inflation: – Inflation remains above the policy target in many countries. – Monetary policies are restrictive to bring inflation down. – RBI projects inflation to moderate to 4.5% in 2024-25.

Foreign Direct Investment (FDI): – FDI inflows have slowed due to weak global demand. – India’s strategies to support investments in technology and energy have attracted attention. – India has benefited from the decline in FDI flows to China.

MPC Members Varma and Goyal Advocate for Rate Cuts to Spur Economic Growth in India

India’s Monetary Policy Committee (MPC) is divided on the timing of interest rate cuts, with some members advocating for cuts to boost growth while others prioritize maintaining stability amid inflation concerns.

Key Points:

Growth vs. Inflation: – MPC member Ashima Goyal believes India needs higher growth to create jobs and boost investment, but inflation must remain within tolerance levels.

Status Quo on Rates: – Despite robust economic growth, Goyal supports maintaining current interest rates due to inflation uncertainties.

Market Expectations: – The market anticipates rate cuts only in early 2025, with Morgan Stanley ruling out any cuts this fiscal year.

Inflation Vulnerability: – RBI Governor Shaktikanta Das warns of inflation’s vulnerability to supply-side shocks, despite progress in disinflation.

Real Rates and Growth: – MPC member Jayanth Varma advocates for rate cuts to prevent rising real rates from hindering private sector investment and growth.

Capex Cycle Concerns: – Goyal expresses caution about an overheated capex cycle, citing past defaults in the private sector.

Growth Slowdown: – Varma argues that a slowdown is already anticipated and that tight monetary policy entails growth sacrifices.

Growth-Inflation Trade-Off: – Varma emphasizes the need to balance growth and inflation, calibrating monetary policy to achieve the inflation target with minimal growth impact.

Uttar Pradesh Expands Industrial Land Bank to 25,000 Acres for Investment Attraction

Uttar Pradesh aims to become a trillion-dollar economy by 2027 and has established a land bank of 25,000 acres to attract industries. The state has acquired land in 75 districts and recently allocated 1,470 acres for a bulk drug park in Lalitpur. UPSIDA, the state’s nodal agency, has implemented e-auctions for transparency, resulting in increased plot allotments and revenue. The state also plans to establish mini-industrial clusters in rural areas and utilize Gram Sabha land for industrial development. MSMEs play a crucial role in UP’s economy, and the government aims to double their exports to Rs 3 trillion.

Key Points:

Land Bank: – 25,000 acres of land bank acquired across 75 districts. – 1,470 acres allocated for bulk drug park in Lalitpur.

UPSIDA: – Chief Executive Officer: Mayur Maheshwari. – Introduced e-auction of plots for transparency. – Plot allotments increased from 191 in 2017-18 to 693 in 2023-24. – Operating revenue doubled from Rs 615 crore in 2018-19 to Rs 1,359 crore in 2023-24.

Women-Centric Facilities: – Built under Atal Industrial Infrastructure Mission (AIIM) and Safe Industrial Area Projects. – Aim to enhance female participation and employment in industrial parks.

Mini-Industrial Clusters: – Planned in rural areas to boost economic activities and create jobs. – Gram Sabha land to be handed over to industrial department for allotment. – 25,000 units targeted in the hinterland with incentives.

MSME Sector: – Contributes 60% to UP’s annual industrial output. – Government aims to double MSME exports to Rs 3 trillion.

India’s Medical Device Exports to Russia: Potential for Triple Growth in Five Years

India aims to triple its medical device exports to Russia within the next five years through collaborative efforts. The initiative follows a recent online meeting between Indian and Russian stakeholders to explore opportunities in manufacturing and marketing life-saving medical equipment.

Key Points:

1. Export Potential: – India’s medical device exports to Russia can be tripled in the next five years.

2. Current Export Status: – India exported medical devices worth $75 million to Russia in FY 2022-23. – Russia is not currently among the top five importers of Indian medical devices.

3. Collaborative Efforts: – AiMeD and DRISP have signed an MoU to accelerate bilateral engagements. – Indian and Russian stakeholders have emphasized the need for dynamic economic engagement.

4. Regulatory Approvals: – Fast-tracking regulatory approvals is crucial for increasing exports.

5. Manufacturing and Marketing: – Collaborations in manufacturing and marketing of medical devices are being explored.

6. CIS Region: – Russia accounts for 60% of India’s medical device exports in the CIS region.

7. MoU with DRISP: – AiMeD has signed an MoU with DRISP to promote partnerships in the medical device industry.

SBI Expresses Shock and Disapproval over NCLAT’s Jet Airways Takeover Order

The State Bank of India (SBI) has expressed shock and disapproval over the National Company Law Appellate Tribunal’s (NCLAT) decision to uphold the transfer of Jet Airways’ ownership to Jalan Kalrock Consortium (JKC). SBI argues that the order undermines a Supreme Court ruling and jeopardizes the recovery of significant debt owed by the airline.

Key Points:

SBI’s Objection: – SBI considers the NCLAT order “shocking” and “completely unacceptable.” – The order reverses a Supreme Court ruling on a Rs 150 crore bank guarantee. – SBI is concerned about recovering Rs 4,400 crore in debt, while JKC is struggling to repay Rs 300 crore.

JKC’s Response: – JKC’s lawyer argues that the order should not be described as “shocking.” – Such language is inappropriate for a court order.

Supreme Court Hearing: – The Supreme Court has not issued a notice in the case. – The matter will be heard on Friday, April 26th.

NCLAT’s Order: – NCLAT approved the transfer of Jet Airways’ ownership to JKC in March 2023. – The order upheld the NCLT’s decision from January 2022. – SBI’s appeal against the takeover was dismissed.

Background: – NCLAT directed lenders to complete the transfer within 90 days. – JKC was instructed to obtain an air operator’s certificate within the same period. – NCLAT allowed JKC to adjust Rs 150 crore from its bank guarantee towards the first tranche of payment to lenders. – Lenders were ordered to create security on immovable properties offered by JKC. – Upon security creation, lenders were to adjust the Rs 150 crore bank guarantee towards payment from JKC. – JKC was to receive shares of Jet Airways and take over the company within 30 days of security creation. – All payments to lenders were to be completed within 30 days of handover.

Government Explores Cluster-Based Strategy for Enhancing Agricultural Productivity

The Indian government plans to implement cluster-based development for agricultural crops, similar to the approach used for horticulture crops. This aims to create specialized regions for different crops, allowing farmers to sell their produce locally and attract industry and processors to source raw materials directly.

Key Points:

Cluster-Based Development: – The government intends to establish clusters for specific crops, enabling farmers to grow the same crop within a defined geographical area. – This approach facilitates marketing as buyers are drawn to clusters with high volume availability of a particular commodity.

Incentivization: – To encourage farmers to adopt the cluster approach, the government is considering linking existing schemes to cluster development or connecting clusters with processing industries.

Crop Planning: – The cluster approach will aid in implementing crop planning, as recommended by the committee on doubling farmers’ income. – This involves balancing inflation with fair prices for farmers, increasing market networks, and shifting towards high-value commodities.

Rainfed Agro-Economic Zones (RAEZ): – The committee recommended delineating RAEZs and developing crop zoning for rainfed areas. – This aims to bridge yield gaps, provide safety nets, and implement crop planning based on market intelligence.

TMB’s Q4 Net Profit Remains Stable at ₹253 Crore; FY24 Profit Witnesses 4% Growth

Tamilnad Mercantile Bank (TMB) reported a flat net profit for the March 2024 quarter and a 4% increase for FY24. The bank’s operating profit declined due to wage arrears and provisions for an NPA account. Despite this, net interest income and interest income grew, and the bank maintained a net interest margin above 4%. The bank’s asset quality improved, with a reduction in stressed assets and a decrease in gross and net NPAs. TMB is currently searching for a new Managing Director & CEO after RBI rejected the candidates proposed by the bank.

Key Points

Net Profit – Flat net profit for the March 2024 quarter – 4% increase in net profit for FY24

Operating Profit – Lower operating profit in the March 2024 quarter due to wage arrears and NPA provisions

Net Interest Income – Growth in net interest income for Q4FY24 and FY24

Interest Income – Increase in interest income for FY24

Non-Interest Income – Slight increase in non-interest income for FY24

Total Expenditure – Higher total expenditure for FY24

Net Interest Margin – Maintained a net interest margin above 4% as of March 31, 2024

Slippage Ratio – Reduction in slippage ratio from 2.15% in FY2020 to 1.36% in FY24

Special Mention Accounts – Reduction in SMA to gross advances ratio to 3.97%

Gross NPA – Increase in gross NPA to 1.44% as of March 31, 2024

Net NPA – Decrease in net NPA to 0.85% as of March 31, 2024

Advances and Deposits – Increase in gross advances and total deposits

CASA Ratio – Increase in CASA ratio to 30%

Search for New MD & CEO – TMB is searching for a new Managing Director & CEO after RBI rejected the candidates proposed by the bank

RBI Directs Payment System Operators to Monitor and Report Suspicious Transactions During Elections

The Reserve Bank of India (RBI) has instructed authorized non-bank Payment System Operators (PSOs) to report high-value and suspicious transactions during the election period. This measure aims to prevent the misuse of electronic payment systems to influence voters or fund candidates.

Key Points:

RBI’s Directive: – RBI has asked PSOs to report high-value and suspicious transactions to appropriate authorities.

Election Commission’s Concern: – The Election Commission of India (ECI) has expressed concerns about the potential misuse of electronic payments during elections.

PSOs’ Role: – PSOs facilitate electronic payments through various channels, including online payments, card payments, and mobile payments.

Types of Transactions to Monitor: – RBI wants PSOs to track out-of-the-ordinary transactions, recurring transactions, and increases in certain types of transactions, including through Prepaid Payment Instrument (PPI) wallets.

Purpose of Monitoring: – The monitoring aims to prevent the misuse of funds and ensure compliance with anti-money laundering regulations.

Post-Merger Entity: A Distinct Organization with Incomparable Financials

HDFC Bank’s MD and CEO, Sashidhar Jagdishan, emphasizes that the merged entity of HDFC and HDFC Bank is a “completely new organization” with a distinct financial profile. He acknowledges criticism regarding the bank’s post-merger communication and highlights the importance of deposit mobilization and customer engagement. Jagdishan also discusses the bank’s focus on inorganic growth to meet priority sector targets and its commitment to profitability and long-term objectives.

Key Points

New Organization – The merged entity is a “completely new organization” with a unique financial profile. – Comparisons to pre-existing lenders are not appropriate.

Post-Merger Communication – The bank has received feedback and incorporated it into its communication strategy. – Deposit accretion is typically higher in the last quarter due to transitory year-end flows.

Deposit Mobilization – Enhanced customer engagement and a “service-first” culture are crucial for sustaining deposit growth. – Technology and digital channels will be key focus areas.

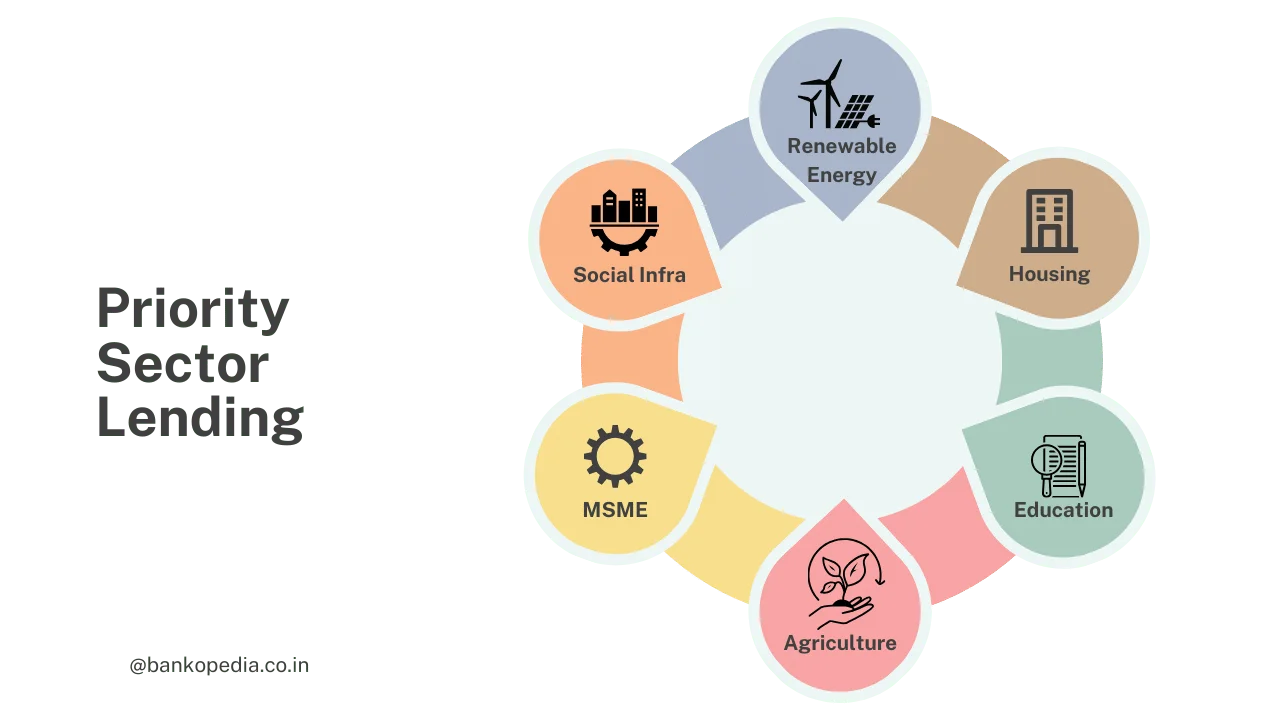

Inorganic Growth – The bank may consider inorganic opportunities to meet priority sector targets, particularly in areas such as small and marginal farmers and economically weaker sections.

Growth Strategy – The bank will not chase growth for the sake of growth. – Margins are expected to remain at current levels. – Investors should be patient during the transition period.

Profitability and Long-Term Objectives – The bank’s focus is on improving profitability metrics, including return on assets (RoA) and earnings per share. – Retail deposit franchise is a key priority. – Providing guidance would distract from long-term objectives.

Employee Appreciation – The bank announced an ex-gratia payment of Rs 1,500 crore for employees to address attrition and appreciate their efforts during and post the merger.

India Emerges as a Major Contributor to U.S. Citizenship

India has emerged as the second-largest source country for new US citizens, with over 65,000 Indians naturalizing in 2022. This positions India behind only Mexico, which remains the leading source country. The data also reveals that India has the second-largest foreign-born population in the US, with over 2.8 million individuals.

Key Points:

1. India’s Contribution to US Citizenship: – India is the second-largest source country for new US citizens, with 65,960 Indians naturalizing in 2022. – Mexico remains the leading source country, with 128,878 new citizens.

2. Foreign-Born Population in the US: – Approximately 46 million foreign-born individuals reside in the US, constituting 14% of the population. – Of these, 24.5 million (53%) are naturalized citizens.

3. India’s Foreign-Born Population in the US: – India has the second-largest foreign-born population in the US, with 2,831,330 individuals. – However, 42% of India-born foreign nationals are ineligible for US citizenship.

4. USCIS Naturalization Backlogs: – USCIS has reduced the number of pending naturalization applications by more than half since 2020. – As of 2023, there are approximately 408,000 pending applications.

5. Eligibility for Naturalization: – Applicants must meet specific criteria, including being a lawful permanent resident for at least five years. – Naturalization rates vary depending on country of origin.

WTO Members Condemn EU and UK Steel Duties

India, China, Russia, and other WTO members have criticized the EU’s extension of safeguard measures on steel products, arguing that they violate WTO rules. The EU claims the measures are necessary to protect its domestic industry, while other countries contend that they are protectionist and hinder global trade.

Key Points:

EU’s Safeguard Measure: – EU has extended safeguard measures on certain steel products beyond June 30. – The measure was initially imposed after the US imposed additional duties on steel imports from the EU in 2018.

Criticism from WTO Members: – India, China, Russia, and other WTO members argue that the EU’s safeguard duty is inconsistent with WTO rules. – They claim that the measure is not justified and harms global trade.

UK’s Safeguard Measures: – The UK has also imposed safeguard measures on steel products. – WTO members allege that the UK has not conducted a proper investigation to justify the measures.

Retaliatory Measures: – India has proposed retaliatory import duties on EU products in response to the safeguard measures. – India has also proposed additional customs duties on UK products in retaliation for its restrictions on steel imports.

WTO Safeguards Agreement: – Under the WTO Safeguards Agreement, members can impose temporary restrictions on imports if their domestic industry is seriously injured. – The measures must apply to all imports and cannot last more than four years. – Developing countries accounting for less than 3% of exports are excluded from such measures.

Escalating Red Sea Tensions Threaten to Drive Up Shipping Costs

Tensions between Iran and Israel are driving up freight charges and insurance premiums for ships navigating global routes, particularly those bound for Western Europe and the US. Disruptions and capacity constraints in the Red Sea have led to a $100 increase in freight rates per container, while war risk insurance premiums have surged to between 0.75% and 1% of the vessel’s insured value. The space constraint on ships is also contributing to higher fares, with the cost of shipping a standard container to Europe now five times higher than before October 2023.

Key Points:

Freight Charges: – Freight rates have increased by $100 per container for ships passing through the Red Sea due to disruptions and capacity constraints.

Insurance Premiums: – War risk insurance premiums have risen to between 0.75% and 1% of the insured value of the vessel due to increased risk from Houthi activity in the region.

Space Constraints: – Space constraints on ships are leading to higher fares, with the cost of shipping a standard container to Europe now at $2,500, five times higher than before October 2023.

Impact on US: – Fares to the United States’ east coast have also risen significantly to $4,500 per container, up from $1,500 in the pre-crisis period.

Escalating Costs: – Tensions between Iran and Israel remain heightened, and costs will escalate if the Red Sea crisis worsens.

Enhanced National Career Service Portal to Boost Employment Opportunities

The Indian government plans to upgrade the National Career Service (NCS) portal to enhance its efficiency and connect millions of job seekers with potential employers. The upgraded version, NCS 2.0, will leverage artificial intelligence (AI) and machine learning (ML) to improve job matching and provide a centralized platform for job seekers, employers, and other stakeholders.

Key Points:

- Upgraded NCS Portal: The government plans to upgrade the NCS portal to make it more efficient and user-friendly.

- AI and ML Integration: NCS 2.0 will leverage AI and ML to improve job matching and provide personalized recommendations.

- Micro Sites for States and Districts: The upgraded portal will include micro sites for states and districts to facilitate local job search and skill development.

- Centralized Data: The portal will centralize data on job seekers, employers, and skill sets in demand, providing a comprehensive view of the job market.

- Integration with Other Portals: NCS is currently integrated with over 50 portals, including Udyam, EPFO, and private job portals.

- Increased Job Vacancies: Over 10 million vacancies were mobilized on NCS in FY24, indicating a resilient economy and growing job opportunities.

- Industry Trends: The NCS newsletter highlights emerging opportunities in technology, healthcare, manufacturing, and hospitality.

- Industry Feedback: Recruiters have welcomed the government’s decision to upgrade the NCS portal, as it has not undergone significant changes in recent years.

- Dynamic Recruitment Process: The portal needs to keep pace with the evolving recruitment landscape to remain relevant for recruiters.

Offshore Investors in AIFs May Face Increased Restrictions

The Securities and Exchange Board of India (Sebi) and the Reserve Bank of India (RBI) have proposed changes to classify Alternative Investment Funds (AIFs) with a majority of non-resident or offshore investors as indirect foreign investments. This move aims to address concerns over the circumvention of regulations through the AIF structure.

Key Points:

Classification of AIF Investments:

- Currently, AIF investments are classified based on the domicile of the fund manager or sponsor.

- If the fund is owned and controlled in India, it is not considered indirect foreign investment.

Proposed Change:

- If more than 50% of an AIF’s units are held by or issued to non-residents, all its investments will be treated as indirect foreign investment.

Reason for Change:

- Certain AIFs with a limited number of foreign investors were found to be bypassing regulations by investing in debt securities and exceeding sectoral limits under FDI norms.

Impact of Change:

- Such investments will be subject to sectoral caps and foreign investment guidelines.

- Investors may opt for alternative structures to avoid the restrictions.

Onshoring of Fund Management:

- The proposed change may reduce the onshoring of fund management in India.

Other Measures:

- RBI has restricted banks and NBFCs from investing in AIFs with downstream links to debtor firms.

- Sebi is considering changes to QIB norms to address circumvention concerns.