Welcome to Daily Banking Digest, your premier source for the latest news and insights on April 19, 2024, focusing on banking, the economy, and finance. Our platform offers a comprehensive overview of the day’s most critical financial stories, market trends, and economic developments. Whether you’re a professional in the financial sector, an investor monitoring market movement, or someone interested in staying informed about the economic landscape, Daily Banking Digest provides reliable, up-to-date information.

Join our Telegram Channel for Daily PDF in your Inbox – Click Here

Table of Contents

WTO Dispute Resolution Benefits American Rural Communities, Says USTR

US Trade Representative Katherine Tai emphasized the resolution of WTO disputes with India as a victory for American agriculture. The settlements have improved market access for US products, including chickpeas, lentils, almonds, walnuts, apples, turkey, duck, blueberries, and cranberries, benefiting farmers in various states. However, concerns were raised about India’s wheat subsidies allegedly harming American farmers.

Key Points

WTO Dispute Resolution

- India and the US resolved six WTO disputes in June 2023, with India removing retaliatory tariffs on US products.

- In September 2023, the final outstanding WTO dispute was settled, with India reducing tariffs on US products.

Benefits to US Farmers

- Improved market access for chickpeas, lentils, almonds, walnuts, apples, turkey, duck, blueberries, and cranberries.

- Farmers in Michigan, Oregon, Washington, North Carolina, Pennsylvania, Virginia, and Wisconsin have benefited.

India’s Wheat Subsidies

- Senator Ron Wyden raised concerns about India’s wheat subsidies distorting prices and harming American farmers.

- India maintains that its subsidies are within WTO limits and necessary for food security.

USTR’s Perspective

- USTR Katherine Tai highlighted the positive impact of WTO dispute resolution on US farmers.

- She cited an example of an almond-growing family in California that benefited from the removal of retaliatory tariffs.

US-India Trade

- The US was India’s largest trading partner in 2022-23, with bilateral trade increasing by 7.65%.

Zepic, a Chennai-based SaaS startup, Secures $2.1 Million in Pre-Seed Funding

Zepic, a Chennai-based SaaS startup specializing in marketing automation, has secured $2.1 million in pre-seed funding. The investment will be used to enhance product development, expand market reach, and incorporate AI into the platform’s recommendation engine.

Key Points:

Investment: – $2.1 million pre-seed investment round – Led by Neon Fund with $500,000 – Participation from angel investors from Apple, Chargebee, Freshworks, Microsoft, and Zoho

Platform: – No-code marketing automation platform – Ingests business data from various sources – Enables marketers to create personalized campaigns based on customer preferences and behaviors – Collates customer records for consistency and accuracy

Team: – Co-founded by Naveen Venkatesan, Bharathi Kannan Ravikumar, Sunil Kumar, and Sreelesh Pillai – Over 20 years of B2B SaaS experience – 20-member team in Chennai

Customers: – Pilot customers include HockeyAustralia and TourismFiji

Funding Allocation: – Product and engineering enhancements – Market outreach expansion in the US and other markets – Growth of data science team in Chennai for AI integration

IRDAI Celebrates Silver Jubilee with Comprehensive Regulatory Enhancements

The Insurance Regulatory and Development Authority of India (IRDAI) celebrates its 25th anniversary, marking a period of significant growth and regulatory reforms in the insurance industry. The regulator has played a pivotal role in fostering innovation, safeguarding consumer interests, and propelling industry advancement. As IRDAI enters its silver jubilee year, it is implementing a slew of regulatory reforms announced in March, including the replacement of 34 regulations with six.

Key Points

1. IRDAI’s Establishment and Role – IRDAI was established in 1999 as an autonomous body to regulate and develop the insurance industry. – It was incorporated as a statutory body in 2000 and opened the market to foreign companies with up to 26% ownership. – IRDAI has the power to frame regulations under the Insurance Act, 1938.

2. Industry Growth under IRDAI – Life and non-life insurance premium income reached ₹7.83 lakh crore and ₹2.57 lakh crore in 2022-23. – The industry is expected to grow by 13-16% in 2024.

3. IRDAI’s Pivotal Role – Fostered innovation, safeguarded consumer interests, and propelled industry advancement. – Engaged with policyholders and prioritized their well-being. – Increased awareness about insurance as a risk management tool. – Nurtured an environment of innovation within the industry.

4. Regulatory Revamp – IRDAI has replaced 34 regulations with six, enhancing clarity and coherence. – Introduced two new regulations to strengthen regulatory governance. – Working on master circulars to implement recent reforms.

5. Inclusive Approach – IRDAI’s inclusive approach has facilitated ease of doing business while prioritizing policyholders’ interests. – Initiatives have led to the development of consumer-centric insurance products and enhanced access through a freed-up distribution model.

Banks Seek to Deposit Excess Liquidity of ₹1.03 Lakh Crore with RBI

The Reserve Bank of India (RBI) conducted an overnight variable rate reverse repo (VRRR) auction, receiving offers for ₹1,03,930 crore against the notified amount of ₹75,000 crore. The RBI accepted offers amounting to ₹75,027 crore at a weighted average rate of 6.49%. This move is part of the RBI’s “withdrawal of accommodation” monetary policy stance, aiming to absorb surplus liquidity in the banking system. Additionally, the RBI announced a 14-day variable rate repo (VRR) auction to infuse ₹75,000 crore liquidity into the banking system.

Key Points:

Overnight VRRR Auction: – Banks offered ₹1,03,930 crore for liquidity parking. – RBI accepted offers for ₹75,027 crore at a weighted average rate of 6.49%.

RBI’s Liquidity Management: – RBI aims to withdraw excess liquidity through VRRR auctions. – RBI will use a mix of instruments to manage liquidity and ensure orderly money market interest rates.

14-Day VRR Auction: – RBI will conduct a 14-day VRR auction to infuse ₹75,000 crore liquidity. – This auction will be held alongside the auction of two dated securities for ₹24,000 crore.

Sundaram Home Finance Strengthens its Footprint in Rajasthan

Sundaram Home Finance is expanding its operations beyond its traditional southern market, with plans to open new branches in northwestern India. The company has opened a branch in Kota, Rajasthan, and plans to open another in Udaipur. Rajasthan is seen as a promising market with a strong credit culture and growing economic prosperity. Sundaram Home Finance aims to disburse ₹300 crore in Rajasthan over the next 2-3 years. The company is also exploring opportunities to expand further in select geographies outside the South market, including Western India.

Key Points:

Expansion Beyond Southern Market: – Sundaram Home Finance is expanding outside its southern market. – The company has opened a branch in Kota, Rajasthan, and plans to open another in Udaipur.

Rajasthan Market: – Rajasthan is a vibrant market with a high degree of credit culture. – The company believes there is potential to register disbursements of about ₹300 crore in Rajasthan over the next 2-3 years.

Expansion Strategy: – Sundaram Home Finance has strengthened its presence in South India, expanding into Tier 2 and 3 towns. – The company is also exploring opportunities to expand further in select geographies outside the South market. – The expansion in Rajasthan and Western India is part of this strategy.

Branch Network: – Sundaram Home Finance has over 140 branches in the Southern region and Madhya Pradesh, Rajasthan, Maharashtra, and Gujarat.

India’s Pulse Imports Surge to Six-Year Peak Driven by Red Lentil Demand

India’s pulses imports surged 84% in fiscal 2024 to 4.65 million metric tons, the highest in six years. Lower production and duty-free imports of red lentils and yellow peas contributed to the increase. The imports have supported global prices and reduced stocks in exporting countries.

Key Points:

Import Surge: – India’s pulses imports surged 84% year-on-year to 4.65 million metric tons in fiscal 2024. – The value of imports increased by 93% to $3.75 billion.

Reasons for Surge: – Lower domestic production – Government’s decision to scrap import taxes

Major Imports: – Red lentils imports from Canada doubled to 1.2 million tons. – Yellow peas imports from Russia and Turkey increased after duty-free imports were allowed. – Pigeon peas and chickpeas were also imported to meet production shortfalls.

Impact on Global Market: – India’s imports have supported global prices and reduced stocks in exporting countries such as Canada, Australia, and Myanmar.

ASEAN-India Trade Deficit Widens Post-FTA Implementation

India’s trade deficit with ASEAN has surged since the implementation of the Free Trade Agreement (FTA) in 2010, with imports outpacing exports. The deficit has widened significantly over the past decade, raising concerns among policymakers. The ongoing review of the ASEAN-India Trade in Goods Agreement (AITIGA) aims to address the imbalance and enhance trade ties.

Key Points:

Trade Deficit: – India’s trade deficit with ASEAN has more than doubled since 2010. – In 2022-23, India’s exports to ASEAN were USD 44,000.42 million, while imports were USD 87,577.42 million. – The deficit continued to widen in FY 2023-24, with exports at USD 32,713.01 million and imports at USD 68,550.60 million.

Factors Contributing to Deficit: – India’s import policy evolution and tariff structures have influenced trade dynamics. – Import tariff rates have fluctuated over the years, with the introduction of GST in 2017. – Challenges persist in achieving a more balanced trade relationship with ASEAN.

Addressing the Deficit: – Enhancing export competitiveness and diversifying export baskets. – Addressing structural constraints in key sectors. – Promoting trade facilitation and enhancing market access. – Fostering innovation and technology exchange.

Ongoing Review of AITIGA: – Aims to enhance trade ties between India and ASEAN in a balanced and sustainable manner. – Targets to conclude the review by 2025.

India Sets New Record: Exports 48.86 Lakh Tonnes of Oilmeal in FY24

India’s oilmeal exports reached a record high of 48.86 tonnes in the 2023-24 financial year, driven by a revival in soybean meal shipments. The value of exports also hit a record of Rs 15,368 crore.

Key Points:

Overall Export Performance: – Highest oilmeal exports since 2013-14 in terms of quantity and value. – Total exports reached 48.86 lakh tonnes, up 13% from the previous year.

Soybean Meal Exports: – Revived during the year, reaching 21.33 lakh tonnes. – Indian soybean meal was competitive in the international market. – Exports likely to slow down due to higher Indian prices compared to Argentina.

Rapeseed Meal Exports: – Remained stagnant at 22.13 lakh tonnes. – Slowed down due to competition from soybean meal.

De-oiled Ricebran Exports: – Declined sharply to 1.52 lakh tonnes due to a ban on shipments. – Ban extended till July, threatening rice bran processors with closure.

Major Importers: – Bangladesh: 8.92 lakh tonnes – South Korea: 8.32 lakh tonnes – Thailand: 6.33 lakh tonnes – Iran: Largest importer of soybean meal (8.64 lakh tonnes)

Digitization of Land Records: A Key Reform in the New Government’s 100-Day Agenda

The Indian government is prioritizing the digitization of land records to streamline land acquisition and accelerate infrastructure projects. The proposed plan aims to complete the digitization process by 2026, with an estimated budget of ₹1,035 crore. This reform is expected to reduce land disputes, provide accurate ownership and usage data, and significantly shorten project completion times.

Key Points:

1. Digitization of Land Records: – The government is working on digitizing all land records by the end of 2026. – The plan includes adding ownership, usage, and risk information to the database.

2. Budget Allocation: – The government may allocate ₹1,035 crore for the digitization plan. – The announcement is expected to be made in the full budget presentation.

3. Impact on Land Acquisition: – Digitization will streamline the land acquisition process and speed up infrastructure projects. – It will reduce land disputes and provide accurate ownership and usage patterns.

4. 100-Day Economic Agenda: – The digitization plan is part of the government’s 100-day economic agenda. – It includes rejigging land-use policies for urban, forest, and agricultural land.

5. Unique Land Parcel Identification Number (ULPIN): – The government is already implementing ULPIN, which provides a unique identity to land parcels. – This 14-digit ID is based on Geo-coordinates and aligns with international standards.

India’s DPI to Shape the Global Future, Not Big Tech: Amitabh Kant

India’s G-20 sherpa, Amitabh Kant, believes that the future of global technology will be shaped by digital public infrastructure platforms developed locally, rather than by large technology companies. India’s digital public infrastructure, which includes Aadhaar, UPI, and other services, has been showcased to the world and is gaining international recognition. Kant emphasizes the need for Indian investors, including insurance companies and pension funds, to support the country’s startup ecosystem. He also advocates for self-regulation within the startup sector and a focus on manufacturing to create jobs.

Key Points:

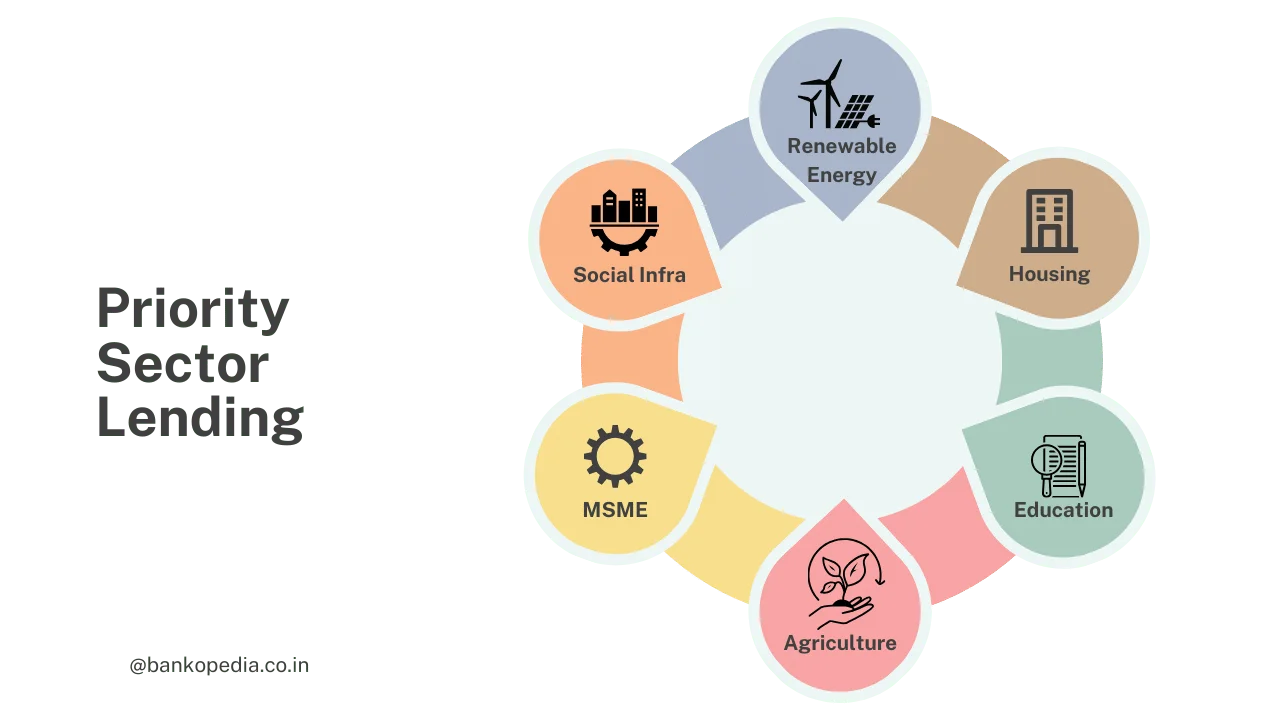

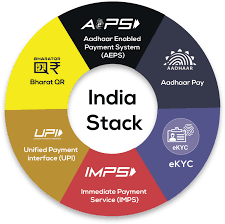

- Digital Public Infrastructure (DPI):

- India’s DPI consists of digital identity (Aadhaar), real-time payment (UPI), and other services.

- The G-20 has accepted the definition and framework of DPI.

- DPI will drive the future of global technology, not big tech companies.

- India’s DPI to Transfer to the World:

- India will share its DPI with other countries.

- This presents opportunities for Indian entrepreneurs.

- DPI will become synonymous with India’s growth story.

- Investment in Startups:

- Insurance companies, pension funds, and HNIs should invest in India’s startup movement.

- Currently, most funding comes from international sources.

- Indian investors need to take risks and support domestic startups.

- Fund of Funds for Deep Tech:

- India needs a fund of funds for deep tech startups.

- This will help venture capital funds invest in startups with future relevance.

- Corporate Governance and Self-Regulation:

- Startups should focus on corporate governance and building a robust culture.

- Self-regulation is the best solution for the startup sector.

- Government regulation could stifle innovation.

- Focus on Manufacturing:

- India should focus on manufacturing alongside the service sector.

- Manufacturing creates jobs and supports economic growth.

Dream11 Exempted from Insolvency Proceedings

The National Company Law Appellate Tribunal (NCLAT) has granted relief to Sporta Technologies, the parent company of Dream11, by rejecting a petition to initiate corporate insolvency resolution proceedings (CIRP). NCLAT ruled that the alleged default occurred during the period protected by Section 10A of the Insolvency and Bankruptcy Code, which prohibits CIRP for defaults between March 25, 2020, and March 25, 2021.

Key Points:

- Default Date: The default date for the alleged debt fell within the timeline of Section 10A of the Insolvency and Bankruptcy Code, 2016.

- Section 10A Protection: Section 10A prohibits the initiation of CIRP for defaults occurring between March 25, 2020, and March 25, 2021, to protect firms affected by COVID-19.

- NCLT Error: NCLAT found that the National Company Law Tribunal (NCLT) had erred in admitting the CIRP application under Section 9.

- CIRP Application Rejected: NCLAT set aside the NCLT order admitting the CIRP application.

- Dream11 Relief: Sporta Technologies and Dream11 were granted relief from the CIRP process.

NARCL Acquires Essel Infra’s Road Project Debt

The National Asset Reconstruction Company of India (NARCL) has offered to acquire ₹988 crore of debt from lenders for a road project awarded to Essel Infraprojects in Ludhiana. NARCL’s offer includes a 27% recovery for lenders, with 15% in cash and 85% in security receipts. Lenders have invited counteroffers from other asset reconstruction companies (ARCs) and will hold a Swiss challenge auction on April 19.

Key Points:

Debt Acquisition: – NARCL has offered to acquire ₹988 crore of debt from lenders for the Ludhiana Talwandi Toll Road (LTTRPL) project. – The debt includes ₹543 crore in principal debt. – Punjab National Bank, Indian Overseas Bank, and Central Bank of India are among the major lenders.

Recovery Rate: – NARCL’s offer equates to a 27% recovery for lenders. – The offer includes 15% in cash and 85% in security receipts payable on recovery.

Project Details: – LTTRPL is a joint venture between Essel Infraprojects and Pan India Network. – The project involves building a 78-kilometer four-lane stretch of National Highway-95 between Ludhiana and Talwandi Bhai. – The project was awarded in 2011 with a completion deadline of September 2014.

Legal Proceedings: – IIFCL has filed an application before the Delhi Debts Recovery Tribunal for recovery of ₹174 crore under a guarantee reportedly given by Essel Infraprojects.

Project Delays: – The project has faced delays due to changes in EPC contractors and clearance issues. – Most of the pending work is on the stretch between Moga and Talwandi Bhai.

Changi Airport Dethroned: New Airport Emerges as World’s Best; Indian Airports Make Limited Impact in Top 100

The Skytrax World Airport Awards have named Doha’s Hamad International Airport as the world’s best airport for 2024, dethroning Singapore’s Changi Airport, which had held the title for 12 consecutive years. Seoul Incheon Airport secured third place, while Tokyo’s Haneda and Narita airports ranked fourth and fifth, respectively.

Key Points:

1. Hamad International Airport Crowned World’s Best: – Doha’s Hamad International Airport has been named the world’s best airport for 2024. – It is the first time in 13 years that Singapore’s Changi Airport has not won the award.

2. Seoul Incheon Airport Ranks Third: – Seoul Incheon Airport has secured third place in the rankings. – It has also been named the most family-friendly airport of 2024.

3. Tokyo Airports Rank High: – Tokyo’s Haneda and Narita airports have ranked fourth and fifth, respectively.

4. Hong Kong Airport Makes Significant Improvement: – Hong Kong Airport has jumped 22 spots to reach 11th place.

5. Indian Airports in the Top 100: – Five Indian airports have made it to the top 100 list, with Delhi airport retaining its 36th rank. – Mumbai airport has dropped to 95th place, while Bengaluru and Hyderabad airports have improved their rankings.

6. Dubai Airport Climbs the Ranks: – Dubai airport has climbed to the 7th rank from 17th last year.

7. US Airports Fall Short: – No US airports have made it near the top of the list. – Seattle-Tacoma, the highest-ranked US airport, has dropped to 24th place.

8. Europe Maintains Strong Presence: – Paris Charles de Gaulle, Munich, Zurich, and Istanbul have all stayed in the top 10.

Paytm Updates UPI ID Format: Essential Information for Users

NPCI has approved Paytm’s parent company, OCL, to shift its users to new banks for UPI payments. This follows RBI’s restriction on Paytm Payments Bank’s operations due to KYC violations. Paytm has integrated with Axis Bank, HDFC Bank, SBI, and YES Bank to facilitate the transition, ensuring seamless UPI services for users.

Key Points:

NPCI’s Approval: – NPCI has approved OCL to operate as a TPAP under a multi-bank model.

Bank Integration: – Paytm has integrated with Axis Bank, HDFC Bank, SBI, and YES Bank.

User Transition: – Paytm users will be shifted to the partner banks for UPI payments. – Users’ current UPI IDs with ‘@paytm’ will be changed to new IDs with ‘@ptsbi’, ‘@pthdfc’, ‘@ptaxis’, or ‘@ptyes’.

Seamless Experience: – Users can expect uninterrupted access to UPI payments and AutoPay mandates.

RBI’s Restriction: – RBI had restricted Paytm Payments Bank’s operations due to KYC violations. – Paytm was previously relying on Paytm Payments Bank for settlement services.

RBI Fines Five Co-operative Banks a Total of Rs 60.3 Lakhs

The Reserve Bank of India (RBI) has imposed penalties totaling Rs 60.3 lakh on five cooperative banks for violating regulatory norms. The penalties range from Rs 2 to Rs 43.30 lakh and are based on deficiencies in regulatory compliance.

Key Points:

- Rajkot Nagarik Sahakari Bank: Penalty of Rs 43.30 lakh for non-compliance with RBI directions on loans to directors and relatives, opening of saving bank accounts for certain bodies, and maintenance of deposit accounts.

- The Kangra Co-operative Bank (New Delhi): Penalty of Rs 5 lakh for regulatory compliance deficiencies.

- Rajdhani Nagar Sahkari Bank (Lucknow): Penalty of Rs 5 lakh for regulatory compliance deficiencies.

- Zila Sahakari Bank, Garhwal (Kotdwar, Uttarakhand): Penalty of Rs 5 lakh for regulatory compliance deficiencies.

- District Co-operative Bank (Dehradun): Penalty of Rs 2 for regulatory compliance deficiencies.

- Note: The penalties are not intended to pronounce upon the validity of any transactions or agreements entered into by the banks with their customers.

GMR Hyderabad Airport Recognized for Exceptional Staff Service

GMR Hyderabad International Airport Ltd (GHIAL) has been recognized as the “Best Airport Staff in India & South Asia 2024” by Skytrax, a global air transport rating organization. The award acknowledges the exceptional service provided by the airport’s staff across various customer-facing roles.

Key Points:

Award Recognition: – GHIAL wins the “Best Airport Staff in India & South Asia 2024” award from Skytrax.

Evaluation Criteria: – The award is based on thorough audits and evaluations of staff service quality, including attitude, friendliness, and efficiency.

Customer-Facing Roles: – The evaluation includes staff working at customer help and information counters, immigration and security staff, shops, and food & beverage outlets.

Skytrax Rating System: – Skytrax assigns star ratings from 1 to 5 stars based on assessments that impact passenger experience.

Global Recognition: – Skytrax has been evaluating airports and airlines worldwide since 1989, providing a benchmark for industry standards.

ONGC Appoints Nauvata and PERC Engineering for Project Management Consultancy

ONGC has awarded a contract to a consortium of Nauvata Energy Transition Enterprise and PERC Engineering for Front End Engineering Design (FEED) and project management consultancy (PMC) services for two developments in the Krishna-Godavari (KG) basin. This contract follows ONGC’s successful completion of its KG-DWN-98/2 development project, where Nauvata and PERC provided PMC services.

Key Points:

Contract Award: – ONGC has awarded a FEED and PMC contract to a consortium of Nauvata Energy Transition Enterprise and PERC Engineering.

Scope of Work: – The contract includes concept study and tender bid package preparation for two developments in the KG basin.

Previous Collaboration: – Nauvata and PERC previously provided PMC services for ONGC’s KG-DWN-98/2 development project.

Nauvata’s Role: – Nauvata played a significant role in the KG-DWN-98/2 project, managing interfaces and contractors.

PERC’s Confidence: – PERC is confident in its ability to execute the project successfully and build a long-term relationship with ONGC and Nauvata.

Dhanlaxmi Bank Appoints Ajith Kumar as New Managing Director and CEO

The Reserve Bank of India (RBI) has approved the appointment of Ajith Kumar K.K as the Managing Director & CEO of Dhanlaxmi Bank for a three-year term. Kumar, currently the Chief Human Resources Officer at Federal Bank, brings over 36 years of banking experience to the role. The appointment comes as the bank prepares for a Rights Issue of up to ₹300 Crore.

Key Points:

- Appointment of Ajith Kumar K.K:

- Approved by RBI as Managing Director & CEO of Dhanlaxmi Bank for three years.

- Currently holds the position of Chief Human Resources Officer at Federal Bank.

- Experience and Qualifications:

- Over 36 years of experience in various banking facets, including Credit, Human Resources, Business, and Branch Banking.

- Board Approval and Shareholder Consent:

- Board of Directors meeting to be held to approve the appointment.

- Shareholder approval to be obtained as per regulatory provisions.

- Extension of J K Shivan’s Term:

- RBI previously approved the extension of J K Shivan’s term as Managing Director & CEO until Kumar assumes office.

- Rights Issue:

- Dhanlaxmi Bank is planning a Rights Issue of up to ₹300 Crore.

Binance to Resume Operations in India as Compliant Financial Intelligence Unit (FIU)-Registered Entity

Binance, the world’s largest cryptocurrency exchange, is set to return to India after paying a penalty of approximately $2 million. The exchange will operate as an entity registered with the Financial Intelligence Unit (FIU) and comply with all applicable laws, including the Prevention of Money Laundering Act (PMLA) and the VDA taxation framework.

Key Points:

Penalty: – Binance will pay a penalty of approximately $2 million to return to India.

Registration and Compliance: – Binance will register with the Financial Intelligence Unit (FIU) of the finance ministry. – The exchange will comply with all applicable laws, including PMLA and the VDA taxation framework.

Government Stance: – India’s stance has always been clear: global cryptocurrency exchanges must comply with all laws to operate in the country. – Binance took over two years to realize that there is no room for negotiations or special treatment.

Market Impact: – Binance’s return could upend the market dynamics due to its superior technology and larger liquidity. – Indian exchanges will face increased competition.

Tax Leakage: – Binance’s previous non-compliance with tax laws allowed investors to trade without paying TDS. – Global crypto exchanges without registered entities in India caused tax leakage of nearly Rs 3,000 crore annually.

Binance’s Plans: – Binance plans to offer localized payment solutions, build a dedicated India team, and invest further in the country’s blockchain system. – The exchange operates in over 100 geographies, with significant operations in Seychelles, Malta, Cayman Islands, and Singapore.

Adani-EdgeConneX Joint Venture Aims to Expand Data Center Operations with $5 Billion Investment Plan

Adani Enterprises, through its joint venture AdaniConneX, plans to invest $5 billion in its data center business over the next five years. The expansion aims to develop 1 GW of data center capacity by 2030, driven by the growth of AI-led businesses and the Supreme Court’s ruling in favor of the Adani Group. AdaniConneX is in talks with international banks to raise $1.2-1.4 billion in offshore loans to support its growth plans.

Key Points:

Investment Plan: – $5 billion investment plan over five years – More than half of the investment to be made in the current year – Promoter equity infusions to account for around a quarter of the investment

Capacity Expansion: – Aim to develop 1 GW of data center capacity by 2030

Funding: – In talks with international banks to raise $1.2-1.4 billion in offshore loans – Standard Chartered Bank, ING Bank, Sumitomo Mitsui Banking Corporation, and MUFG Bank involved in the transaction

Growth Drivers: – Rapid acceleration in AI-led businesses – Supreme Court ruling in favor of the Adani Group

Market Opportunity: – India’s data center industry expected to double in the next three years – Significant under-penetration of data center capacity in India

Current Capacity: – 17 MW live capacity in Chennai

Partnerships: – Tied up with global technology giants for 5-15 years

Previous Funding: – Raised $213 million through a debt facility in June 2023 – Signed memoranda of understanding to acquire two subsidiaries of Adani Power for Rs 540 crore in August 2023 – In talks with global lenders to raise $400 million through a five-year offshore loan in January 2024