Welcome to Daily Banking Digest, your premier source for the latest news and insights on April 14, 2024, focusing on banking, the economy, and finance. Our platform offers a comprehensive overview of the day’s most critical financial stories, market trends, and economic developments. Whether you’re a professional in the financial sector, an investor monitoring market movement, or someone interested in staying informed about the economic landscape, Daily Banking Digest provides reliable, up-to-date information.

Join our Telegram Channel for Daily PDF in your Inbox – Click Here

Table of Contents

Simplified Payment Process for Pulse Imports from Myanmar

The Indian government has simplified the payment mechanism for traders importing pulses from Myanmar. Importers are now required to use the Rupee/Kyat direct payment system through a Special Rupee Vostro Account (SRVA) with Punjab National Bank. This move aims to reduce costs and complexities associated with currency conversions. Additionally, the government has mandated weekly stock disclosure of pulses by importers and industry players to prevent forward trading and ensure market stability.

Key Points:

Payment Mechanism Simplification: – Rupee/Kyat direct payment system implemented through SRVA with Punjab National Bank. – Reduces costs and eliminates complexities related to currency conversions.

Stock Disclosure Mandate: – Importers and industry players required to declare pulse stocks weekly on the portal https://fcainfoweb.nic.in/psp/ from April 15. – States and Union Territories to enforce stock disclosure and verify declared stocks.

Enforcement Measures: – Forward trading of pulses prohibited and violators will be dealt with under the Essential Commodities Act. – False information on stock disclosure portal will result in strict action.

Market Monitoring: – Feedback from industry and market intelligence used to verify stock positions.

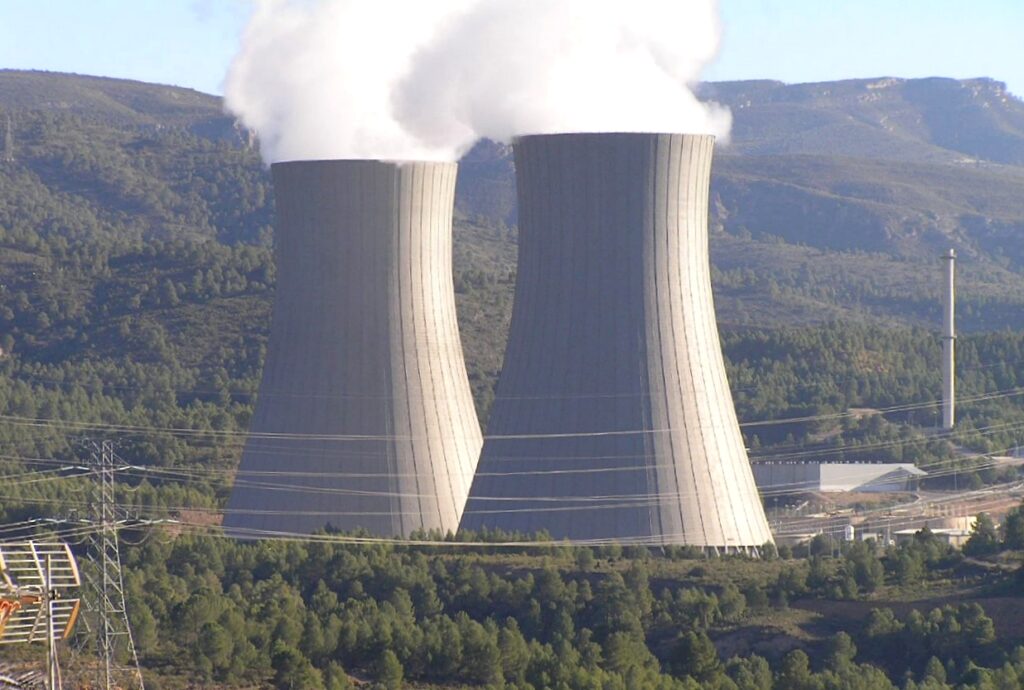

Government Mandates Gas-Based Power Plants to Operate Amidst Rising Electricity Demand

The Indian government has ordered all gas-based power plants to operate from May 1 to June 30 to meet the anticipated surge in electricity demand during the summer. This decision aims to optimize the availability of power from gas-based generating stations and ensure sufficient supply to meet the projected peak demand of 260 GW.

Key Points:

1. Gas-Based Power Plants to Operate: – All gas-based power generating stations directed to operationalize from May 1 to June 30. – Order issued under Section 11 of the Electricity Act, 2003.

2. Projected Peak Power Demand: – Ministry projects peak power demand of 260 GW this summer (April to June 2024). – Peak demand reached an all-time high of 243 GW in September 2023.

3. Measures to Meet Summer Demand: – Planned maintenance of power plants shifted to monsoon season. – New capacity additions fast-tracked. – Partial outages of thermal power plants reduced.

4. Gas-Based Power Generation: – GBSs with PPAs to offer power to PPA holders first. – Unused power to be offered in the power market. – GBSs not tied to PPAs must offer generation in the power market.

5. Implementation and Monitoring: – High-level committee headed by Chairperson, Central Electricity Authority constituted to facilitate implementation. – GRID-INDIA to inform GBSs of required gas-based power days in advance.

India’s Iron Ore Exports Surge to Three-Year Peak of 47.8 Million Tonnes

India’s iron ore exports reached 47.8 million tonnes in FY24, a three-year high and the second highest in six years. China accounted for over 90% of the exports, driven by strong demand for steel-making raw materials. However, exports have declined in recent months due to reduced demand from China.

Key Points:

Exports: – 47.8 million tonnes exported in FY24, a 130% increase year-over-year. – China accounted for over 90% of exports, with 43.20 MT shipped. – Indonesia was the second largest export destination, with 0.91 MT.

Demand: – Strong demand for fines and lumps, with 37 MT exported. – Pellets accounted for 24% of total shipments (11.32 MT). – Iron ore demand in FY23 was 21.28 MT, lower than FY22’s 26.40 MT.

Sequential Decline: – Exports peaked in January at 6.63 MT. – February exports declined 22% to 5.18 MT. – March exports further dropped 31% to 3.60 MT.

Reasons for Decline: – Reduced domestic demand for steel in China. – Sufficient stocks and holiday periods in China. – Lack of fresh orders from international buyers.

Tamilnad Mercantile Bank’s MD & CEO Candidates Dismissed by RBI

The Reserve Bank of India (RBI) has rejected three candidates proposed by Tamilnad Mercantile Bank (TMB) for the position of Managing Director and Chief Executive Officer (MD & CEO). The bank has been asked to submit a new panel of candidates with suitable experience. RBI has also appointed Thomas Mathew as an Additional Director on the board of TMB.

Key Points:

RBI Rejects TMB’s MD & CEO Candidates: – RBI found the candidates proposed by TMB unsuitable. – TMB has been asked to submit a fresh panel of candidates.

TMB’s Board Finalizes Candidates: – TMB’s Board of Directors finalized three candidates for the MD & CEO position on November 22, 2023.

S Krishnan Resigns as MD & CEO: – S Krishnan resigned as MD & CEO on September 28, 2023, citing personal reasons. – He continues to helm the bank until a new appointment is made.

Technical Glitch Leads to Wrong Credit: – A technical glitch in September 2023 led to a wrong credit of ₹9,000 crore into a taxi driver’s account. – TMB has implemented additional checks to prevent such incidents in the future.

RBI Appoints Thomas Mathew as Additional Director: – RBI has appointed Thomas Mathew as an Additional Director on the board of TMB for a period of two years. – He replaces S.B. Suresh Kumar, who has retired.

ClaimBuddy, a Health Insurance Claim Assistance Platform, Secures $5 Million in Funding

ClaimBuddy, a health insurance claim assistance platform, has secured $5 million in Series A funding led by Bharat Innovation Fund. The investment will enable ClaimBuddy to enhance its technology, expand its team and sales network, and introduce new product lines for its growing hospital network.

Key Points:

Funding: – ClaimBuddy raised $5 million in Series A funding. – The funding round was led by Bharat Innovation Fund (BIF). – Other participants included CAC Capital, Chiratae Ventures, and Rebright Partners.

Purpose of Funding: – Advance technology. – Expand team and sales network. – Add new product lines.

Company Overview: – Founded in 2020 by Khet Singh Rajpurohit and Ajit Patel. – Aims to simplify healthcare financing by addressing challenges in health insurance claims. – Has processed claims for over 35,000 patients, valued at over 500+ crore. – Collaborates with 250+ partner hospitals across India.

Vision: – Alleviate the burden on patients and hospitals in navigating healthcare expenses and insurance claims. – Introduce innovative financial tools. – Scale operations and drive impact in the healthcare industry.

Market Need: – Patients face challenges in the speed of discharge and settlement of health insurance claims. – ClaimBuddy addresses these challenges by offering cashless and hassle-free experiences.

Indri: The World’s Fastest-Growing Single Malt Whisky Surpasses 100,000 Cases

Indri, an Indian single malt whisky, has achieved remarkable growth, surpassing 1 lakh cases within two years of its launch. It aims to capture over 30% of the Indian market share and become one of the world’s top five-selling single malts. The Indian single malt market has witnessed a surge in demand, with domestic producers accounting for a significant portion of sales. Despite challenges such as varying state tax rates and weather conditions, the industry is projected to experience continued growth in the coming years.

Key Points:

Indri’s Success: – Crossed 1 lakh cases mark within two years of launch – Fastest-growing single malt whisky in the world – Aims to dominate over 30% of the Indian market share

Indian Single Malt Market Growth: – Surge of 144% in 2021-22 – 6,75,000 cases sold in India last year – Domestic producers accounted for around 3,45,000 cases

Industry Outlook: – Enhanced margins and increased sales projected for FY2025 – Revenue growth of 8-10% expected for domestic alcohol beverage companies – IMFL companies anticipating revenue growth of 11-13%

Challenges: – Varied state tax rates – Weather hindrance for desi single malt

Indri’s Recognition: – ‘Double Gold Best In Show’ award at the world’s largest whisky-tasting competition – Tokyo Whiskey and Spirits Competition 2023 winner – Fifty Best World Whiskies 2022 Award winner – Featured in Whisky Advocate’s Top 20 Whiskies of the World list

DLF Plans Rs 2,200 Crore Investment for Gurugram Shopping Mall Development

DLF, a leading real estate developer, has commenced construction of a new 26-27 lakh square feet shopping mall in Gurugram, investing approximately Rs 2,200 crore. This expansion is driven by the rebound in retail consumption post-COVID-19. DLF currently has a retail footprint of 42 lakh square feet, with plans to add 3.4 lakh square feet under DLF Ltd and develop high-street shopping centers near its housing projects.

Key Points:

Construction of New Mall in Gurugram: – DLF has started construction of a 26-27 lakh square feet shopping mall in Gurugram. – The investment for the project is estimated to be around Rs 2,200 crore.

Bullish on Retail Sector: – DLF is optimistic about the growth of the retail sector, leading to increased demand for retail space. – The retail sector has witnessed a strong recovery post-COVID-19, with increased footfalls and sales in shopping malls.

Expansion Plans: – DLF is constructing a premium mall in Goa of around 6 lakh square feet. – The company is also developing high-street shopping centers near its housing projects. – Two shopping centers in Gurugram and Delhi are expected to become operational in the next 18 months.

Retail Leasing: – Retail leasing across malls and high streets reached over 7 million square feet in 2023. – Brands are actively targeting aspirational customers with new formats, experiential stores, and international merchandise offerings.

Consumption Trends: – Consumption trends have rebounded in 2023, with cinemas stabilizing and growth in footwear, travel & leisure, QSRs, and jewelry & watches.

DLF Group Overview: – DLF Group is engaged in residential and commercial property development and leasing. – The group has developed over 158 real estate projects and has an annuity portfolio of over 42 million square feet. – DLF has land banks to develop 215 million square feet across residential and commercial segments.

Restaurants Encouraged to Display Nutritional Information on Menus and Boards

The Food Safety and Standards Authority (FSSAI) has clarified that restaurants have flexibility in displaying nutritional information, including calorific value, for freshly prepared food and beverages. Restaurants can use menu cards, boards, booklets, handouts, or websites to provide this information. E-commerce food aggregators must obtain nutritional information from restaurants and display it on their platforms. FSSAI advises states to avoid unnecessary actions against food service establishments that comply with these norms.

Key Points:

Flexibility in Displaying Nutritional Information: – Restaurants can use menu cards, boards, booklets, handouts, or websites to display calorific value and other nutritional information.

Mandatory Menu Labeling: – Restaurants with central licenses or ten or more locations must follow menu labeling norms.

E-commerce Food Aggregators: – Food aggregators must obtain nutritional information from restaurants and display it on their platforms.

Discretion for Food Service Establishments: – Restaurants have the discretion to choose the method of displaying nutritional information.

Avoidance of Unnecessary Actions: – FSSAI advises states to avoid unnecessary actions against compliant food service establishments.

CBI Files FIR Against Megha Engineering, Major Electoral Bond Purchaser, in Bribery Case

The Central Bureau of Investigation (CBI) has filed an FIR against Megha Engineering and Infrastructure Ltd. and several officials for alleged bribery in connection with a project related to the Jagdalpur integrated steel plant. Megha Engineering, the second-largest buyer of electoral bonds, had donated significant amounts to various political parties.

Key Points:

Alleged Bribery: – CBI has registered an FIR against Megha Engineering and Infrastructure Ltd. for alleged bribery of ₹78 lakh. – Eight officials of NISP and NMDC and two officials of MECON were also named in the FIR for receiving the bribe.

Electoral Bond Purchases: – Megha Engineering emerged as the second-largest buyer of electoral bonds, donating ₹586 crore to the BJP. – The company also donated to other political parties, including BRS, DMK, YSRCP, TDP, Congress, JD-S, Jana Sena Party, and JD-U.

Project Details: – The alleged bribery is related to a ₹315 crore project awarded to Megha Engineering for works at the Jagdalpur integrated steel plant. – The project involved the construction of an intake well, pump house, and cross-country pipeline.

CBI Investigation: – The CBI registered a preliminary enquiry on August 10, 2023, and recommended a regular case on March 18. – The FIR was filed on March 31, naming the accused officials and Megha Engineering.

Accused Officials: – Eight officials of NISP and NMDC Ltd. were named for allegedly receiving ₹73.85 lakh in bribes. – Two officials of MECON Ltd. were named for allegedly receiving ₹5.01 lakh in bribes.

Other Accused: – Subhash Chandra Sangras, general manager of Megha Engineering, has also been named as an accused. – Megha Engineering and unknown others are also named in the FIR.

BFSI Sector Witnesses Decline in Deal Activity Amid Investor Caution

The banking, financial services, and insurance (BFSI) sector in India experienced a decline in deal activity during the first quarter of 2024. Total deals fell by 7% in volume and 14% in value compared to the previous quarter. Regulatory changes and investor caution contributed to the slowdown. However, private equity investments showed a slight uptick, driven by a large investment in SMFG India Credit Company.

Key Points

Deal Activity – Total deals in Q1 2024: 52 – Total deal value: $1.7 billion – Volume decline: 7% sequentially – Value decline: 14% sequentially

Mergers and Acquisitions (M&A) – M&A deals: 13 – Total M&A value: $973 million – Volume decline: 28% sequentially – Value decline: 28% sequentially

Private Equity (PE) Investments – PE deals: 39 – Total PE value: $681 million – Volume increase: 3% sequentially – Value increase: 18% sequentially

Regulatory Impact – Regulatory changes expected to impact deal activity in the financial services sector – RBI’s digital lending guidelines seen as a potential booster for fintechs

Notable Deals – Sumitomo Mitsui Financial Inc. acquired a 25% stake in SMFG India Credit Company for $700 million – Mizuho Bank acquired a 15% stake in Kisetsu Saison Finance for $145 million – Advent International and Multiples PE invested $233 million in Svantantra Microfin – TPG-backed SK Finance raised $160 million from various funds

Investor Sentiment – Investors are being more cautious about investments – Search for value rather than irrational exuberance – India remains a bright spot for investment

Recent Enhancements to Health Insurance: Making Coverage More Attractive

IRDAI has recently implemented two changes to health insurance policies: reducing the waiting period for pre-existing diseases (PEDs) to 36 months and shortening the moratorium period to 60 months. These changes benefit policyholders by providing earlier coverage for PEDs and reducing the risk of claim rejection due to non-disclosure.

Key Points

Pre-existing Disease Waiting Period

- Reduced from 48 months to 36 months

- Applies to new contracts and existing policyholders with PEDs

- PEDs include chronic diseases such as diabetes, asthma, and heart disease.

- Accurate disclosure of PEDs is crucial to avoid claim rejection.

Moratorium Period

- Shortened from 8 years to 5 years.

- After 5 years, insurers cannot contest a claim based on non-disclosure.

- Applies to the first coverage amount and any subsequent enhancements.

- Disclosure of all relevant health information is essential to avoid claim complications.

Quantum Mutual Fund Objects to Sebi’s Plan to Delist ISec

Quantum Mutual Fund has objected to ICICI Bank’s plan to delist its subsidiary ICICI Securities, alleging non-compliance with regulations and irregularities in the scheme of arrangement. Quantum claims the delisting will result in significant losses for minority shareholders and has raised concerns about ICICI Bank’s exemption claims from SEBI.

Key Points:

Quantum’s Objections:

- Scheme of arrangement is non-compliant as ICICI Bank and ICICI Securities are not in the same line of business.

- Swap ratio will result in a net loss of at least ₹1,776 crore to ICICI Securities minority shareholders.

Quantum’s Concerns:

- ICICI Bank’s claims of receiving exemptions from SEBI for the delisting proposal are unclear.

- Valuation reports have ignored current market peer comparison data and failed to disclose the basis of valuation.

Allegations of Irregularities:

- Majority voting in favor of the scheme of merger was achieved by “fraudulent means” by ICICI Bank.

- ICICI Bank contacted retail shareholders of ICICI Securities to coax them to vote in favor of the scheme.

ICICI Bank’s Defense:

- Scheme of arrangement was recommended by independent valuers.

Shareholder Vote:

- Scheme of arrangements was approved by public shareholders, with 71.89% voting in favor.

- ICICI Securities shares will soon be delisted from the bourses.