Welcome to Daily Banking Digest, your premier source for the latest news and insights on March 23, 2024, focusing on banking, the economy, and finance. Our platform offers a comprehensive overview of the day’s most critical financial stories, market trends, and economic developments. Whether you’re a professional in the financial sector, an investor monitoring market movement, or someone interested in staying informed about the economic landscape, Daily Banking Digest provides reliable, up-to-date information.

Join our Telegram Channel for Daily PDF in your Inbox – Click Here

Table of Contents

India’s Economic Growth Projected at 6.5-7% for Fiscal Year 2025

India’s financial outlook for FY25 appears promising, with various agencies projecting growth between 6.5% and 7%. The government anticipates a growth rate exceeding 7%, supported by improving global investor confidence and inclusion in Bloomberg’s bond index. Inflation is moderating, and other economic indicators are positive. However, the report cautions about potential headwinds, including rising crude oil prices and global supply chain disruptions.

Key Points

Growth Outlook – India’s growth rate for FY25 is estimated between 6.5% and 7%. – The Reserve Bank of India projects a growth rate of 7%. – The government expects a growth rate of over 7%.

Inflation Outlook – Core inflation is trending downwards, indicating moderation in price pressures. – Summer sowing is expected to reduce food prices. – Retail inflation has remained stable within the target range for six consecutive months.

External Outlook – The narrowing merchandise trade deficit and rising net services receipts are expected to improve the current account balance in FY24. – The current account deficit will bear watching in FY25.

Cautions – Rising crude oil prices and global supply chain bottlenecks pose headwinds. – An increase in domestic household savings is necessary to finance private sector capital formation.

Air India Penalized ₹80 Lakh by DGCA for Safety Breaches

The Directorate-General of Civil Aviation (DGCA) has fined Air India ₹80 lakh for violating pilot duty hour regulations. The fine was imposed after a spot audit revealed that the airline had rostered pilots over 60 years old, failed to provide adequate rest, and exceeded permissible duty periods.

Key Points:

- Violation of Pilot Duty Hours: Air India rostered pilots over 60 years old, violating existing rules.

- Inadequate Rest: The airline failed to provide adequate weekly rest, rest before and after ultra-long haul flights, and rest on layovers.

- Exceeding Duty Periods: Crew members exceeded permissible duty periods.

- Wrongly Marked Training Records: Training records were marked incorrectly.

- DGCA’s Commitment to Safety: The DGCA emphasized its commitment to maintaining high safety standards in the civil aviation sector.

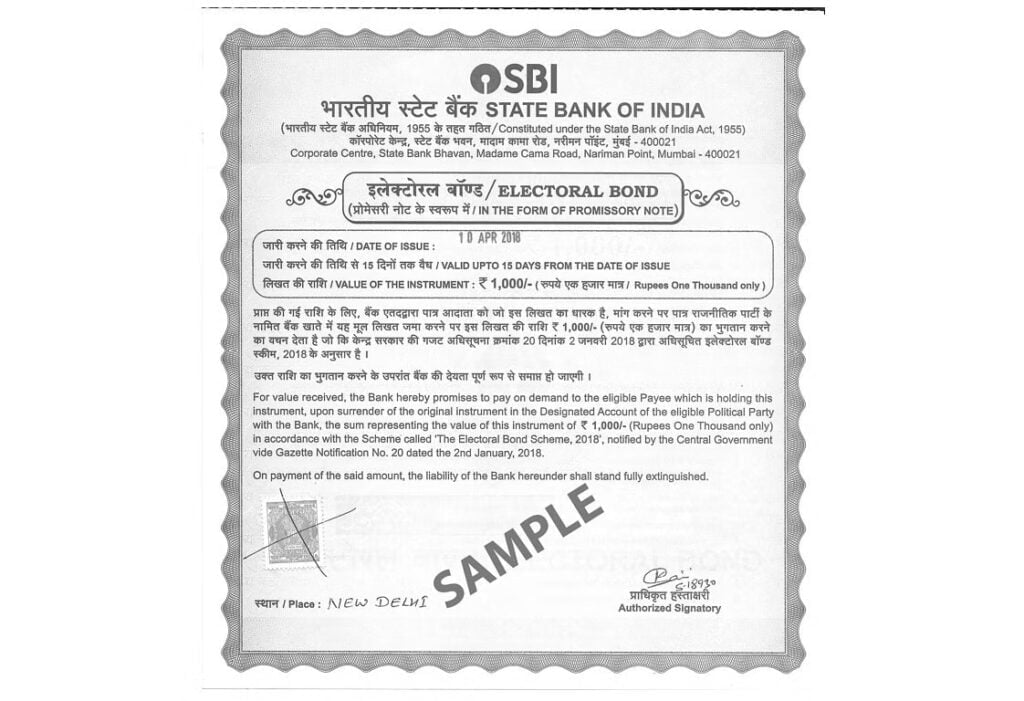

Unidentified Donors: ₹623 Crore in Electoral Bonds Remain Unaccounted for

The latest Electoral Bonds data released by SBI reveals that some bonds encashed by political parties do not have corresponding donor names, raising questions about the transparency of the scheme.

Key Points:

Unmapped Bonds: – 1,679 bonds worth ₹623.2 crore encashed by political parties have no donor names mapped to them. – BJP encashed ₹466 crore, Congress ₹70 crore, and Trinamool Congress ₹17 crore from these unmapped bonds. – The omission occurred because the Supreme Court’s disclosure order applied to bonds purchased and encashed after April 12, 2019, but these bonds were purchased before that date.

Unencashed Bonds: – 130 bonds worth ₹9.63 crore purchased between April 2019 and January 2024 have no encashment dates or political parties mapped. – These bonds may have not been handed to political parties or may have expired before being encashed.

Expired Bonds: – Some of the unencashed bonds were issued by large donors, including Future Gaming, Pacifica Developers, and investigative journalist Poonam Agarwal. – Agarwal purchased a bond in 2020 to demonstrate the existence of alphanumeric numbers on Electoral Bonds.

Supreme Court Order: – The Supreme Court declared Electoral Bond donations unconstitutional in February 2024. – SBI subsequently submitted data on bonds encashed and purchased since April 12, 2019, to the Election Commission.

Cashfree Payments Witnesses 30% Surge in Transaction Volumes Post PA License Acquisition

Cashfree Payments has experienced significant growth since receiving its final PA license from the Reserve Bank of India in December. The company’s transaction volume has increased by 25-30% in one quarter, and merchant leads have doubled to 35,000 per month. Cashfree Payments is on track for double-digit growth and aims to return to profitability by the first quarter of FY25.

Key Points

Transaction Volume Growth – Transaction volume has grown by 25-30% in one quarter.

Merchant Leads – Merchant leads have increased by 75% to 35,000 per month.

Double-Digit Growth – Cashfree Payments is on track for double-digit growth compared to FY23.

Volume Growth – The company has recorded over 80% growth in volume compared to last financial year.

Product Diversification – Cashfree Payments offers over 15 products across payments, collections, and other services.

RiskShield – RiskShield provides real-time risk management and fraud compliance.

FlowWise – FlowWise offers an end-to-end payments management system for enterprises.

Profitability Target – Cashfree Payments aims to return to profitability by the first quarter of FY25.

Funding – The company is currently well-funded and does not have an immediate need to raise additional capital.

New Product Contribution – New products are expected to contribute 20-25% of total revenue by the next financial year.

Indian Rupee Hits Record Low Against US Dollar, Closing at 83.4250

The Indian Rupee (INR) hit a record low of 83.4250 against the US Dollar on Friday, March 22, 2024. The decline was primarily driven by a weak offshore Chinese Yuan and strong demand for Dollars from Indian corporates and investors. The last time the Rupee reached this low was on November 10, 2023.

Key Points:

Currency Dynamics:

- The decline in the Rupee was influenced by the performance of the Chinese Yuan, particularly its offshore counterpart.

- Indian companies and investors repatriated funds and bought Dollars to settle accounts and hedge foreign exchange exposures.

- Corporates made financial decisions towards the end of the financial year, which may have impacted currency flows.

RBI’s Role:

- RBI’s actions will be crucial in curbing the Rupee’s free fall.

Market Outlook:

- The Rupee is expected to rebound from its record lows due to RBI intervention.

- Strong foreign capital inflows and a lower current account deficit support the currency.

Government Securities:

- Government securities (G-Secs) yields rose due to record borrowing plans of States at the next weekly auction.

- Sixteen States and two Union Territories will collectively borrow ₹60,032.49 crore via auction of State government Securities (SGS) on March 26.

Income Tax Department Scrutinizes High-Value Transactions as ITR Filing Deadline Approaches

The Income Tax Department is sending emails to taxpayers regarding significant transactions visible in their Annual Information Statement (AIS). These communications aim to increase compliance and authenticate financial transactions. Taxpayers can access the specific transaction details through the AIS/Compliance Portal under the “e-Campaign” tab. Failure to respond to these communications may result in scrutiny proceedings or assessment for escaped income.

Key Points

Who Receives the Communication? – Taxpayers who have received information from various sources, such as non-filing of return or significant transactions.

Purpose of the Communication – To authenticate financial transactions based on information sourced by the tax department.

How to Check for the Communication? – Login to the ITR e-filing portal, go to the Pending Action tab, and click on “Compliance Portal.” – Click on the “e-Campaign” tab to view the list of flagged transactions.

What to Do if You Receive the Communication? – Provide feedback if the information is incorrect. – File an updated ITR if a deadline exists.

Consequences of Not Responding – Scrutiny proceedings or assessment for escaped income.

Other Ways to Access the Compliance Portal – Go to the e-filing ITR portal, go to the Pending Action tab, and click on “Compliance Portal.” – Click on the “Notices” button.

Why the Income Tax Department Sends the Communication – To increase compliance and authenticate financial transactions.

India Suspends Russian Oil Imports via Sovcomflot Tankers

Indian refiners have stopped accepting Russian crude transported on Sovcomflot tankers due to US sanctions. This has led to increased scrutiny of tanker ownership and disruptions in the trade of Russian oil to India.

Key Points:

US Sanctions on Sovcomflot: – US Treasury designated Sovcomflot and 14 crude oil tankers in which it has an interest. – This is part of wider measures imposed on non-Sovcomflot ships and Russia-friendly companies for violating the G7 price cap on Russian oil.

Impact on Indian Refiners: – Indian refiners, including Indian Oil Corp., have stopped taking cargoes on Sovcomflot tankers. – They are scrutinizing tanker ownership to ensure no affiliation with sanctioned entities.

Disruptions in Russian Oil Trade: – The ban on Sovcomflot tankers has reduced the number of vessels available to deliver Russian crude. – This has led to discounts on Russian oil narrowing to compensate for higher freight costs. – India is still expected to import large volumes of Russian crude this month, but the Sovcomflot issue is causing delays.

Other Impacts: – Two oil ships carrying Russian oil have been waiting off the South Asian coast for several weeks without unloading. – Sovcomflot has stated that the sanctions are putting pressure on its operations.

Finance Ministry Projects Positive Economic Outlook for India in Upcoming Fiscal Year

India’s economic outlook for the next fiscal year (FY25) appears positive, with private investment rising, inflation trending down, and the inclusion of Indian bonds in the Bloomberg bond index expected to boost inflows. The robust investment activity is driving growth, while consumption is also rising steadily.

Key Points:

Private Investment: – Private investment has increased, indicating a positive outlook for the economy.

Inflation: – Inflation is trending down, with core inflation showing a broad-based moderation in price pressures. – The pick-up in summer sowing is expected to help reduce food prices.

Bloomberg Bond Index: – The inclusion of Indian bonds in the Bloomberg bond index from January 2025 is expected to bolster inflows.

Growth: – India grew above 8% for three consecutive quarters, reaffirming its position as a standout performer amid sluggish global growth trends. – Various agencies have revised India’s FY24 growth estimates closer to 8%.

Construction Activity: – Increased demand for residential properties in tier-2 and tier-3 cities is expected to further construction activity.

Employment: – Non-farm employment has revived, improving the capacity to absorb labor leaving agriculture. – The manufacturing sector is expected to generate quality employment.

External Account: – India’s external account is stable, contributing to the positive economic outlook.

Headwinds: – Hardening crude oil prices and global supply chain bottlenecks pose potential headwinds.

RBI Intervenes with Multiple VRR Auctions as Overnight Rates Exceed MSF

The Reserve Bank of India (RBI) conducted three variable rate repo (VRR) auctions to address liquidity tightness in the banking system. The liquidity deficit widened to Rs 1.38 trillion, leading to an increase in weighted average money market rates above the Marginal Standing Facility (MSF) rate. The deficit is expected to persist due to the upcoming government borrowing program.

Key Points:

Liquidity Tightness: – Liquidity deficit in the banking system widened to Rs 1.38 trillion. – Weighted average money market rates rose above the MSF rate.

VRR Auctions: – RBI conducted three VRR auctions to ease liquidity. – First 14-day auction: Received bids for Rs 1.05 trillion, allotted Rs 25,004 crore at 6.73%. – Second 4-day auction: Received bids for Rs 1.32 trillion, allotted Rs 50,005 crore at 6.74%. – Third 4-day auction: Received bids for Rs 40,700 crore, allotted Rs 40,700 crore at 6.73%.

Outlook: – Deficit liquidity is expected to persist due to government borrowing. – Banks are cautious about lending due to the end of the financial year.

Positive Global Trade Outlook Amidst Lingering Geopolitical Concerns: UNCTAD

The United Nations Conference on Trade and Development (UNCTAD) predicts a rebound in international trade in 2024, despite ongoing geopolitical uncertainties. However, logistical challenges, such as shipping disruptions, pose risks to the optimistic outlook.

Key Points:

Global Trade Outlook:

- International trade is expected to rebound in 2024, reversing the 3% contraction in 2023.

- Moderating global inflation and improving economic growth forecasts contribute to the positive outlook.

- Rising demand for environmental goods is expected to boost trade in 2024.

2023 Trade Performance:

- Global trade contracted by 3% in 2023, equaling roughly $1 trillion.

- Trade in goods declined by 5% compared to 2022.

- The services sector grew by 8% year-on-year in 2023.

Quarterly Growth Trends:

- Quarter-on-quarter figures indicate a return to growth in some major economies, including China and India.

- However, overall statistics for 2023 remain negative.

India’s Trade Performance:

- Merchandise exports grew by 5% in the last quarter of 2023 compared to the same period a year ago.

- On an annual basis, export growth saw a 6% contraction.

- Services exports remained flat in the last quarter of 2023 compared to the same period a year ago.

- On an annual basis, services exports from India grew by 14% in 2023.

RBI Board Assesses Domestic Economic Landscape, Prospects, and Obstacles

The Reserve Bank of India’s (RBI) central board met to review the domestic economic situation and outlook, including challenges posed by global financial market volatility. The board also approved the bank’s budget for the 2024-25 accounting year.

Key Points:

- Global and Domestic Economic Outlook: The board reviewed the global and domestic economic situation, including challenges posed by geopolitical developments and global financial market volatility.

- RBI Activities: The board discussed the RBI’s activities, including progress in digital payments, consumer education, and awareness during the current accounting year.

- Board Members: Directors Satish K Marathe, Revathy Iyer, Sachin Chaturvedi, Venu Srinivasan, and Ravindra H Dholakia attended the meeting.

- Deputy Governors: Deputy governors Michael Debabrata Patra, M Rajeshwar Rao, T Rabi Sankar, and Swaminathan J were present.

- Government Representatives: Ajay Seth, Secretary, Department of Economic Affairs, and Vivek Joshi, Secretary, Department of Financial Services, also participated.

India’s Foreign Exchange Reserves Surge by $6.40 Billion, Reaching $642.50 Billion

India’s foreign exchange reserves increased by USD 6.396 billion to USD 642.492 billion for the week ended March 15, 2023. This marks a rise from the previous week’s increase of USD 10.47 billion. The reserves had reached an all-time high of USD 645 billion in October 2021 but have since declined due to the central bank’s intervention to defend the rupee against global pressures.

Key Points:

- Overall Reserves: Increased by USD 6.396 billion to USD 642.492 billion.

- Foreign Currency Assets: Increased by USD 6.034 billion to USD 568.386 billion.

- Gold Reserves: Increased by USD 425 million to USD 51.14 billion.

- Special Drawing Rights (SDRs): Increased by USD 65 million to USD 18.276 billion.

- Reserve Position with IMF: Decreased by USD 129 million to USD 4.689 billion.

Federal Bank and NPCI Collaborate for Seamless Contactless Payments with ‘Flash Pay’

Federal Bank has introduced ‘Flash Pay,’ a RuPay smart key chain that enables contactless payments at metro stations and PoS terminals. It offers convenience and security, allowing users to make payments up to ₹5,000 without a PIN and up to ₹1 lakh per day at PoS terminals.

Key Points:

- Contactless Payments: ‘Flash Pay’ allows contactless payments at enabled metro stations and PoS terminals.

- PIN Authentication: Payments over ₹5,000 require PIN authentication.

- Daily Limit: The per day limit at any PoS terminal is capped at ₹1 lakh.

- Convenience: Users can make payments with a simple tap, eliminating the need for physical cards or cash.

- Security: The device uses tokenization and encryption to ensure secure transactions.

- Partnership: Federal Bank has partnered with NPCI to introduce the RuPay Smart Key chain.

- Executive Director’s Statement: Shalini Warrier, Executive Director at Federal Bank, emphasizes the convenience and security offered by ‘Flash Pay.’

Maldives President Requests Debt Relief from India Following Withdrawal of Military Personnel

Maldives President Mohamed Muizzu has softened his stance towards India, acknowledging its importance as the country’s closest ally. He has urged India to provide debt relief to the Maldives, which owes approximately USD 400.9 million. Muizzu’s conciliatory tone comes after the first batch of Indian military personnel left the Maldives as planned.

Key Points

India’s Importance to the Maldives – India has been instrumental in providing aid and implementing projects in the Maldives. – India remains the Maldives’ closest ally.

Debt Relief Request – The Maldives has taken significant loans from India, which are heftier than the economy can bear. – Muizzu is discussing with India to explore options for repaying the loans within the Maldives’ economic capabilities.

Indian Military Presence – The presence of Indian military personnel in the Maldives was the only matter of contention between the two countries. – India has agreed to withdraw the military personnel.

Pro-China Policy – Muizzu has pursued a pro-China policy, signing a comprehensive strategic cooperative partnership with China. – China has provided a USD 130 million grant and promised to send more tourists to the Maldives.

Maldives’ Strategic Importance – The Maldives’ proximity to India and its location in the Indian Ocean Region give it significant strategic importance.

IRDAI Unveils Governance Enhancement Guidelines

The Insurance Regulatory & Development Authority of India (IRDAI) has implemented new regulations to strengthen the insurance industry’s regulatory framework. These regulations aim to protect policyholders, promote rural and social sector responsibilities, and enhance electronic insurance marketplaces, foreign reinsurance branches, and various aspects of insurance operations.

Key Points:

- Policyholder Protection: Regulations focus on safeguarding policyholders’ interests.

- Rural and Social Sector Responsibilities: Regulations promote insurance coverage in rural and social sectors.

- Electronic Insurance Marketplace: Regulations govern the establishment and operation of electronic insurance marketplaces.

- Foreign Reinsurance Branches: Regulations provide guidelines for the registration and operation of foreign reinsurance branches.

- Registration: Regulations streamline the registration process for insurance companies.

- Actuarial: Regulations enhance actuarial standards and practices.

- Finance and Investment: Regulations strengthen financial and investment management practices.

- Corporate Governance: Regulations promote good governance in product design, pricing, and corporate operations.

IRDAI Approves Galaxy Health’s Health Insurance Launch and Establishes Insurance E-Marketplace

IRDAI has granted a Certificate of Registration to Galaxy Health and Allied Insurance Company Limited, marking the sixth registration approval in the insurance sector within a year. The company, led by V Jagannathan, former founder of Star Health, aims to tap into the rapidly growing health insurance market in India. IRDAI has also introduced new regulations to strengthen the insurance industry and launched Bima Sugam, an electronic marketplace for insurance products and services.

Key Points:

1. Galaxy Health and Allied Insurance Company Limited Registration: – IRDAI has approved the registration of Galaxy Health and Allied Insurance Company Limited to conduct health insurance operations in India. – The company is led by V Jagannathan, former founder of Star Health.

2. Health Insurance Market Growth: – Health insurance is the fastest-growing segment in the general insurance industry, with a projected CAGR of 23% until 2030. – The COVID-19 pandemic has increased awareness of health insurance, contributing to its growth.

3. IRDAI’s New Regulations: – IRDAI has introduced new regulations to strengthen the insurance industry, covering areas such as policyholder protection, rural and social sector obligations, and corporate governance.

4. Bima Sugam Electronic Marketplace: – IRDAI has launched Bima Sugam, an electronic marketplace for insurance products and services. – The platform aims to facilitate product showcasing, customer service, and policy portability. – It is expected to foster collaboration and transparency in the insurance industry.

HDFC Bank Secures $1 Billion in Three-Year Loan Facility

HDFC Bank, India’s largest lender, has secured a $1 billion overseas loan through a term loan syndication involving 23 global banks. The loan, initially set at $500 million, was increased to $1 billion due to strong demand. The funds will be used to support HDFC Bank’s liabilities after its merger with its parent company, HDFC.

Key Points:

Loan Amount: – $1 billion, raised through a term loan syndication

Participating Banks: – 23 global banks from Asia, the Middle East, and Europe

Greenshoe Option: – HDFC Bank exercised the greenshoe option to raise an additional $500 million

Loan Term: – Three years

Pricing: – 110 basis points above the three-month Secured Overnight Financing Rate (SOFR)

Purpose of Loan: – To shore up liabilities after the acquisition of HDFC

Sole Mandated Bank: – MUFG Bank

Other Participating Banks: – Taipei Fubon, Bank of Taiwan, Saudi National Bank, Bank of China, CIMB Bank

India Poised to Rank Third in Global Airline Seat Capacity for Q2

India’s airline seat capacity is projected to grow by 10.5% in Q2 2024, placing it third globally behind the US and China. This growth is driven by IndiGo, which is expected to become the fastest-growing airline among the top 10 globally. However, some regions and countries still lag behind pre-pandemic seat capacity levels.

Key Points:

India’s Airline Seat Capacity Growth: – Projected 10.5% growth in Q2 2024 compared to Q2 2023. – Third-highest capacity globally after the US and China.

India’s Growth Compared to Pre-Pandemic Levels: – 16.8% growth in seat capacity between Q2 2019 and Q2 2024. – Second-highest growth globally, behind only China.

IndiGo’s Growth: – Projected 9.7% growth in Q2 2024. – Expected to become the fastest-growing airline among the top 10 globally. – 50.3% growth between Q2 2019 and Q2 2024.

Global Airline Seat Capacity: – Projected 8% growth in Q2 2024 compared to Q2 2023. – 1.5 billion seats globally in Q2 2024.

Regions and Countries Lagging Behind Pre-Pandemic Levels: – Southeast Asia (down 11.3%) – Eastern and Central Europe (due to Ukraine war) – South Africa – Southwest Pacific – UK (down 1%) – Germany (down 15.5%) – Japan (down 6.5%)

Precious Metals Plummet Due to Global Market Weakness

Gold and silver prices witnessed a significant decline in the national capital on Friday due to weak global market trends. Gold fell by Rs 875 to Rs 66,575 per 10 grams, while silver plunged by Rs 760 to Rs 76,990 per kg.

Key Points:

Gold Price:

- Gold price dropped by Rs 875 to Rs 66,575 per 10 grams.

- Spot gold prices in Delhi markets traded at Rs 66,575 per 10 grams.

- Comex spot gold traded at USD 2,167 per ounce, down USD 35 from the previous day.

- Gold prices declined by nearly 2% from their all-time high due to profit-booking and a rebound in the dollar index.

Silver Price:

- Silver price plunged by Rs 760 to Rs 76,990 per kg.

- Comex spot silver traded at USD 24.45 per ounce.

- Silver prices experienced a correction due to a rise in the dollar index and profit-booking.

Outlook:

- Despite the correction, the overall outlook for gold remains positive.

- Some volatility and further correction may be expected in the near term.

India-EFTA Investment Chapter: A Catalyst for Enhanced Economic Cooperation

The India-EFTA Trade and Economic Partnership Agreement (TEPA) marks a significant step in India’s approach to bilateral trade agreements. The agreement includes a first-of-its-kind Investment Chapter, where EFTA member states commit to promoting foreign direct investment (FDI) and job creation in India. India and EFTA states also agreed to cooperate on skill development, vocational training, and technology collaboration.

Key Points

Investment Promotion and Cooperation – EFTA commits to promoting investments to increase FDI stock from EFTA countries in India by $50 billion over the first 10 years and another $50 billion in the following five years. – EFTA aims to create one million direct jobs in India through such investments.

Skill Development and Technology Collaboration – India and EFTA states will cooperate on skill development, vocational training, and technology collaboration in areas of mutual interest, such as earth science, telemedicine, and renewable energy.

Novel Approach to Investment – The Investment Chapter is a novel attempt to set out concrete steps towards materializing the economic benefits of a bilateral trade agreement. – EFTA governments commit to nudging private investors to look towards India, while India agrees to ensure a conducive investment climate.

Dispute Settlement – The Investment Chapter excludes access to the state-to-state dispute settlement mechanism of the TEPA. – Investor-state dispute settlement (ISDS) is also not included.

Monitoring and Review – Progress on investment and employment targets will be monitored at five-year intervals by government representatives from both sides. – A grace period is built in to allow EFTA states an additional opportunity to meet targets.

Government-to-Government Consultation – A three-tier government-to-government consultation mechanism is included to find mutually agreeable solutions if targets are not met. – India can suspend concessions given to EFTA states in trade of goods if targets are not met.

New Approach by India – The Investment Chapter indicates a new approach by India in its trade and investment relations with partners. – India seeks to ensure sufficient economic benefit from future bilateral agreements.

Collaboration and Balance – EFTA states acknowledge the need for balance in trade agreements. – The TEPA heralds a new beginning of international treaty making with a focus on balanced benefits for both sides.

2 thoughts on “Complete Daily Banking Digest – 23 March 2024”