Daily Banking Digest – 20 February 2024

Welcome to Daily Banking Digest, your premier source for the latest news and insights on February 20, 2024, focusing on banking, the economy, and finance. Our platform offers a comprehensive overview of the day’s most critical financial stories, market trends, and economic developments. Whether you’re a professional in the financial sector, an investor monitoring market movement, or someone interested in staying informed about the economic landscape, Daily Banking Digest provides reliable, up-to-date information.

Join our Telegram Channel for Daily PDF in your Inbox – Click Here

Table of Contents

Licences of 64 pharma companies cancelled after govt crackdown.

Indian authorities have cracked down on pharmaceutical companies and drug testing laboratories for failing to follow “good manufacturing practices” (GMP). This resulted in license cancellations for 64 pharma companies and the shutdown of 17 testing labs. The move aims to address concerns about the quality of exported drugs from India.

Key Points

- Scope of Action: 423 companies were investigated over a year, resulting in license cancellations, suspensions, and show-cause notices.

- Ongoing Review: Compliance reviews are continuous, and licenses will not be automatically reinstated.

- Industry Size: India has around 10,500 drug manufacturing units, with GMP now mandatory for all.

- Spurious Drug Concerns: The crackdown was prompted by reports of substandard drugs exported from India and questions about the quality of cough syrups linked to child deaths abroad.

- Tighter Export Regulations: India has implemented stricter export norms, including mandatory government lab testing of cough syrups.

- Pharmaceutical Significance: India is a major global drug manufacturer, with pharmaceutical exports projected to exceed $20 billion in FY24.

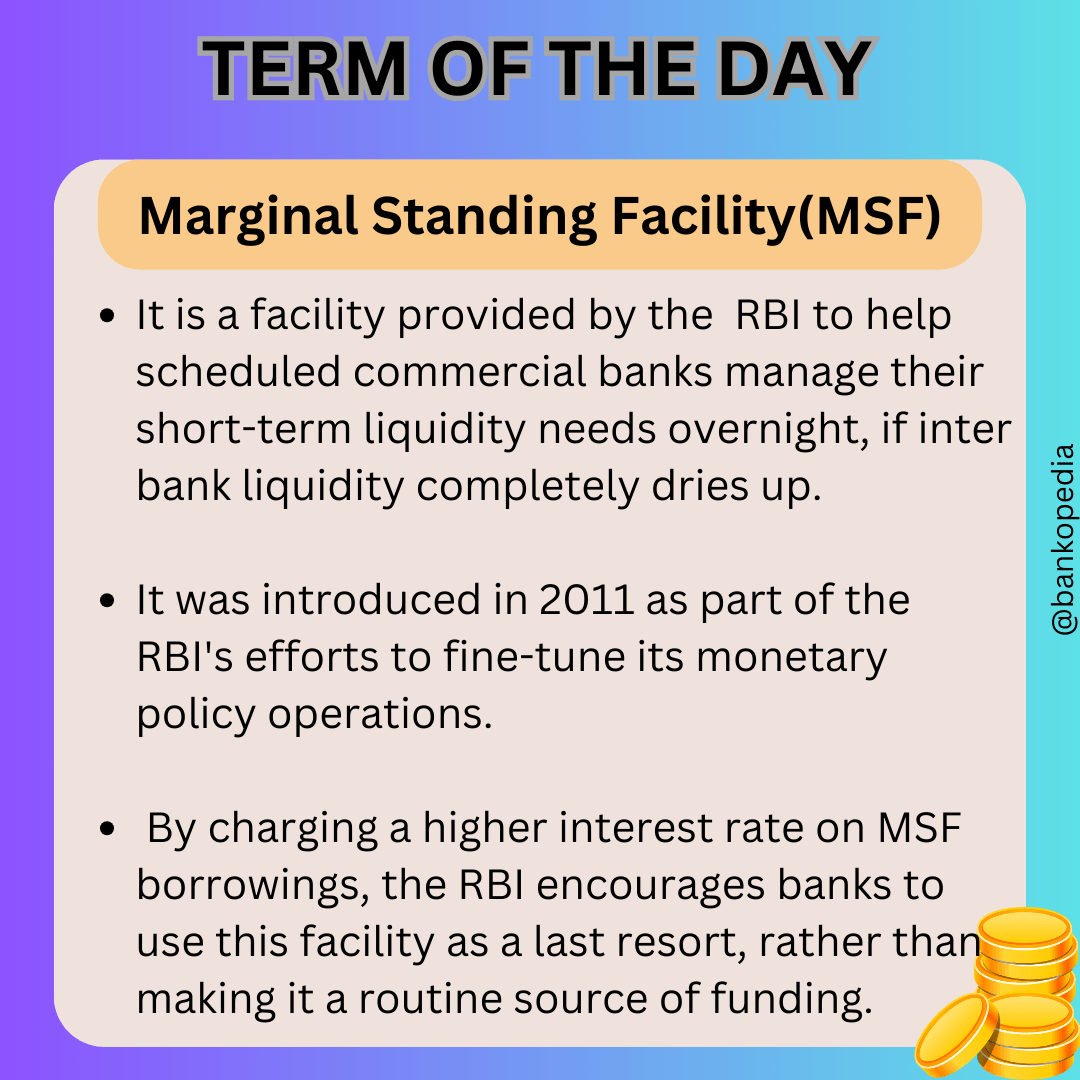

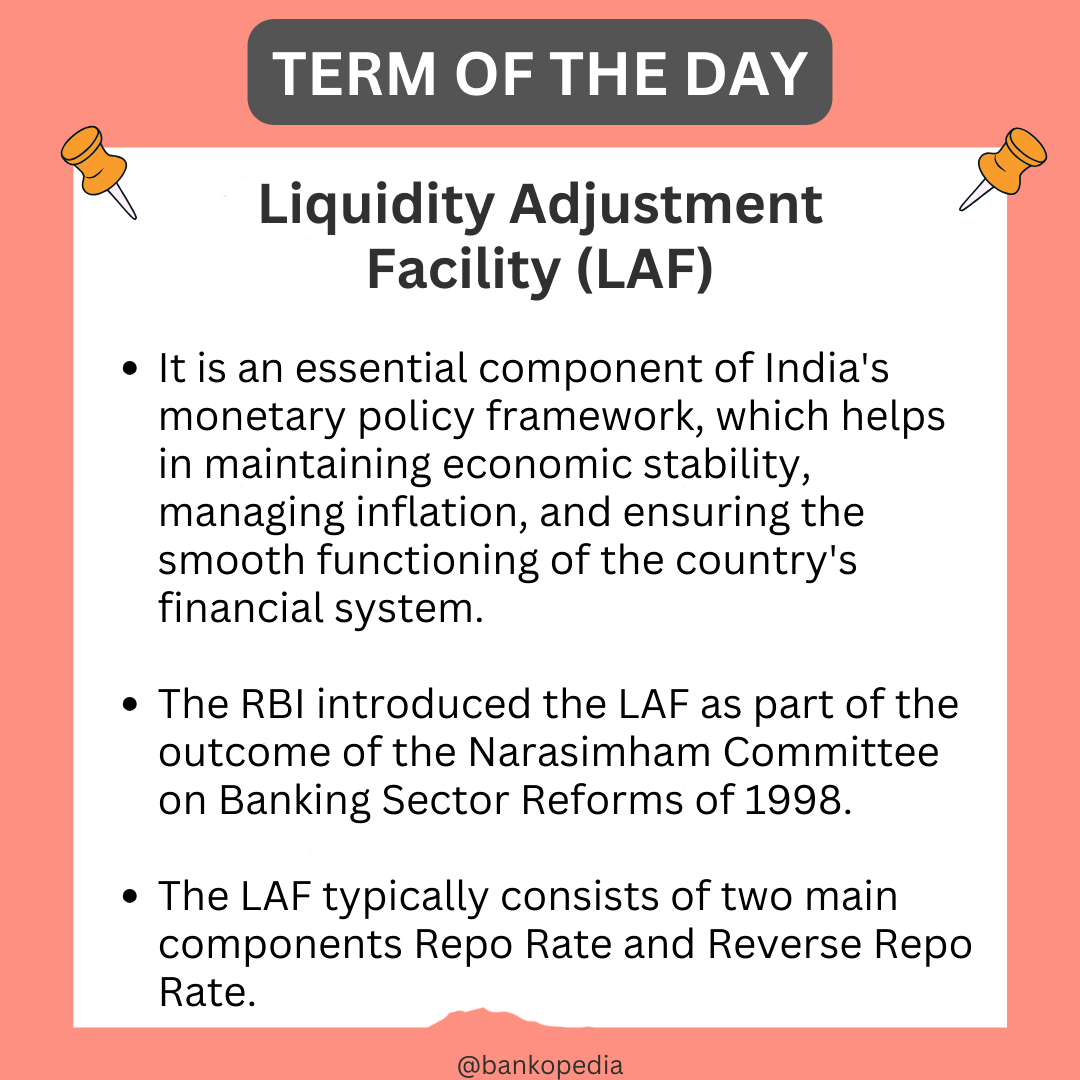

India’s overall financial conditions tightened in January: Crisil index.

India’s financial conditions tightened in January as indicated by CRISIL’s Financial Conditions Index (FCI). This tightening is attributed to factors such as deeper liquidity deficits, pressure on short-term interest rates, and foreign portfolio investors (FPIs) selling off investments.

Key Points

- FCI Decline: The FCI fell to 0.5 in January from 0.7 in December, signaling tighter financial conditions.

- Liquidity Deficit: A widening gap in domestic systemic liquidity resulted in increased reliance on RBI’s liquidity adjustment facility (LAF).

- Impact on Rates: Liquidity challenges put upward pressure on short-term interest rates, including call money, commercial paper (CP), and certificates of deposit (CD) rates.

- Incomplete Policy Transmission: The RBI’s interest rate hikes have not been fully transmitted to lending and deposit rates, prompting the central bank to maintain its stance on withdrawing accommodation.

- Outlook: CRISIL expects the RBI to use liquidity management and regulatory measures to curb excessive credit growth, potentially moderating GDP growth in the next fiscal year. Rate cuts are foreseen from June 2024.

Budget update: Tamil Nadu’s 2024-25 revenue deficit soars to ₹49,279 crore

Tamil Nadu’s budget highlights a growing fiscal challenge with increasing revenue and fiscal deficits. The state government blames the central government for lack of support, particularly related to disaster relief and the financial burden imposed by electricity utility debt.

Key Points

- Rising Deficits: Tamil Nadu’s revenue deficit for 2024-25 is projected at ₹49,279 crore, and the fiscal deficit at ₹1,08,690 crore. Both deficits show significant increases compared to 2023-24 estimates.

- Electricity Utility Burden: The state’s financial strain is significantly worsened by compensating for the electricity utility TANGEDCO, requiring substantial government support.

- Appeal for Reform: Tamil Nadu seeks a revision of the borrowing calculation rules to exclude utility debt, arguing that it hinders the state’s development initiatives.

- Criticism of Central Government: The state accuses the central government of a “step-motherly” treatment and failing to provide disaster relief funds despite repeated requests.

- Tax Revenue Impact: Natural calamities have slowed tax revenue growth, with lower-than-budgeted projections.

- Fiscal Consolidation Effort: Despite the challenges, Tamil Nadu aims to reduce its fiscal deficit to 3.44% of GSDP, in line with the 15th Finance Commission’s recommendations.

Implementation of budget announcement. Withdrawal of small IT demands not to entail credit, refund, says IT Dept

The Central Board of Direct Taxes (CBDT) has clarified the details of the income tax demand remission scheme announced in the Interim Budget. The scheme offers relief to taxpayers with small outstanding tax demands, but it does not imply any credit, refund, or immunity from prosecution.

Key Points

- Remission Scope: The scheme covers outstanding income tax, wealth tax, and gift tax demands up to a maximum of ₹1 lakh per taxpayer, including interest, penalties, and fees.

- No Credit or Refund: Taxpayers won’t receive any credit or refund as a result of the demand remission.

- No Immunity from Prosecution: The scheme won’t provide immunity against pending or future criminal proceedings against taxpayers.

- Exclusions: Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) demands are not eligible for remission.

- Benefits: The scheme aims to benefit over 1 crore taxpayers by clearing long-standing small tax disputes.

- Expert Commentary: Tax experts view the scheme positively, seeing it as a way to reduce the burden on taxpayers, simplify administration, and focus on larger cases. However, they emphasize that it doesn’t grant immunity from prosecution for tax-related offenses.

PM’s rooftop scheme for 1 cr homes may open up 30-40 GW of installation opportunity

The Indian government’s “PM Surya Ghar: Muft Bijli Yojana” rooftop solar scheme aims to provide free electricity to 1 crore (10 million) homes and is expected to generate substantial business opportunities in the rooftop solar sector.

Key Points

- Program Scope: The scheme plans to provide up to 300 units of free electricity per month to 1 crore households, with an investment exceeding Rs 75,000 crore.

- Industry Opportunity: The initiative could create 30-40 GW of new rooftop solar installation capacity over 2-3 years, offering major growth potential for the industry.

- Tata Power’s Position: Tata Power, a leading rooftop solar player, sees significant business potential and plans to utilize its in-house solar module manufacturing capacity.

- Solar Manufacturing: While India has achieved self-sufficiency in solar module production, solar cell manufacturing capacity needs to be expanded.

- Benefits: The scheme promotes sustainable energy, provides financial relief for households, and could help achieve 80-85% of the government’s 40 GW rooftop solar target.

Vladivostok-Chennai route talks on, dedicated shipping service under consideration too

India and Russia are actively working to increase traffic and commercial viability of the Chennai-Vladivostok Eastern Maritime Corridor shipping route. Discussions are focused on securing cargo commitments and potentially establishing dedicated shipping services.

Key Points

- Goal: The aim is to quickly operationalize the route and attract commercial cargo volume.

- Cargo Focus: Initial focus is on crude oil and coking coal imports, with trial shipments currently underway.

- Steel Industry Interest: A major Indian steelmaker is exploring using the corridor for coking coal imports, potentially boosting volumes.

- Route Advantages: The Eastern Maritime Corridor significantly reduces shipping distance and time between India and Russia’s Far East ports compared to traditional routes.

- Chennai Port Growth: Chennai Port continues to show traffic growth, supporting the potential for increased cargo movement via the new route.

Paytm nodal account: Axis Bank to get “fee and float” boost.

Axis Bank will benefit from handling Paytm’s nodal account, gaining both fees and float income, following RBI’s restrictions on Paytm Payment Bank Ltd (PPBL). Paytm’s parent company, One 97 Communications Limited (OCL), has moved the account due to concerns about conflicts of interest with PPBL.

Key Points

- Nodal Account Shift: Paytm moves its nodal account from PPBL to Axis Bank after RBI scrutiny.

- Benefits for Axis Bank: Axis Bank will earn fees for merchant settlements and can utilize the account’s float funds to generate income.

- RBI’s Concerns: The RBI disapproved of the previous arrangement where Paytm’s nodal account was with PPBL, a company in which Paytm holds a significant stake.

- PPBL Restrictions: Due to compliance issues, the RBI imposed restrictions on PPBL, prompting the account shift.

- Additional Nodal Bank: Paytm is seeking a second partner bank for further diversification of its nodal services.

Centre proposes 5-year guaranteed procurement at MSP for 5 crops cotton, maize, tur, urad and masur.

To address farmer protests over Minimum Support Price (MSP), the Indian government proposes to directly purchase five crops (cotton, maize, tur, urad, masur) at MSP without quantity limits. Farmers demand a legal guarantee for MSP, which the government hasn’t committed to yet.

Key Points

- Government Proposal: Direct purchase of five crops at MSP through government agencies, but no legal guarantee for MSP.

- Farmers’ Response: Farmer leaders will discuss the proposal within their groups and seek a response on outstanding demands of debt waiver and land acquisition formula by February 21st. Peaceful protests to resume if demands aren’t met.

- Cooperation Minister’s Scheme: The proposal aligns with a scheme to extend assured purchase benefits to more crops.

- Punjab Chief Minister’s Presence: CM Bhagwant Mann participated in the talks between the Centre and farmers.

- SKM’s Position: The Samyukt Kisan Morcha (SKM) maintains its demand for MSP based on the C2 + 50% formula and plans to gherao BJP leaders’ residences in Punjab.

Paytm ready for all options for bank’s survival, including acquisition.

Despite facing severe regulatory setbacks for Paytm Payments Bank, its parent company One 97 Communications (Paytm) remains hopeful for the bank’s survival, even if it requires an acquisition. Sources suggest potential miscommunication with the RBI contributed to the situation.

Key Points

- Acceptance of Loss: Paytm acknowledges the potential loss of its associate, Paytm Payments Bank, due to regulatory restrictions.

- Hope for Survival: Paytm seeks a chance for the bank to survive through acquisition if the regulator allows it.

- RBI Restrictions Impact: New restrictions threaten the operations of Paytm Wallet and FASTag, affecting millions of users.

- Seeking Clarity: Paytm continues to question the severity of RBI’s actions while attempting to rectify the identified lapses.

- Suspected Miscommunication: Sources hint at potential misunderstandings between Paytm and the RBI that may have exacerbated the situation.

- Regulatory History: Paytm Payments Bank has faced ongoing scrutiny and past violations since its inception.

Fintech start-up Bold Finance to shut shop.

Gold loan fintech startup Bold Finance shuts down due to low productivity in new branches, challenges in the fragmented gold loan market, and increased competition from organized players. This closure follows a similar trend in the fintech sector.

Key Points

- The Rise and Fall: Bold Finance initially saw success after raising $1.5 million seed funding but ultimately faced operational challenges.

- Unfavorable Market: The unorganized gold loan market, Bold Finance’s target, is shrinking and has difficulty offering sustainable economics.

- Increased Competition: Banks with competitive products and relaxed RBI regulations during Covid have intensified competition in the gold loan sector.

- Challenges for Jewellers: Jewellers, Bold Finance’s partners, struggle to obtain larger-ticket gold loans and find processing small-ticket loans inconvenient.

- Fintech Trend: Bold Finance’s closure adds to concerns about the sustainability of Indian fintech startups amidst challenging market conditions.

India’s first spy satellite made by local private player set for SpaceX liftoff.

India’s first privately-built military-grade spy satellite is ready for launch by SpaceX. This landmark project underscores India’s growing prowess in space technology and strengthens its ability to monitor borders and military targets.

Key Points

- Domestic Production: Tata Advanced Systems (TASL) has manufactured the satellite domestically, collaborating with Satellogic.

- Technological Leap: The satellite offers high-resolution (0.5-meter) imagery, rivaling capabilities previously sourced from foreign vendors.

- Strategic Control: India will maintain full control over ground operations and coordinate monitoring, enhancing operational secrecy.

- Operational Benefits: The satellite will provide timely intelligence for monitoring infrastructure, military targets, and border regions.

- Global Potential: The technology has export potential to friendly countries.

- Scalability: TASL’s facility can produce 25 similar satellites annually, enabling the rapid formation of constellations.

Chanda Kochhar case: HC calls out CBI for abuse of power while arresting former ICICI chief, husband

The Bombay High Court strongly criticizes the Central Bureau of Investigation (CBI) for its handling of the loan fraud case against Chanda Kochhar (ex-ICICI Bank chief) and her husband Deepak Kochhar. The court declared their arrests illegal, citing misuse of power and failure to follow legal procedures.

Key Points

- Court Condemns CBI’s Methods: The CBI is criticized for arresting the Kochhars without sufficient grounds and demonstrating “abuse of power”.

- Illegal Arrests: The court finds the arrests illegal as the CBI failed to provide justification or evidence supporting the decision.

- Right to Silence: The court upholds the Kochhars’ right to remain silent under Article 20(3) of the Indian Constitution, rejecting CBI’s argument of non-cooperation.

- Procedural Lapses: The court notes violations of Criminal Procedure Code (CrPC) Section 41A, highlighting CBI’s disregard for proper arrest procedures.

- Time Delay: The court questions the lengthy gap between the FIR registration (2019) and the Kochhars’ questioning (2022).

Background: Videocon Loan Fraud Case

- The CBI alleges ICICI Bank, under Chanda Kochhar, sanctioned loans to Videocon Group in violation of banking regulations.

- Venugopal Dhoot (Videocon founder) was also arrested but later released on bail.

- Allegations include quid pro quo investments in Deepak Kochhar’s company by Dhoot in exchange for the loans.

Piyush Goyal confident of rate cut by Reserve Bank in coming months.

Commerce and Industry Minister Piyush Goyal expresses optimism that the Reserve Bank of India (RBI) will soon reduce interest rates as inflation comes under control.

Key Points

- Minister’s Expectation: Goyal believes a rate cut is likely in the near future, citing India’s strong economic fundamentals and easing inflation.

- Interest Rate Impact: A reduction in RBI’s key policy rate would lower borrowing costs for businesses and individuals, potentially decreasing EMIs.

- Recent Monetary Policy: RBI maintained the repo rate at 6.5% in February but lowered the retail inflation projection for the next fiscal year.

- Inflation Trend: Both retail (CPI) and wholesale (WPI) inflation figures moderated in January.

- Economic Growth Target: The government aims to significantly increase India’s economy to $30-35 trillion by 2047.

ED has not yet found forex breaches at Paytm unit, source says.

An ongoing investigation by India’s Enforcement Directorate (ED) into Paytm Payments Bank for potential foreign exchange violations has yet to find significant breaches. While some lapses in compliance were initially noted, further investigation is needed to determine if charges will be brought.

Key Points

- Initial Probe: The ED investigation revealed potential lapses in Know-Your-Customer (KYC) rules and suspicious transaction reporting, but no major foreign exchange violations were uncovered.

- Market Reaction: Paytm shares rose for a second day despite the ongoing investigation, following a period of significant decline sparked by RBI restrictions on the bank.

- Analyst Sentiment: Brokerages express mixed opinions on Paytm’s future, with some citing positive developments like the Axis Bank partnership, while others maintain cautious outlooks pending regulatory clarity.

- RBI and Paytm Actions: Paytm Payments Bank was granted a 15-day extension to wind down operations and is actively seeking banking partners to maintain services.

After shifting nodal accounts to Axis, Paytm to seek third-party app licence from NPCI.

Paytm, facing limitations due to RBI restrictions on its Payments Bank, is seeking a Third-Party Application Provider (TPAP) license from the National Payments Corporation of India (NPCI) to continue operating its UPI services.

Key Points

- TPAP Significance: A TPAP license allows entities to facilitate UPI transactions through partner banks and is currently held by major players like PhonePe and Google Pay.

- License Necessity: Paytm needs a TPAP license to maintain UPI operations without relying on its Payments Bank, which is being wound down by RBI directive.

- Axis Bank Partnership: Axis Bank, a key partner for major UPI players, is expected to support Paytm’s TPAP application.

- Industry Support: NPCI is reportedly keen to expedite the license process to ensure continuity of UPI services for Paytm users.

- Alternative Licenses: Paytm’s existing payment licenses have limitations or have been denied, making the TPAP license crucial for the company’s UPI future.

- Market Landscape: Paytm is a significant player in UPI transactions, making a smooth transition and maintaining its market share important for the overall UPI ecosystem.

Farmer leaders reject govt’s proposal over MSP, to go ahead with ‘Delhi Chalo’ march on Feb 21

Farmer leaders rejected the government’s proposal on Minimum Support Price (MSP), stating it offers no benefits to farmers. They plan to proceed with their ‘Delhi Chalo’ march on February 21st and criticize the treatment of farmers by authorities.

Key Points

- Rejected Proposal: Farmers find the government’s offer on MSP unacceptable and unfavorable.

- March Plans: The planned ‘Delhi Chalo’ march will proceed on February 21st.

- Punjab CM’s Involvement: Punjab Chief Minister Bhagwant Mann attended the meeting and advocated for a legal guarantee on MSP.

- Condemnation of Authorities: Farmer leaders criticized the use of tear gas and pellet guns against demonstrators and requested the Supreme Court to take note.

- Outstanding Demands: Farmer’s demands, including a legal guarantee for MSP, implementation of Swaminathan Commission recommendations, and addressing of other concerns, remain unresolved.

- Government’s Stance: The government acknowledges the complexity of farmers’ demands, requiring further discussions and potentially a change in government post-elections.

At $365 billion, Tata Group grows bigger in size than entire Pakistan economy.

The Tata Group’s market capitalization surpasses the total GDP of Pakistan, highlighting the conglomerate’s success and India’s outpaced economic growth compared to its neighbor. Tata’s dominance is fueled by substantial gains across many of its listed companies.

Key Points:

- Tata’s Market Value: The conglomerate’s market value exceeding $365 billion dwarfs Pakistan’s GDP estimated at $341 billion.

- Key Driver: TCS, India’s second-largest company, accounts for roughly half of Pakistan’s entire economy.

- Exceptional Returns: Numerous Tata companies like Tata Motors and Trent delivered significant returns for investors.

- Unlisted Strength: Even without considering substantial unlisted Tata entities, the group’s scale rivals Pakistan’s economy.

- Ownership Structure: Unlike typical family-owned businesses, Tata’s success stems from professional management and ownership by philanthropic trusts.

- Investor Confidence: The late investor Rakesh Jhunjhunwala was famously bullish on Tata stocks, with a sizable portion of his portfolio invested in the group.

- Contrasting Fortunes: While India is poised to become the world’s third-largest economy, Pakistan faces severe economic hardships with heavy debt, low foreign reserves, and dwindling international support.

FM Nirmala Sitharaman to meet fintech heads next week.

Finance Minister Nirmala Sitharaman will meet with fintech industry leaders and government officials to address concerns arising from RBI’s actions against Paytm Payments Bank. The aim is to reassure the sector of its importance and the government’s commitment to innovation.

Key Points

- Meeting Purpose: The meeting aims to understand fintech industry concerns and demonstrate continued government support for the sector.

- Context: RBI’s directives restricting Paytm Payments Bank have heightened worries among fintech firms about innovation and regulation.

- Signal to Ecosystem: The government wants to reaffirm the importance of fintech and startups while clarifying that Paytm’s situation is isolated.

- Wider Concerns: Startup founders have written to the RBI and Finance Minister expressing concerns about the Paytm case and its impact on the broader fintech ecosystem.

- Government Priorities: The government prioritizes fintech and digital payments as key components of inclusive growth and social programs.

Panel on insolvency proposes mediation at pre-default stage.

An expert committee recommends introducing mediation before loan defaults occur to improve resolution outcomes and prevent cases from entering the formal Insolvency and Bankruptcy Code (IBC) process. This aims to address the significant number of delayed resolution cases under the IBC.

Key Points

- Pre-Default Mediation: Mediation at the pre-default stage could lead to faster out-of-court settlements, avoiding lengthy IBC proceedings.

- Focus on Prevention: Promoting dispute resolution before borrowers enter insolvency proceedings could aid in swift recoveries and maintain company control outside the IBC process.

- Addressing IBC Delays: A staggering 68% of IBC resolution cases have exceeded stipulated timelines, highlighting the need for alternative strategies to prevent case overload and value erosion.

- Alternative Dispute Resolution: Mediation offers a potential tool to avoid cases even needing a formal IBC insolvency process.

- Committee Formation: The proposal originated from an expert committee established by the Insolvency and Bankruptcy Board of India (IBBI).

IRDAI to enhance scrutiny of health & savings plans aimed at individuals over 55 to curb misselling.

India’s insurance regulator (IRDAI) seeks tighter scrutiny of complex insurance products targeted at older individuals (55+) to combat misselling. Discussions include enhanced transparency, video verification during sales, and stricter accountability for all involved parties.

Key Points

- Complex Product Focus: Increased oversight will apply to market-linked products, health plans, and savings plans, where benefits vary and misselling risks are higher for older customers.

- Transparency and Accountability: Regulator pushes for clear explanations during sales, especially to less financially literate clients, and audits of processes and redressal mechanisms.

- Bancassurance Restrictions: Proposals aim to reduce misselling via banks by banning targets/incentives and introducing regular audit requirements.

- Video Verification: Introduction of mandatory video confirmation before issuing policies is being considered to improve the sales process.

- IT Department Focus: Tax authorities have investigated cases of insurers using intermediaries to circumvent commission regulations, indicating additional concerns in the insurance sector.