Table of Contents

Introduction

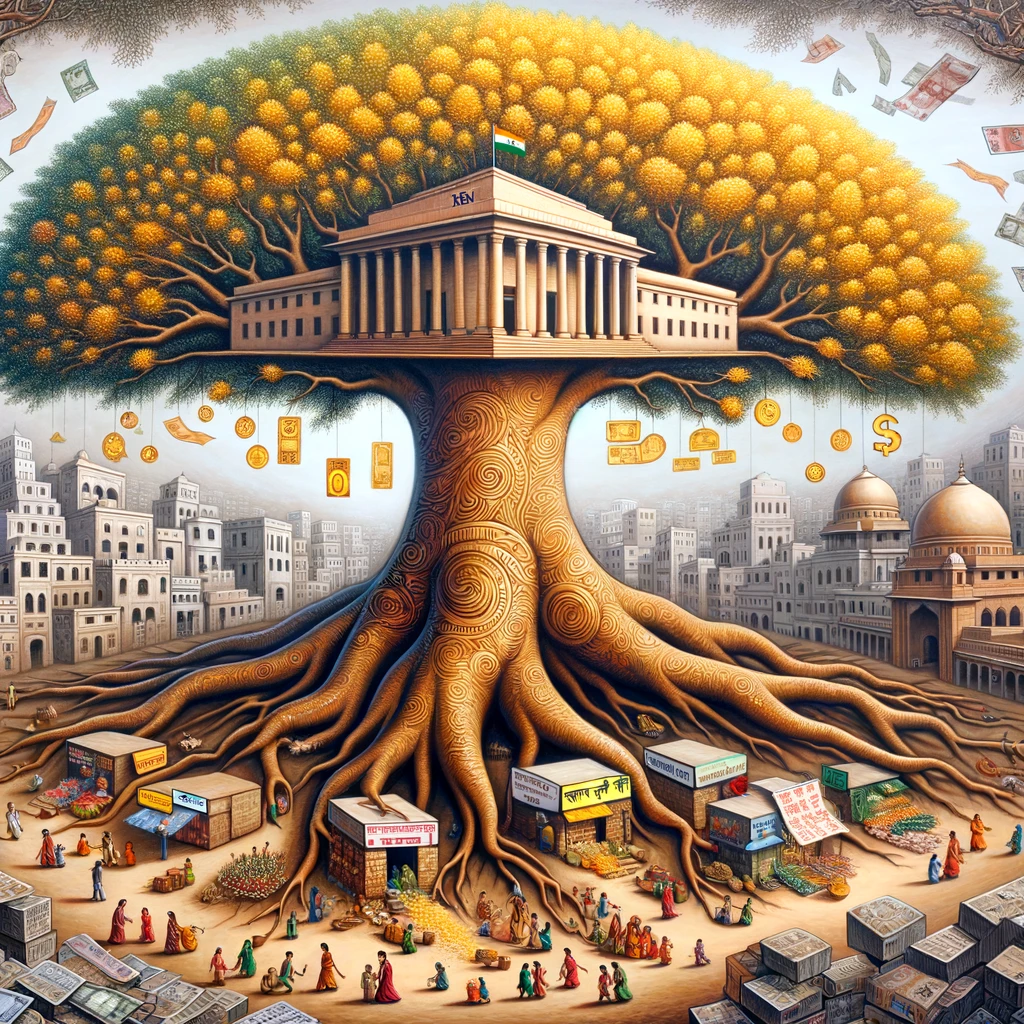

Monetary policy is a crucial tool employed by central banks to manage the money supply, maintain price stability, and promote economic growth. In India, the Reserve Bank of India (RBI) is responsible for formulating and implementing monetary policy. The RBI uses various monetary policy instruments to achieve its objectives, which can be broadly categorized into quantitative and qualitative measures.

Join our Telegram Channel for Daily PDF in your Inbox – Click Here

Quantitative Measures

1. Repo Rate and Reverse Repo Rate

The repo rate is the interest rate at which the RBI lends money to commercial banks against securities. By increasing or decreasing the repo rate, the RBI can influence the cost of borrowing for banks, thereby affecting the overall liquidity in the system. For example, if the RBI increases the repo rate from 4.00% to 4.25%, it becomes more expensive for banks to borrow from the RBI, leading to a reduction in liquidity.

The reverse repo rate is the interest rate at which the RBI borrows money from commercial banks. By adjusting the reverse repo rate, the RBI can influence the amount of excess liquidity in the banking system. For instance, if the RBI increases the reverse repo rate from 3.35% to 3.60%, banks will be incentivized to park their excess funds with the RBI, thus reducing the overall liquidity in the system.

2. Open Market Operations (OMOs)

OMOs involve the buying and selling of government securities by the RBI in the open market. When the RBI buys government securities, it injects liquidity into the system, as it pays for the securities with money. Conversely, when the RBI sells government securities, it absorbs liquidity from the system. For example, if the RBI purchases government securities worth Rs. 10,000 crore, it effectively injects Rs. 10,000 crore into the banking system.

3. Cash Reserve Ratio (CRR)

The CRR is the proportion of a bank’s total deposits that it must maintain as reserves with the RBI. By adjusting the CRR, the RBI can directly influence the amount of money available for banks to lend. For instance, if the RBI increases the CRR from 3% to 4%, banks will have to maintain a higher proportion of their deposits as reserves, reducing the amount available for lending.

4. Statutory Liquidity Ratio (SLR)

The SLR is the proportion of a bank’s total deposits that it must maintain in the form of liquid assets, such as government securities, cash, and gold. By changing the SLR, the RBI can influence the amount of funds available for banks to lend. For example, if the RBI reduces the SLR from 18% to 17%, banks will have more funds available for lending, as they can maintain a lower proportion of their deposits in liquid assets.

Qualitative Measures

1. Marginal Standing Facility (MSF)

The MSF is a window through which banks can borrow overnight funds from the RBI at a higher rate than the repo rate. This facility is typically used by banks to meet their short-term liquidity needs. The MSF rate is usually set 25 basis points above the repo rate. For instance, if the repo rate is 4.00%, the MSF rate would be 4.25%.

2. Bank Rate

The bank rate is the interest rate at which the RBI provides long-term loans to commercial banks and other financial institutions. This rate is typically higher than the repo rate and is used to signal the RBI’s long-term monetary policy stance. For example, if the RBI increases the bank rate from 4.25% to 4.50%, it indicates a tightening of monetary policy.

3. Moral Suasion

Moral suasion refers to the RBI’s use of persuasion and unofficial guidance to influence the behavior of commercial banks. This can include informal discussions, public statements, or even directives to banks to encourage or discourage certain lending or investment practices. For instance, the RBI might use moral suasion to encourage banks to increase lending to priority sectors, such as agriculture or small businesses.

Unconventional Monetary Policy Measures

1. Long-Term Repo Operations (LTROs)

LTROs are a tool used by the RBI to provide long-term liquidity to the banking system. Under this mechanism, the RBI conducts repo auctions with tenors of one to three years, allowing banks to borrow funds at the prevailing repo rate. For example, in February 2020, the RBI conducted a three-year LTRO auction for Rs. 25,000 crore at a repo rate of 5.15%, providing long-term liquidity to the banking system.

2. Targeted Long-Term Repo Operations (TLTROs)

TLTROs are a variant of LTROs that aim to provide targeted liquidity to specific sectors of the economy. Under this mechanism, the RBI conducts repo auctions with tenors of up to three years, with the condition that the funds borrowed by banks must be invested in specific sectors, such as corporate bonds, commercial paper, or non-convertible debentures. For instance, in April 2020, the RBI conducted TLTRO auctions totaling Rs. 50,000 crore to provide liquidity support to sectors affected by the COVID-19 pandemic.

3. Operation Twist

Operation Twist is an unconventional monetary policy tool that involves the simultaneous purchase of long-term government securities and the sale of short-term government securities. This operation aims to flatten the yield curve by lowering long-term interest rates and raising short-term rates. For example, in December 2019, the RBI conducted an Operation Twist by purchasing Rs. 10,000 crore of 10-year government bonds and selling an equivalent amount of short-term government securities.

Conclusion

The Reserve Bank of India employs a wide range of monetary policy instruments to manage the money supply, maintain price stability, and support economic growth. These instruments include quantitative measures, such as the repo rate, reverse repo rate, open market operations, cash reserve ratio, and statutory liquidity ratio, as well as qualitative measures, such as the marginal standing facility, bank rate, and moral suasion. In recent years, the RBI has also resorted to unconventional monetary policy measures, such as long-term repo operations, targeted long-term repo operations, and Operation Twist, to address specific challenges in the economy. By effectively utilizing these instruments, the RBI aims to ensure a stable and conducive financial environment that fosters sustainable economic development in India.

1 thought on “Monetary Policy Instruments in India”