Welcome to Daily Banking Digest, your premier source for the latest news and insights on March 14, 2024, focusing on banking, the economy, and finance. Our platform offers a comprehensive overview of the day’s most critical financial stories, market trends, and economic developments. Whether you’re a professional in the financial sector, an investor monitoring market movement, or someone interested in staying informed about the economic landscape, Daily Banking Digest provides reliable, up-to-date information.

Join our Telegram Channel for Daily PDF in your Inbox – Click Here

Table of Contents

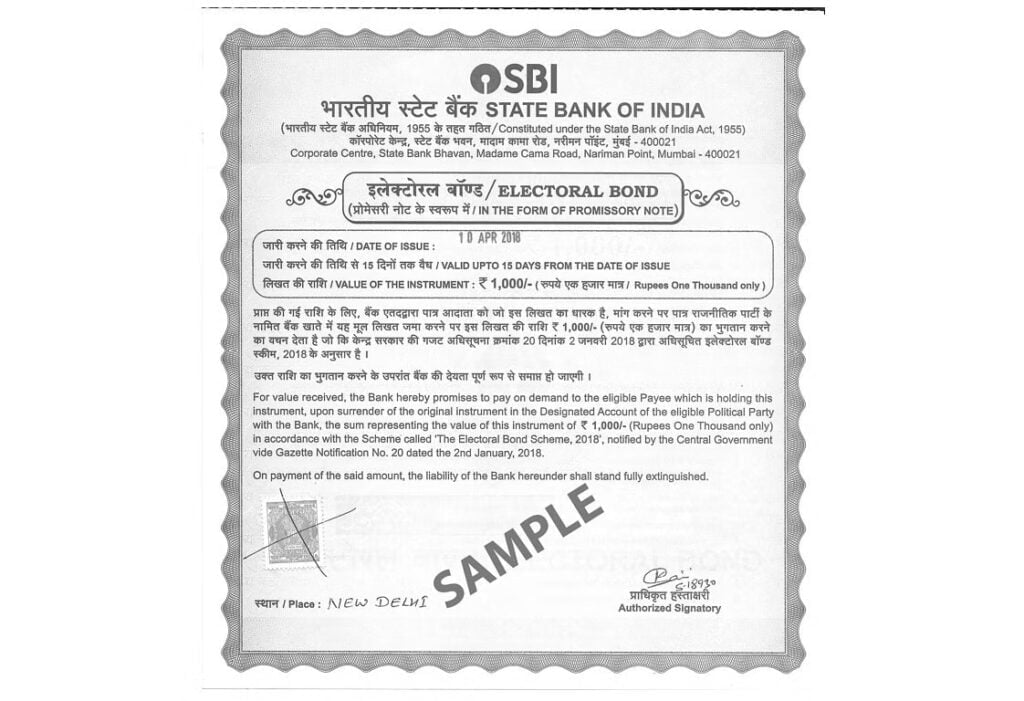

Electoral Bond Transactions: 22,217 Purchased, 22,030 Redeemed

The State Bank of India (SBI) has disclosed details of 22,217 electoral bonds sold between April 2019 and February 2024, with 22,030 redeemed during the same period. The data, including purchaser names and bond denominations, has been submitted to the Election Commission of India (ECI) for public disclosure by March 15.

Key Points:

Number of Electoral Bonds Sold and Redeemed: – 22,217 electoral bonds sold between April 1, 2019 and February 15, 2024 – 22,030 electoral bonds redeemed during the same period

Data Furnished to ECI: – Date of purchase of each electoral bond – Name of the purchaser – Denomination of the electoral bond purchased – Date of encashment of the electoral bond – Name of political party receiving the contribution – Denomination of the electoral bond encashed

Compliance with Court Directions: – SBI submitted the data to ECI by March 12, as directed by the Supreme Court – ECI will upload the data by 5 pm on March 15

Uncashed Electoral Bonds: – Amount of uncashed electoral bonds transferred to Prime Minister’s National Relief Fund

NHAI Urges Paytm FASTag Users to Transition to Alternative Bank FASTags

The National Highways Authority of India (NHAI) has advised Paytm FASTag users to obtain a new FASTag from another bank by March 15, 2024. This is due to restrictions imposed by the Reserve Bank of India on Paytm Payments Bank, which will prevent users from recharging or topping up their Paytm FASTags after that date.

Key Points:

- Paytm FASTag Restrictions: Paytm FASTag users will not be able to recharge or top up their balance after March 15, 2024.

- New FASTag Required: Users are advised to procure a new FASTag from another bank before March 15, 2024.

- Existing Balance: Users can continue to use their existing Paytm FASTag balance to pay tolls beyond March 15.

- Penalties and Double Fees: Failure to obtain a new FASTag may result in penalties or double fee charges at toll plazas.

- Contact Information: Users can contact their respective banks or refer to the FAQs on the IHMCL website for assistance.

RBI Proposes Framework for Climate-Related Financial Disclosures

The Reserve Bank of India (RBI) has released draft guidelines for regulated entities (REs) to disclose climate-related financial risks. These guidelines align with global frameworks and require REs to disclose information on governance, strategy, risk management, metrics, and targets. The disclosures will cover Scope 1, 2, and 3 greenhouse gas emissions. REs are expected to provide feedback by April and implement the guidelines gradually over the next few years.

Key Points

1. Scope of Guidelines – Applies to scheduled commercial banks, Tier IV primary urban co-operative banks, foreign banks in India, all Indian financial institutions, and top and upper layer non-banking financial companies.

2. Thematic Pillars of Disclosure – Governance: Board oversight, senior management role, risk identification. – Strategy: Impact on business, strategy, and financial planning. – Risk Management: Identification, assessment, and mitigation of climate-related risks. – Metrics and Targets: Performance on targets and metrics, including emissions reporting.

3. Alignment with Global Frameworks – Follows the Task Force on Climate-related Financial Disclosures (TCFD) framework. – Encompasses Scope 1, 2, and 3 greenhouse gas emissions, unlike recent U.S. SEC requirements.

4. Glide Path for Disclosures – Governance, Strategy, and Risk Management pillars: FY 2025-26 onwards. – Metrics and Targets: FY 2027-28 onwards (FY 2028-29 for commercial banks, AIFIs, and NBFCs with UCBs).

5. Implications for REs – Requires significant changes to portfolio evaluation and maintenance processes. – Necessitates measurement of portfolio risks and opportunities, using estimations or proxies where data is lacking. – Demands comprehensive end-to-end portfolio risk assessment solutions. – Requires integration of climate risk into credit risk assessment processes. – Emphasizes the importance of scenario analysis for evaluating financial risks from climate change.

RBI Granted Exemption from Import Duties on Gold Imports

India has exempted its central bank, the Reserve Bank of India (RBI), from paying import duties on gold. This move aims to boost the country’s gold reserves and support the domestic gold market.

Key Points:

- Import Duty Exemption: India has allowed the RBI to import gold without paying import levies, including basic customs duty and Agriculture Infrastructure and Development Cess (AIDC).

- Gold Reserves: As of September 2023, the RBI held 800.79 metric tonnes of gold, including 39.89 tonnes of gold deposits.

- Overseas and Domestic Holdings: Of the total gold reserves, 388.06 tonnes are held overseas, while 372.84 tonnes are held domestically.

- Support for Gold Market: The exemption from import duties is expected to support the domestic gold market by reducing the cost of gold imports and making it more affordable for consumers.

Royal Sundaram Partners with Dvara KGFS to Enhance Insurance Accessibility

Royal Sundaram, a private sector general insurer, has partnered with Dvara KGFS, a non-banking finance company, to offer general insurance products in rural areas. This collaboration aims to increase insurance penetration in these regions by leveraging Dvara KGFS’s extensive branch network.

Key Points:

Partnership: – Royal Sundaram and Dvara KGFS have partnered to offer general insurance products in rural areas.

Distribution Network: – 400 branches of Dvara KGFS will offer Royal Sundaram’s general insurance products.

Product Suite: – Royal Sundaram’s comprehensive suite of general insurance products will be available to Dvara KGFS customers.

Commitment to Rural Penetration: – The partnership demonstrates Royal Sundaram’s commitment to enhancing insurance penetration in rural areas.

Value for Customers: – Customers will have access to affordable, customized, and comprehensive insurance solutions.

Innovation and Excellence: – The partnership reflects Royal Sundaram’s dedication to innovation and excellence.

Dvara KGFS’s Commitment: – Dvara KGFS is committed to delivering value and maximizing financial well-being in rural India.

Collaboration for Value Creation: – The collaboration aims to create lasting value for customers and communities.

Aadhaar Update Deadline Extended: New Date and Easy Guide to Update Your Details

The Unique Identification Authority of India (UIDAI) has extended the deadline for updating Aadhaar details for free until June 14, 2024. This extension allows Aadhaar holders to update their Proof of Identity (PoI) and Proof of Address (PoA) documents online or offline.

Key Points:

Extension of Deadline: – The deadline for updating Aadhaar details for free has been extended to June 14, 2024.

Purpose of Aadhaar: – Aadhaar is a unique 12-digit identity number that prevents duplicate numbers and detects fake identities.

Importance of Updating Aadhaar: – Updating Aadhaar ensures accurate demographic information, leading to better service delivery and successful authentication.

Online Update Process: – Log in to the myAadhaar portal using Aadhaar number and OTP. – Verify identity and address details. – Upload PoI and PoA documents (less than 2 MB in JPEG, PNG, or PDF format). – Submit consent.

Offline Update Process: – Visit the UIDAI website to locate nearby Aadhaar centers. – Enter location details or PIN code to find centers. – Visit the center and submit PoI and PoA documents.

RBI Restricts Federal Bank from Issuing Co-Branded Credit Cards

The Reserve Bank of India (RBI) has ordered Federal Bank to cease issuing co-branded credit cards, a significant revenue stream for the bank. The bank has three co-branded credit card partnerships, primarily targeting younger customers. Federal Bank is working to address the deficiencies identified by the RBI and will seek regulatory approval before resuming new card issuance.

Key Points:

- RBI Directive: RBI has directed Federal Bank to stop issuing co-branded credit cards.

- Co-Branded Credit Cards: Federal Bank has three co-branded credit card partnerships with OneCard Scapia Technology Pvt. Ltd and FI Brand Pvt Ltd.

- Target Audience: Co-branded credit cards primarily target new generation customers.

- Bank’s Response: Federal Bank is rectifying deficiencies and will seek regulatory clearance before resuming new issuance.

- Existing Customers: The bank will continue to service existing co-branded credit card holders.

- Non-Co-Branded Credit Cards: Federal Bank will continue to offer credit cards in the non-co-branded segment.

- Gross Advances: At the end of December 2023, Federal Bank’s gross advances through credit cards stood at Rs 2778 crore, with co-branded cards contributing about 75%.

RBI Penalizes Bank of India and Bandhan Bank for Regulatory Violations

The Reserve Bank of India (RBI) has imposed penalties on Bank of India, Bandhan Bank, and Indostar Capital Finance Ltd for non-compliance with regulatory norms.

Key Points:

Bank of India:

- Penalty: Rs 1.4 crore

- Non-compliance with directions related to:

- Interest rate on deposits

- Customer service in banks

- Interest rate on advances

- Credit Information Companies Rules, 2006

Bandhan Bank:

- Penalty: Rs 29.55 lakh

- Non-compliance with certain directions

Indostar Capital Finance Ltd:

- Penalty: Rs 13.60 lakh

- Non-compliance with:

- Monitoring of Frauds in NBFCs (Reserve Bank) Directions, 2016

- KYC directions

Finance Ministry Directs PSU Banks to Conduct Thorough Assessment of Gold Loan Portfolios

The Finance Ministry has instructed state-owned banks to review their gold loan portfolios due to concerns over non-compliance with regulatory norms. The review will cover the period from January 1, 2022, to January 31, 2024, and will focus on ensuring compliance with regulations and internal policies.

Key Points:

Non-Compliance with Regulatory Norms: – Instances of non-compliance with regulatory norms have been noticed by the government.

Comprehensive Review: – Banks have been asked to undertake a comprehensive review of their gold loan business.

Specific Concerns: – Disbursement of gold loans without requisite gold collateral. – Anomalies regarding collection of fees and repayment in cash.

Review Period: – The review will cover the period from January 1, 2022, to January 31, 2024.

Gold Price Surge: – The price of gold has surged to a record level, highlighting the importance of proper gold loan management.

SBI’s Gold Loan Portfolio: – State Bank of India (SBI) has a gold loan portfolio of Rs 30,881 crore as of December 2023.

RBI Norms: – Banks can provide only 75% of the value of the jewellery as gold loans. – Relaxation was provided during COVID-19 to mitigate hardship, but it expired on March 31, 2021.

IIFL Finance Restriction: – RBI has barred IIFL Finance Ltd from disbursing gold loans due to supervisory concerns, including deviations in assaying and certifying gold purity.

Apprenticeship Programs for MSMEs: Potential for Reduced Duration and Enhanced Compensation

The Indian government is exploring measures to enhance apprenticeship training within micro, small, and medium enterprises (MSMEs) to foster a skilled workforce. These initiatives aim to reduce apprenticeship duration, increase stipend subsidies, provide tax incentives, and engage the private sector to address staffing shortages in MSMEs.

Key Points:

1. Measures to Boost Apprenticeship Training:

- Reducing apprenticeship tenure from six months to three months

- Raising stipend subsidy for MSMEs to 50% from 25%

- Offering tax incentives to MSMEs for hiring apprentices

- Collaborating with the private sector to provide manpower to MSMEs

2. Rationale for Focus on MSMEs:

- MSMEs account for 38.4% of manufacturing output and 45.03% of exports

- Employ 23% of the workforce (110 million workers)

- Contribute 27% to GDP

3. Need for Tripartite Engagement:

- Industry, academia, and the private sector should collaborate to enhance apprenticeship training

- Industry chambers and staffing companies can facilitate apprentice deployment across MSMEs

4. Alignment with Economic Goals:

- Apprenticeship training aligns with India’s aspirations to become a developed nation by 2047

- Supports economic growth and skilled workforce development.

Television Prices Poised for 10% Increase in April Amidst Open Cell Rate Surge

Television panel manufacturers are planning to raise prices again in April due to rising open cell prices, which have increased by 30% in the past year. The price hike is expected to be around 10%, affecting both small and large screen panels.

Key Points:

Open Cell Price Increase: – Open cell prices have increased by 30-35% in the last year. – Open cell manufacturers have decided to cut production, leading to increased demand and higher prices.

Impact on Television Prices: – Television panel manufacturers expect open cell prices to continue to increase. – Manufacturers may raise prices by up to 10% in April. – The price hike will affect both small and large screen panels.

Open Cell Contribution to Manufacturing Cost: – Open cell contributes 60-65% to the manufacturing cost of televisions. – The increase in open cell prices will raise manufacturing costs by 3-8%.

Demand for Television Panels: – Demand for television panels has been soft post the festival season. – Manufacturers are passing on the price increase to customers.

Adani Accuses Short Seller of Defaming India’s Governance Practices

Gautam Adani, chairman of the Adani group, alleges that the short-selling attack by Hindenburg Research aimed to not only destabilize the group but also politically defame India’s governance practices. Despite the initial impact on Adani group shares, the company recovered and Adani emphasizes the importance of resilience and rising above adversity. He highlights the growth potential of India’s economy and stock market, predicting a tenfold increase in market capitalization and the emergence of trillion-dollar valued companies.

Key Points:

- Hindenburg Attack:

- Objective was to destabilize Adani group and politically defame India’s governance.

- Adani group remained resilient and recovered after the initial impact.

- Challenges and Success:

- Success attracts challenges and targets.

- True measure of success lies in overcoming adversities.

- Digital Revolution:

- Democratized the playing field, creating opportunities for more companies.

- Emergence of disruptive tech billionaires.

- India’s Economic Growth:

- Accelerated growth in Gross Domestic Product.

- Anticipated addition of a trillion dollars to GDP every 18 months.

- Path to becoming a 25-30 trillion-dollar economy by 2050.

- Stock Market Growth:

- Total market capitalization expected to increase tenfold to $40-45 trillion.

- India will have its own trillion-dollar valued companies.

- Billion-Dollar Valued Companies:

- India now has over 500 billion-dollar valued companies, ranking fourth in the world.

- Significant growth from none in 1991.

Government Introduces EMPS Scheme to Encourage Electric Two- and Three-Wheelers, Excluding Four-Wheelers

The Indian government has launched the Electric Mobility Promotion Scheme (EMPS) 2024 to promote the sale of electric two-wheelers (e2W) and three-wheelers (e3W). The scheme, with a budget of Rs 500 crore, will be valid for four months from April 1, 2023. The government has reduced the subsidy cap for e2W and e3W to encourage industry growth and prepare for a post-subsidy environment.

Key Points

Scheme Details

- New scheme: Electric Mobility Promotion Scheme (EMPS) 2024

- Budget: Rs 500 crore

- Duration: Four months from April 1, 2023

Subsidy Changes

- Reduced subsidy cap for e2W: Rs 10,000 per vehicle

- Reduced subsidy cap for e3W: Rs 50,000 per vehicle

- Incentive of Rs 5,000 per kilowatt-hour (kWh) for both e2W and e3W

Exclusions

- No incentives for e4W and e-buses under EMPS 2024

- Existing schemes (Auto PLI and PM-eBus Sewa Scheme) cover e4W and buses

EV Sales and Penetration

- Robust increase in EV sales in 2023: Over 45%

- Total EV registration in 2023: Close to 1.5 million units

- Overall EV penetration in India: 6.3% (up from 4.8% in 2022)

Niti Aayog Advocates for Enhanced Financing and E-commerce Integration to Accelerate MSME Export Growth

Niti Aayog emphasizes the need to enhance export opportunities for MSMEs by simplifying access to export finance and promoting e-commerce exports. The report highlights the challenges faced by small businesses in entering foreign markets and suggests measures to address these obstacles.

Key Points:

1. Challenges Faced by MSMEs in Export Markets:

- Economies of scale hinder small enterprises from accessing export markets.

- Compliance requirements, cost-effective production, and logistics management pose challenges.

2. E-commerce Exports as a Growth Engine:

- E-commerce platforms can facilitate seamless exports for MSMEs.

- India lags behind China in e-commerce exports due to cumbersome compliance processes.

3. Recommendations for Boosting E-commerce Exports:

- Implement “green channel” clearances for MSME e-commerce exporters.

- Distinguish between Exporter on Record (EOR) and Seller on Record (SOR).

- Allow reduction in invoice value without percentage ceiling.

- Introduce annual financial reconciliation process for e-commerce exporters.

- Exempt import duties on rejects/returns.

- Consider exemption on reconciliation requirements for shipments up to $1000.

4. National Trade Network (NTN):

- NTN is essential to ease compliance burdens for MSMEs.

- It should operate as an end-to-end single window system.

5. Access to Finance:

- Export Credit Guarantee (ECG) can improve working capital availability for MSMEs.

- Increase uptake of ECGC schemes to 50% or more.

- Create a single marketplace for export credit providers to reduce costs.

6. Information Asymmetry:

- Establish a single information portal to provide accurate data on tariffs, compliance, finance, and incentives.

7. Data Accuracy:

- Existing estimates of MSME exports are unreliable and inflated.

- Accurate measurement and tracking of impact are crucial for improvement.

8. Compliance Exemption and Incentive Disbursement:

- Exempt MSMEs from compliance burdens for a determined period.

- Forgive errors in compliance during the learning phase.

- Ensure time-bound disbursement of incentives to avoid working capital blockage.

9. Export Potential:

- MSMEs have an export potential of $318 billion in segments such as herbal supplements, wood products, jewellery, handicrafts, and handloom textiles.

Test Your Understanding

Question 1: How many electoral bonds were sold between April 1, 2019, and February 15, 2024, according to the State Bank of India (SBI)?

a) 22,030

b) 22,217

c) 22,300

d) 22,500

Question 2: What is the deadline for the Election Commission of India (ECI) to upload the data on electoral bonds furnished by SBI?

a) March 12

b) March 13

c) March 14

d) March 15

Question 3: What is the reason for Paytm FASTag users being advised to obtain a new FASTag from another bank by March 15, 2024?

a) Expiry of Paytm FASTags

b) Increase in toll charges

c) Restrictions imposed by the Reserve Bank of India

d) Upgrade of FASTag technology

Question 4: What will happen if Paytm FASTag users fail to obtain a new FASTag from another bank by the specified deadline?

a) Their vehicles will be impounded

b) They will be charged double fees at toll plazas

c) Their Paytm FASTags will automatically recharge

d) They will receive a refund for their existing balance

Question 5: What are the thematic pillars of disclosure required by the Reserve Bank of India’s draft guidelines for climate-related financial risks?

a) Technology, Innovation, Efficiency, and Adaptation

b) Governance, Strategy, Risk Management, and Metrics

c) Sustainability, Renewable Energy, Carbon Footprint, and Recycling

d) Policy, Regulation, Compliance, and Enforcement

Question 6: When are regulated entities expected to begin disclosing metrics and targets related to climate-related financial risks according to the RBI’s draft guidelines?

a) FY 2023-24

b) FY 2025-26

c) FY 2027-28

d) FY 2029-30

1 thought on “Complete Daily Banking Digest – Electoral Bond Transactions: 22,217 Purchased, 22,030 Redeemed”