Welcome to Daily Banking Digest, your premier source for the latest news and insights on February 27, 2024, focusing on banking, the economy, and finance. Our platform offers a comprehensive overview of the day’s most critical financial stories, market trends, and economic developments. Whether you’re a professional in the financial sector, an investor monitoring market movement, or someone interested in staying informed about the economic landscape, Daily Banking Digest provides reliable, up-to-date information.

Join our Telegram Channel for Daily PDF in your Inbox – Click Here

Table of Contents

Big move. MCA to refer larger unlisted firms governance framework matter to CLC next month

India’s Ministry of Corporate Affairs (MCA) is working to create a stricter regulatory framework for large unlisted companies. This effort aims to improve corporate governance in these companies and potentially address issues seen in recent controversies, such as the case of Byju’s.

Key Points

- Company Law Committee (CLC) Involvement: The MCA will task the CLC with developing recommendations for a regulatory framework for large unlisted companies.

- Potential Requirements: The CLC might suggest quarterly financial reporting for large unlisted companies, similar to the requirements for listed companies.

- Urgency: The MCA might implement stricter regulations even before the CLC submits its report, based on stakeholder feedback.

- Motivation: Former SEBI Chairman Ajay Tyagi recommended tighter governance oversight for mature startups, influencing the MCA’s actions.

- MCA’s Approach: The MCA wants to be seen as a “light touch” regulator and prefers not to interfere with companies’ daily operations.

- Byju’s Case: The MCA is expediting the release of an inspection report on Byju’s and might have considered an SFIO probe into the company.

- Byju’s Controversies: Recent corporate governance lapses and delayed financial reporting have tarnished Byju’s reputation and valuation.

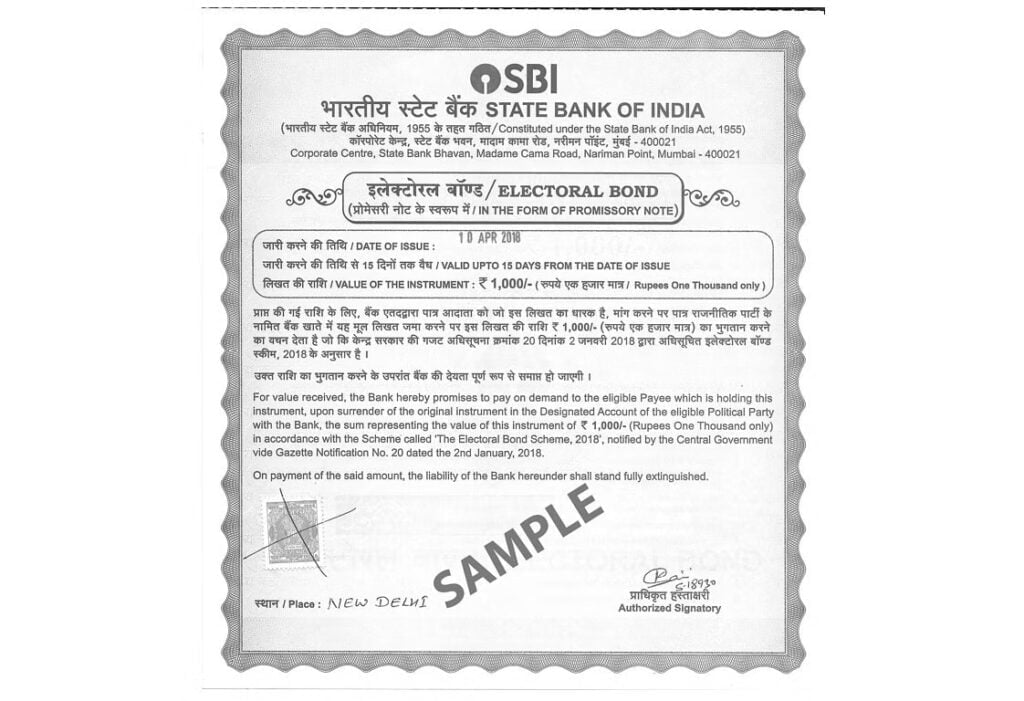

Annulling of electoral bonds will lead to greater transparency: Amartya Sen.

Nobel Laureate Amartya Sen applauds the recent Supreme Court ruling that annulled the electoral bonds scheme in India. He believes this decision will increase transparency in political funding and highlights issues with India’s electoral system.

Key Points

- Sen’s Support: Amartya Sen calls the electoral bonds scheme a “scandal” and welcomes the Supreme Court’s decision to strike it down.

- Increased Transparency: Sen anticipates greater transparency in political funding as a result of this ruling.

- Challenges in India’s Electoral System: Sen points out that India’s electoral system is influenced by party politics and the government’s treatment of the opposition, making it difficult for common people to have their voices heard.

- Constitutional Intent: Sen emphasizes that India’s constitution aims to provide political freedom to all citizens without granting special privileges to any particular group.

- Congressional Support Senior Congress leader P. Chidambaram echoes Sen’s sentiment, praising the Supreme Court’s decision as a win for transparency.

Swiggy changes registered name ahead of IPO.

Swiggy, the food and grocery delivery company, has changed its registered name to “Swiggy Pvt Ltd” as it prepares for an Initial Public Offering (IPO). This change aligns the company’s legal name with its well-known brand.

Key Points

- Name Change: Swiggy’s registered name has changed from “Bundl Technologies Pvt Ltd” to “Swiggy Pvt Ltd”.

- IPO Preparation: The name change aligns the company for an IPO under the well-recognized “Swiggy” brand.

- Board Changes: Swiggy has recently made several changes to its board of directors, appointing Anand Kripalu as Chairperson and adding new independent directors.

- Valuation: Investor Invesco has increased Swiggy’s valuation to $8.3 billion, marking a positive assessment of the company’s value.

- Financial Performance: Swiggy’s revenue is growing, but losses have also increased in the most recent fiscal year.

Paytm advisory panel discussing terms of reference with company: Damodaran.

An advisory committee formed by Paytm is working to address the Reserve Bank of India’s (RBI) restrictions on Paytm Payments Bank. The committee, headed by former SEBI chairman M. Damodaran, is figuring out its scope and leadership. Meanwhile, the RBI is exploring options to migrate Paytm customers to other banks.

Key Points

- Advisory Committee Formation: Paytm established an advisory committee led by M. Damodaran to strengthen compliance and address regulatory concerns raised by the RBI.

- Committee’s Focus: The committee is currently defining its terms of reference and selecting a head.

- RBI Restrictions: The RBI has restricted Paytm Payments Bank from onboarding new customers and accepting deposits due to regulatory concerns.

- Customer Migration: The RBI is instructing the National Payments Corporation of India (NPCI) to explore migrating Paytm customers to other banks to avoid disruptions.

- Damodaran’s Views on SEBI: Damodaran believes SEBI faces bandwidth challenges in handling the volume of issues it oversees.

Govt may look at enhanced KYC requirements for certain class of corporates.

India’s government is considering stricter regulations for corporations to combat illegal activities. This includes enhanced Know Your Customer (KYC) requirements and the development of a uniform KYC system.

Key Points

- Increased Scrutiny: The government may increase scrutiny of certain types of corporations, including stricter KYC requirements.

- Uniform KYC: A committee headed by the finance secretary is exploring the creation of a simplified and uniform KYC system across the financial sector.

- Focus on Corporate Governance: The Ministry of Corporate Affairs is considering stricter regulations for startups in light of recent corporate governance lapses.

- Clampdown on Illegal Activities: The government, including the Ministry of Corporate Affairs, is actively working to identify and shut down companies involved in illegal activities.

- Financial Stability Focus: The Financial Stability and Development Council (FSDC) is focused on strengthening regulations and promoting coordination within the financial sector to support economic growth.

Coalitions at WTO to help India push for open payment systems adoption, cut remittance cost: GTRI

India is advocating for the widespread adoption of open, interoperable payment systems (like UPI) at the World Trade Organization’s (WTO) Ministerial Conference. This aims to reduce the high costs of remittances (money transfers) and promote economic development.

Key Points

- India’s Proposal: India believes that open payment systems can streamline digital payments, increase competition, and lower remittance costs.

- High Remittance Costs: The current global average remittance cost (6.18%) is significantly higher than the UN’s target of 3%. India, as the world’s largest recipient of remittances, is significantly impacted.

- Potential Benefits: Widespread adoption of systems like UPI could potentially save billions of dollars annually in remittance fees.

- WTO Strategy: India will leverage existing WTO agreements to push for policy changes that support cheaper remittances.

- Potential Challenges: India may face opposition from countries with dominant financial institutions or those who prioritize financial security over efficiency.

- Solutions for Cheaper Remittances: Key strategies include promoting digital transfers, fostering interoperable systems, increasing competition, streamlining regulations, and enhancing pricing transparency.

Experts suggest regulatory reassessment to boost fintech sector and ease compliance burden.

Experts believe that India’s regulatory framework for the fintech sector needs to be re-examined to balance innovation and consumer protection. This discussion arises in the wake of the Reserve Bank of India’s (RBI) actions against Paytm Payments Bank.

Key Points

- Need for Regulatory Review: As the fintech sector grows, there’s a need to update regulations to promote financial inclusion while ensuring adequate consumer protection.

- Balancing Innovation and Regulation: Experts emphasize finding a balance between creating a nurturing environment for fintech innovation and establishing safeguards for consumers.

- Addressing Consumer Trust: Regulations should focus on ensuring transparency and security within the fintech ecosystem to increase consumer trust.

- Tailored Approach: Experts advocate for regulations tailored specifically to the fintech sector rather than a one-size-fits-all approach. They suggest lighter regulations that support the early stages of innovation.

- Collaboration and Compliance: Experts suggest increased collaboration between fintech companies and regulators, potentially using sandboxes for testing and communication, to better manage compliance and risk.

Paytm likely to partner with four banks for enabling UPI transactions, sources say.

India’s Paytm, facing regulatory restrictions from the Reserve Bank of India (RBI), is seeking partnerships with major banks to continue processing transactions on the Unified Payments Interface (UPI) system.

Key Points

- RBI Restrictions: The RBI has directed Paytm Payments Bank to halt operations, disrupting its popular payment app.

- Partnership Strategy: Paytm is in talks with major banks, including Axis Bank, HDFC Bank, State Bank of India, and Yes Bank, to act as service providers and facilitate UPI transactions.

- NPCI Involvement: The National Payments Corporation of India (NPCI) will evaluate and approve banks partnering with Paytm, a process expected to take a month.

- User Migration: Paytm users will likely need to switch to updated UPI handles linked to partner banks.

- Bank Interest: Yes Bank’s CEO has expressed openness to a partnership if it aligns with RBI regulations and makes commercial sense.

Banks await RBI approval to appoint a second whole-time director.

Several private sector banks in India are waiting for regulatory approval from the Reserve Bank of India (RBI) to appoint a second Whole Time Director (WTD) to their boards. This comes after the RBI issued a directive mandating the presence of at least two WTDs.

Key Points

- RBI Mandate: In October 2023, the RBI instructed banks to have two WTDs (including the MD & CEO) to address the growing complexity of the banking sector and succession planning.

- Banks Seeking Approval: Banks including IDFC First Bank, City Union Bank, CSB Bank, South Indian Bank, and Karur Vysya Bank have submitted proposals for a second WTD and are awaiting RBI approval.

- Challenges for Some Banks: Dhanlaxmi Bank and Tamilnad Mercantile Bank need to first revise their Articles of Association before seeking regulatory approval for a second WTD. This process could lead to delays.

- Approval Process: Banks typically need approval from their board, the RBI, and their shareholders to appoint a second WTD.

- Status of Specific Banks: The article details the status of various banks in the process of appointing a second WTD, including those awaiting approval and those who haven’t started the process yet.

Govt’s dividend income from RBI in FY25 to be similar to FY24: Report

The Indian government expects to receive a dividend payment from the Reserve Bank of India (RBI) similar to the amount received in the previous financial year. This could impact the government’s borrowing plans.

Key Points

- Dividend Expectation: The government anticipates a dividend from the RBI for the current fiscal year that’s roughly equal to the amount received in the previous year (874.16 billion rupees / $10.55 billion).

- Budget Allocation: The government’s budget for fiscal 2025 includes a surplus transfer of 1.02 trillion rupees from the RBI and public sector banks, but the exact breakdown between the two is not provided.

- Borrowing Review: The government is carrying modest cash balances and will soon review its borrowing requirements via treasury bills to see if there’s potential to reduce borrowing levels.

Real GDP growth likely expanded by 7% in December quarter: Report

Deutsche Bank, a German brokerage, predicts India’s real GDP growth for the December quarter to be surprisingly strong at 7%. This exceeds earlier expectations and suggests continued economic resilience.

Key Points

- Strong Growth Prediction: Deutsche Bank forecasts India’s economic growth for the December quarter to be 7%, higher than previous estimates.

- Data-Driven Analysis: The prediction is based on analysis of high-frequency indicators such as industrial production, exports, imports, bank credit, and consumer goods.

- Resilient Economy: The report highlights India’s economic resilience despite global challenges like the Russia-Ukraine war.

- Positive Corporate Outlook: Robust corporate profits suggest strong industrial sector growth during the quarter.

- Long-Term Growth Potential: Deutsche Bank emphasizes India’s potential for sustained 6-6.5% GDP growth over the next two decades, driven by ongoing reforms.

Govt on course to achieve small savings scheme collection target for FY24.

The Finance Ministry expresses confidence in meeting its target for small savings collections despite the government’s modest cash balance situation. The article also highlights the progress on capital expenditure.

Key Points

- Small Savings Target: The government is on track to meet its small savings collection goal for the fiscal year 2023-24, having collected 64% of the target as of early February.

- Scheme-Specific Progress: Collections for specific schemes like the Senior Citizens’ Savings Scheme and Mahila Samman Savings Certificate have shown significant growth.

- Modest Cash Balance: The government’s cash balance is not high, as borrowings are complete, requiring careful financial management.

- Fiscal Responsibility: The government aims to maintain fiscal discipline with targets of 5.8% of GDP for FY24 and 5.1% of GDP for FY25.

- Capital Expenditure Focus: As of February, the government has achieved 80% of its FY24 capital expenditure target, reflecting an emphasis on infrastructure and development.

Govt concludes G-Sec borrowing for current fiscal.

The Indian government plans to adjust its borrowing strategy for the remainder of the fiscal year, focusing on borrowing only as needed. It has completed its G-Sec borrowing and anticipates a dividend from the Reserve Bank of India (RBI) similar to the previous year.

Key Points

- Prudent Borrowing: The government will not borrow through Treasury Bills (T-Bills) simply for the sake of borrowing. They plan to borrow only what is necessary.

- T-Bill Auctions: While the government had planned for 13 weekly T-Bill auctions during the January-March quarter, only eight have been completed so far.

- G-Sec Borrowing Completed: The government has fulfilled its borrowing target for long-term bonds (dated G-Secs) for the current fiscal year.

- RBI Dividend: The government expects a dividend payment from the RBI for the current fiscal year similar to the amount received in the previous year.

- Expenditure Status: As of early February, capital expenditure stands at 80% of the revised estimates, exceeding the 79% progress on revenue expenditure.

FM asks regulators to hold monthly meetings with fintechs, start-ups.

India’s Finance Minister, Nirmala Sitharaman, proposes regular monthly meetings between fintech companies, startups, and regulators. This comes in the wake of the Reserve Bank of India’s (RBI) actions against Paytm, highlighting the need for improved communication and regulatory compliance within the fintech sector.

Key Points

- Proposed Monthly Meetings: The Finance Minister suggests monthly virtual meetings to address concerns and issues faced by fintech companies and startups.

- India’s Fintech Landscape: India has a thriving fintech sector with over 10,000 companies, placing it third globally in this space.

- Regulatory Focus: The meeting follows the RBI’s restrictions on Paytm Payments Bank due to regulatory compliance issues.

- Addressing Challenges: Government agencies like DPIIT plan to streamline patent processes and address cybercrime concerns through the new Digital India Act.

- Meeting Participants: The meeting included representatives from major fintech companies (RazorPay, PhonePe, Google Pay, Amazon Pay), NPCI, and government officials from the Finance Ministry, MeitY, and the RBI.

Collection in Senior Citizen Saving Scheme surged over two times, MIS saw 4 time rise.

India has seen a significant increase in investments made through specific small savings schemes, notably the Senior Citizen Saving Scheme (SCSS), Monthly Income Scheme (MIS), and the Mahila Samman Savings Certificate.

Key Points

- SCSS and MIS Growth: Collections through the SCSS have doubled, and MIS collections have increased fourfold in the current fiscal year.

- Mahila Samman Savings Certificate: The recently launched Mahila Samman Savings Certificate has generated significant investments.

- Reasons for Growth: Officials attribute the surge in collections to the enhancement of deposit limits for these schemes.

- Overall Small Savings: Overall, small savings collections have reached 64% of the revised estimated target for the fiscal year.

- Interest Rate Revision: The next round of interest rate revision for small savings schemes is pending, with the potential for a downward trend in rates.

RBI imposes ₹ 2 crore penalty on SBI; also fines Canara Bank, City Union Bank

The Reserve Bank of India (RBI) has imposed financial penalties on several banks, including State Bank of India (SBI), Canara Bank, and City Union Bank, and an NBFC (Ocean Capital Market) for violating various regulatory guidelines.

Key Points

- SBI Penalty: SBI faces a ₹2 crore penalty for exceeding shareholding limits as a pledgee and failing to credit funds to the Depositor Education and Awareness Fund within the stipulated time.

- Canara Bank Penalty: Canara Bank is fined ₹32.30 lakh for issues with data reporting to Credit Information Companies and the restructuring of certain accounts that were not standard assets.

- City Union Bank Penalty: City Union Bank is fined ₹66 lakh for divergence in NPA classification and inadequate KYC compliance.

- Ocean Capital Market Penalty: The NBFC Ocean Capital Market faces a ₹16 lakh fine for delayed returns submission, exceeding exposure limits, and failure to form required Board committees.

Paytm Founder and CEO Vijay Shekhar Sharma steps down from Paytm Payments Bank board

Paytm founder Vijay Shekhar Sharma has resigned from the Paytm Payments Bank board as part of a restructuring effort. The Payments Bank is appointing new independent directors to its board, moving away from having nominee directors.

Key Points

- Sharma’s Resignation: Vijay Shekhar Sharma, who held both a nominee position from One97 Communications and a personal majority stake in the Payments Bank, has resigned from the board.

- Board Restructuring: Paytm Payments Bank is transitioning to a board structure composed entirely of independent and executive directors.

- New Independent Directors: Four new independent directors have been appointed: Srinivasan Sridhar, Debendranath Sarangi, Ashok Kumar Garg, and Rajni Sekhri Sibal.

- Focus on Compliance: The restructuring and new appointments emphasize Paytm Payments Bank’s commitment to regulatory compliance and best practices.

RBI announces Financial Literacy Ideathon

The Reserve Bank of India (RBI) has launched a Financial Literacy Ideathon for postgraduate students, aimed at developing innovative strategies to promote financial literacy among young adults.

Key Points

- Ideathon Challenge: Students are invited to submit ideas on how to effectively reach young adults and teach them about responsible financial behavior (saving, budgeting, banking, etc.).

- Theme: The Ideathon aligns with the RBI’s Financial Literacy Week 2024 theme: “Make a Right Start – Become Financially Smart”.

- Submission Details: Entries (up to 2,000 words) can be submitted between February 26th and March 20th, 2024.

- Prizes: The top three submissions will receive cash prizes (1st: ₹1 lakh, 2nd: ₹75,000, 3rd: ₹50,000).

- Idea Usage: The RBI may implement the winning ideas to improve financial literacy outreach.

Japanese and Korean cities to be developed in Noida, authority allocates land.

India’s Yamuna Expressway Industrial Development Authority (YEIDA) plans to establish ‘Japanese’ and ‘Korean’ industrial cities focused on electronics manufacturing, aiming to attract investment from these countries. These cities will be located near the upcoming Noida International Airport.

Key Points

- Dedicated Cities: YEIDA will allocate specific sectors for the establishment of a ‘Japanese City’ (395 hectares) and a ‘Korean City’ (365 hectares).

- Electronics Focus: These cities will primarily house companies specializing in the production of chips, semiconductors, AI equipment, and cameras.

- Self-Sufficient Design: The cities will include residential areas, schools, hospitals, and other amenities for Japanese and Korean residents.

- Investor Interest: The decision follows meetings with Japanese and Korean investors prior to the UP Global Investors Summit and subsequent visits by delegations.

- Supportive Policies: The state government’s FDI policy, offering land cost exemptions and other concessions, has been instrumental in attracting these investments.

- Mixed Land Use: Land within the sectors will be allocated for industrial (70%), commercial (13%), residential (10%), institutional (5%), and other facilities (2%).

- Funding: The project’s estimated cost is Rs 2,544 crore, with YEIDA seeking an interest-free loan from the state government for 50% of the amount.

GIFT City taps RBI for RTGS-like dollar payment system

Officials from GIFT City are consulting with the Reserve Bank of India (RBI) to create a new, more efficient dollar payment system. The proposed system aims to streamline dollar transactions for entities within GIFT City.

Key Points

- Current Inefficiencies: Currently, dollar transactions from a bank’s foreign nostro account to a GIFT City subsidiary can take several hours.

- Proposed System: The new system could potentially function similarly to the Real-Time Gross Settlement System (RTGS).

- Settlement Bank: One proposal involves establishing a single “settlement bank” in GIFT City where entities would maintain dollar balances for faster debits and credits.

- Potential Facilitator: The Clearing Corporation of India (CCIL), with its expertise in payment systems, might be involved in operating the proposed system.

- Context: This initiative aligns with the RBI’s 2023 decision to allow banks in GIFT City to offer rupee-based non-deliverable derivatives contracts to resident non-retail users for hedging purposes.

Balance sheets of SFBs are larger than those of universal banks: Panel.

Despite being eligible, no Small Finance Banks (SFBs) have applied to become universal banks, even though RBI regulations allow them to do so after five years of operation. Industry experts at the Business Standard BFSI Insight Summit 2023 discussed the reasons behind this and the considerations for SFBs contemplating this transition.

Key Points

- Need for Diverse Offerings: Experts emphasize that SFBs should develop a broader range of products and services before seeking a universal bank license.

- Maintaining Focus: SFBs should avoid losing sight of their core focus on serving underserved populations while expanding their product lines.

- Reasons for Hesitancy: The discussion delved into the potential factors behind SFBs not pursuing the universal bank path despite eligibility. It’s important to note that the article doesn’t explicitly list these reasons, so we can only speculate. Some possible reasons could be:

- Stringent Regulations: Universal banks face stricter regulations, which SFBs may not be ready to comply with.

- Operational Complexity: Managing a universal bank is significantly more complex, requiring additional resources and expertise.

- Market Competition: The banking landscape is highly competitive, and SFBs may prefer to focus on their niche rather than directly competing with larger universal banks.

Govt forms panel headed by T V Somanathan to finalise uniform KYC norms

India’s government has formed an expert committee, led by Finance Secretary T V Somanathan, to develop recommendations for uniform Know Your Customer (KYC) norms. This follows recent discussions within the Financial Stability and Development Council (FSDC).

Key Points

- Committee Formation: The newly formed committee includes representatives from various government departments and FSDC members.

- Objective: The committee aims to streamline KYC processes across the financial sector, potentially leading to greater efficiency and consistency.

- Collaborative Approach: The committee will gather input from all FSDC members to inform its recommendations.

- Potential Impact: Uniform KYC norms could simplify onboarding processes for customers and potentially reduce compliance costs for financial institutions.