Priority Sector Lending (PSL) is a crucial financial initiative aimed at providing timely and sufficient credit to key sectors of the economy that might otherwise face difficulties in accessing funds. This special provision targets sectors that have a significant impact on large portions of the population and are known for being intensive sources of employment.

Table of Contents

Priority Sector Lending ( PSL ) is an important role given by the RBI to the banks for providing a specified portion of the bank lending to few specific sectors like agriculture and allied activities, micro and small enterprises, poor people for housing, students for education and other low income groups and weaker sections. This is essentially meant for all round development of the economy as opposed to focussing only on the financial sector.

With an objective to harmonize various instructions issued to Commercial Banks, Small Finance Banks (SFB), Regional Rural Bank (RRB), Urban Cooperative Bank (UCBs) and Local Area Banks (LABs), align these guidelines with the emerging national priorities and bring sharper focus on inclusive development, and also aiming to encourage and support environment friendly lending policies to help achieve Sustainable Development Goals (SDGs), taking into account the recommendations made by the “Expert Committee on Micro, Small and Medium Enterprises, Chairman Shri U K Sinha and the “Internal Working Group to Review Agricultural Credit” Chairman Shri M K Jain apart from discussions with all stakeholders, in 2020, RBI revised the guideline on Priority Sector Lending for all Commercial Banks, SFBs, RRBs, UCBs and LABs superseding the earlier Master Directions on PSL.

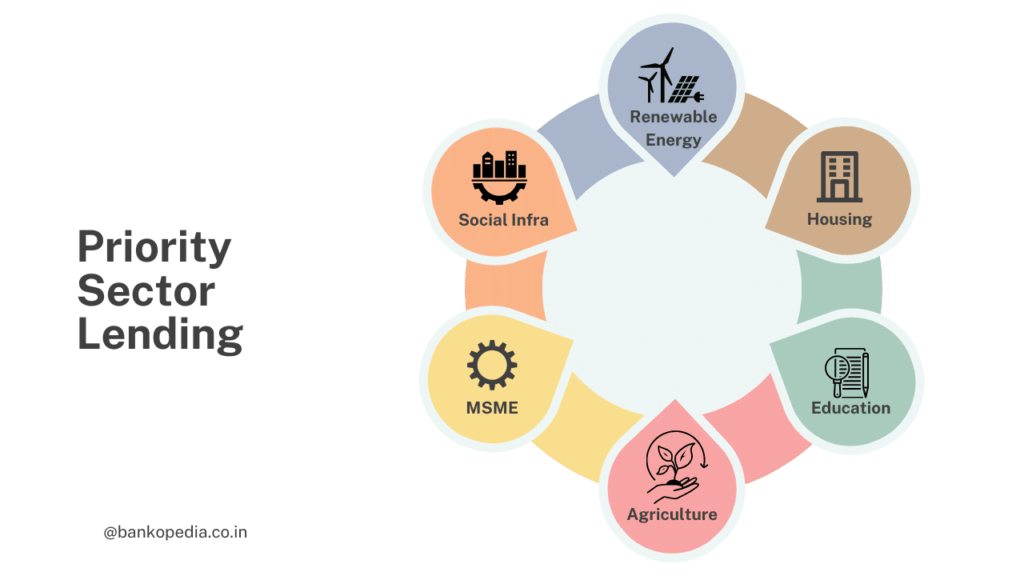

8 – Categories Under Priority Sector Lending

Priority Sector Lending have been categorised into the following 8 categories.

- Agriculture

- Micro, Small & Medium Enterprises

- Export Credit

- Education

- Housing

- Social Infrastructure

- Renewal Energy and

- Others

Targets/Sub-Targets of Financial Institutes for Priority Sector Lending

| Categories | Domestic Commercial Banks & Foreign Banks with 20 Branches and above | Foreign Banks with Less Than 20 Branches | Regional Rural Banks | Small Finance Banks |

| Total Priority Sector | 40% of ANBC or CEOBE whichever is higher | 40% of ANBC or CEOBE whichever is higher; out of which up to 32% can be in the form of lending to Exports and not less than 8% can be to any other priority sector. | 75% of ANBC or CEOBE whichever is higher; However lending to Medium Enterprises, Social Infrastructure and Renewable Energy shall be reckoned for priority sector achievement only upto 15% of ANBC. | 75% of ANBC or CEOBE whichever is higher. |

| Agriculture | 18% of ANBC or CEOBE, whichever is higher; out of which a target of 10%* is Small and Marginal Farmers. | Not Applicable | 18% of ANBC or CEOBE, whichever is higher, out of which a target of 10%* is prescribed for Small and Marginal Farmers. | 18% of ANBC or CEOBE whichever is higher out of which a target a target of 10%* is prescribed for Small and Marginal Farmers. |

| Micro Enterprises | 7.5% of ANBC or CEOBE, whichever is higher. | Not Applicable | 7.5% of ANBC or CEOBE, whichever is higher. | 7.5% of ANBC or CEOBE, whichever is higher. |

| Weaker Sections | 12%^ of ANBC or CEOBE, whichever is higher. | Not Applicable | 15% of ANBC or CEOBE, whichever is higher. | 12%^ of ANBC or CEOBE, whichever is higher. |

| *Revised targets for Agriculture and Small and Marginal Farmers will be implemented in a phased manner as below | ||||

Revised targets for Banks – Small and Marginal Farmers and Weaker Sections in phased manner from upwards FY 2021-2022

| Financial Year | Small & Marginal Farmers * | Weaker Section ^ |

| 2020-21 | 8% | 10% |

| 2021-22 | 9% | 11% |

| 2022-23 | 9.5% | 11.5% |

| 2023-24 | 10% | 12% |

Priority Sector Lending Target and Classification – Primary Urban Co-operative Bank

| Categories | Primary Urban Co-Operative Bank |

| Total Priority Sector | 40% of ANBC or CEOBE, whichever is higher, which shall increase to 75% of ANBC or CEOBE, whichever is higher, w.e.f from March 31, 2024. UCBs shall comply with the stipulated target as per the following schedule. Existing Target March 31, 2021 March 31, 2022 March 31, 2023 March 31, 2024 40% 45% 50% 60% 75% |

| Micro Enterprises | 7.5%^ of ANBC or CEOBE whichever is higher. |

| Weaker Sections | 12% of ANBC or CEOBE whichever is higher |

Important point: All domestic banks (other than UCBs) and foreign banks with more than 20 branches to ensure that the overall lending to Non-Corporate Farmers (NCFs) does not fall below the system-wide average of the last three years’ achievement which will be separately notified every year. The target for lending to the non-corporate farmers for FY 2021-22 was 12.73% and for 2022-23, it was 13.78% of ANBC or CEOBE, whichever is higher. (erstwhile target for direct lending to the agriculture sector).

Calculation of ANBC for the Priority Sector Lending

| Bank Credit in India [As prescribed in item No.VI of Form `A‘ under Section 42(2) of the RBI Act, 1934] | I |

| Bills Rediscounted with RBI and other approved Financial Institutions | II |

| Net Bank Credit (NBC)* | III (I – II) |

| Outstanding Deposits under RIDF and other eligible funds with NABARD, NHB, SIDBI and MUDRA Ltd in lieu of non-achievement of priority sector lending targets/sub-targets + outstanding PSLCs | IV |

| Eligible amount for exemptions on issuance of long-term bonds for infrastructure and affordable housing. | V |

| Advances extended in India against the incremental FCNR (B)/NRE deposits, qualifying for exemption from CRR/SLR requirements, as per the Reserve Banks. | VI |

| Investments made by public sector banks in the Recapitalization Bonds floated by Government of India | VII |

| Other investments eligible to be treated as priority sector (e.g. investments in securitised assets) | VIII |

| Face Value of securities acquired and kept under HTM category under the TLTRO 2.0 and also Extended Regulatory Benefits under SLF-MF Scheme. | IX |

| Bonds/debentures in Non-SLR categories under HTM category | X |

| For UCBs: investments made after August 30, 2007 in permitted non SLR bonds held under ‗Held to Maturity‘ (HTM) category | XI |

| ANBC (Other than UCBs) III + IV- (V+VI+VII) +VIII – IX + X | |

| ANBC for UCBs III + IV – VI – IX + XI | |

* For the purpose of priority sector computation only. Banks should not deduct / net any amount like provisions, accrued interest, etc. from NBC.

While calculating Net Bank Credit as above, if banks subtract prudential write-off at

Corporate/Head Office level, then the credit to priority sector and all other sub-sectors so written-off should also be subtracted category wise from priority sector and sub-target achievement. Wherever, investments or any other items which are treated as eligible for classification under priority sector target / sub-target achievement, the same should also form part of Adjusted Net Bank Credit.

Description of the Eligible Categories under Priority Sector

Agriculture

The activities covered under Agriculture are classified under Three sub-categories viz

- Farm Credit

- Agricultural Infrastructure and

- Ancillary Services

Farm Credit

Under farm credit direct finance includes:

- Loans to individual Farmers [including Self Help Groups (SHGs) or Joint Liability Groups (JLGs), i.e. groups of individual farmers, provided banks maintain disaggregated data of such loans] and Proprietorship Firms of farmers, directly engaged in Agriculture and Allied Activities viz dairy, fishery, animal husbandry, poultry, bee keeping and sericulture. This will include further.

- Crop loans to farmers, which will include traditional/non-traditional plantations and horticulture, and loans for allied activities

- Medium and long terms loans to farmers for agriculture and allied activities (e.g. purchase of agricultural implements and machinery, loans for irrigation and other developmental activities undertaken in the farm, and developmental loans for allied activities).

- Loans to farmers for pre- and post-harvest activities viz spraying, weeding, harvesting, sorting, grading and transporting of their own farm produce.

- Loans to farmers up to Rs 75 lakh against NWRs/eNWRs and up to Rs 50 Lakh against warehouse receipts other than NWRs/eNWRs against pledge/hypothecation of agricultural produce for a period not exceeding 12 months.

- Loans to distressed farmers indebted to non-institutional lenders.

- Loans to farmers under Kisan Credit Card Scheme

- Loans to Small and Marginal Farmers for purchase of land for agricultural purposes.

- Loans to farmers for installation of solar power plants on barren/fallow land or in stilt fashion on agricultural land owned by farmers.

- Loans to farmers for installation of standalone Solar Agriculture Pumps and for solarisation of grid connected Agricultural Pumps.

- Loans to corporate farmers, farmers’ producer organizations/companies of individual farmers, partnership firms and co-operatives of farmers directly engaged in Agriculture and Allied Activities viz dairy, fishery, animal husbandry, poultry, bee-keeping and sericulture.

- Loans for the following activities up to an aggregate limit of Rs 2.00 Crore per borrower entity

- Crop Loans to farmers which will include traditional/non-traditional plantations and horticultural, and loans for allied activities.

- Medium and long-term loans to farmers for agriculture and allied activities (e.g purchase of agricultural implements and machinery, loans for irrigation and other developmental activities undertaken in the farm, and development loans for allied activities)

- Loans to farmers for pre and post-harvest activities viz spraying, weeding harvesting, sorting, grading and transporting of their own farm produce.

- Loans upto Rs 75 Lakh against NWRs/eNWRs and up to Rs 50 Lakh against warehouse receipts other than NWRs/eNWRs against pledge/hypothecation of agricultural produce for a period not exceeding 12 months.

- Loans upto Rs 5 Crore per borrowing entity to FPOs/FPCs undertaking farming with assured marketing of their produce at a pre-determined price.

It may be noted that UCBs are not permitted to lend to co-operatives of farmers.

Agriculture Infrastructure

- Loans for construction of storage facilities (warehouse, market yards, godowns and silos) including cold storage units/cold storage chains designed to store agriculture produce/products, irrespective of their location.

- Soil conservation and watershed development.

- Plant tissue culture and agri-biotechnology, seed production, production of bio-pesticides, bio-fertilizers and vermi composting.

- Loans for construction of oil extraction/processing units for production of bio-fuels, their storage and distribution infrastructure along with loans to entrepreneurs for setting up Compressed Bio Gas (CBG) plants.

For above loans, an aggregate sanctioned limit of Rs 100.00 Crore per borrower from the banking system will apply.

Ancillary Activities

- Loans up to Rs 5.00 Crore to co-operative societies of farmers for purchase of the produce of members. However, this is not applicable to UCBs.

- Loans upto Rs 50 crore to Starts-ups as per definition of Ministry of Commerce and Industry, Government of India that are engaged in agriculture and allied services.

- Loans for Food and Agro-processing up to an aggregate sanctioned limit of Rs 100.00 crore per borrower from the banking system.

- Loans for setting up of Agriclinics and Agribusiness Centers.

- Loans to Custom Service Units managed by individuals, institutions or organisations who maintain a fleet of tractors, bulldozers, well boring equipment, threshers, combines, etc and undertake farm work for farmers on contract basis.

- Banks loans to Primary Agricultural Credit Societies (PACS), Farmers’ Service Societies (FSS) and Large Sized Adivasi Multi-Purpose Societies ( LAMPS) for on-lending to agricultural.

- Loans sanctioned by banks to MFI’s and NBFCs for on-lending to agriculture sector as per the conditions specified.

- Outstanding deposits under RIDF and other eligible funds with NABARD on account of priority sector shortfall.

Small and Marginal Farmers = Sub – Target:

For the purpose of computation of achievement of sub-target, Small and Marginal Farmers will include the following:-

- Farmers with landholding of up to 1 hectare (Marginal Farmers). Farmers with a landholding of more than 1 hectare and up to 2 hectares (Small Farmers).

- Landless agricultural labourers, tenant farmers, oral lessees and share croppers, whose share of land-holding is within the limits prescribed for small and marginal farmers.

- Loans to Self Help Groups (SHGs) or Joint Liability Groups (JLGs) i.e. groups of individual Small and Marginal farmers directly engaged in Agriculture and Allied Activities, provided banks maintain disaggregated data of such loans.

- Loans up to Rs 2.00 Lac to individuals solely engaged in Allied activities without any accompanying land holding criteria.

- Loans to FPOs/FPC of individual farmers and co-operatives of farmers directly engaged in Agriculture and Allied Activities where the landholding share of SMFs is not less than 75% subject to loan limits prescribed for farm credits above.

Micro, Small and Medium Enterprises (MSMEs)

As per new definition, an enterprise will be classified as a Micro, Small or Medium enterprises on the basis of the following criteria, namely.

- A micro enterprise, where the investment in plant and machinery or equipment does not exceed Rs 1.00 Crore and turnover does not exceed Rs 5.00 Crore.

- A small enterprise, where the investment in plant and machinery or equipment does not exceed Rs 5.00 Crore and turnover does not exceed Rs 50.00 crore and

- A medium enterprise, where the investment in plant and machinery or equipment does not exceed Rs 50.00 crore and turn over does not exceed Rs 250.00 crore.

Factoring Transactions

- Factoring Transactions on ‘with recourse’ basis by banks which carry out the business of factoring departmentally, wherever the ‘assignor’ is a Micro, Small or Medium Enterprise, subject to the corresponding limits for investment in plant and machinery/equipment and other extant guidelines for priority sector classification. Such outstanding factoring portfolios may be classified by Banks under MSME category on the reporting date.

- Factoring transactions taking place through the Trade Receivables Discounting System (TReDS) shall also be eligible for classification under priority sector.

- Lending Bank shall obtain from the borrower periodical certificates regarding factored receivables to avoid double financing/counting.

Khadi and Village Industries Commission (KVIC)

All loans to units in the KVIC will be eligible for classification under the sub-target of 7.5 per cent prescribed for Micro Enterprises under priority sector.

Other Finance to MSMEs

- Loans to entities involved in assisting the decentralised sector in the supply of inputs to and marketing of outputs of artisans, village and cottage industries.

- Loans to co-operatives of producers in the decentralized sector viz artisans, village and cottage industries.

- Loans sanctioned by banks to NBFCs and MFIs for on-lending to MSME sector as per the conditions specified.

- Credit outstanding under General Credit Cards (including Artisans Credit Card, Laghu Udyami Card, Swarojgar Credit Card and Weaver’s Cars etc in existence and catering to the non-farm entrepreneurial credit needs of individuals)

- Overdrafts extended by banks to Pradhan Mantri Jan Dhan Yojana (PMJDY) account holders as per limits and conditions prescribed by Department of Financial Services, Ministry of Finance from time to time, will qualify as achievement of the target for lending to Micro Enterprises.

- Outstanding deposits with SIDBI and MUDRA Ltd on account of priority sector shortfall.

- Loans up to Rs 50.00 Crore to Start Ups as per the definition of Ministry of Commerce and Industry, Government of India that confirm to the definition of MSME.

Export Credit

Export credit under agriculture and MSME sectors are allowed to be classified as PSL in the respective categories viz agriculture and MSME. Export Credit (other than in agriculture and MSME) will be allowed to be classified as priority sector as per the following table

| Domestic Banks | Foreign Banks with 20 branches and above | Foreign Banks with less than 20 branches |

| Incremental export credit over corresponding date of the preceding year, up to 2 per cent of ANBC or Credit Equivalent Amount of Off-Balance Sheet Exposure, whichever is higher, subject to a sanctioned limit of up to Rs 40.00 Crore per borrower. | Incremental export credit over corresponding date of the preceding year, up to 2 per cent of ANBC or Credit Equivalent Amount of Off-Balance Sheet Exposure, whichever is higher. | Export credit will be allowed up to 32 per cent of ANBC or Credit Equivalent Amount of Off Balance Sheet Exposure, whichever is higher. |

Education

Loans to individuals for educational purposes, including vocational courses, not exceeding Rs. 20 lakh will be considered as eligible for priority sector classification. Loans currently classified as priority sector will continue till maturity.

Housing

- Loans to individuals up to Rs.35 lakh in metropolitan centres (with population of ten lakh and above) and up to Rs.25 lakh in other centres for purchase/construction of a dwelling unit per family provided the overall cost of the dwelling unit in the metropolitan centre and at other centres does not exceed Rs.45 lakh and Rs.30 lakh respectively. Existing individual housing loans of UCBs presently classified under PSL will continue as PSL till maturity or repayment.

- Housing loans to banks‟ own employees will not be eligible for classification under the priority sector.

- Since Housing loans which are backed by long term bonds are exempted from ANBC, banks should not classify such loans under priority sector. Investments made by UCBs in bonds issued by NHB / HUDCO on or after April 1, 2007 shall not be eligible for classification under PS.

- Loans up to Rs.10 lakh in metropolitan centres and up to Rs.6 lakh in other centres for repairs to damaged dwelling units.

- Bank loans to any governmental agency for construction of dwelling units or for slum clearance and rehabilitation of slum dwellers subject to dwelling units with carpet area of not more than 60 sq.mtrs.

- Bank loans for affordable housing projects using at least 50% of FAR/FSI for dwelling units with carpet area of not more than 60 square meters.

- Bank loans to HFCs (approved by NHB for their refinance) for on-lending, up to Rs.20 lakh for individual borrowers, for purchase/construction/ reconstruction of individual dwelling units or for slum clearance and rehabilitation of slum dwellers.

- Outstanding deposits with NHB on account of priority sector shortfall.

Social Infrastructure

Bank loans to social infrastructure sector as per limits prescribed below are eligible for priority sector classification.

- Bank loans up to a limit of Rs.5 crore per borrower for setting up schools, drinking water facilities and sanitation facilities including construction/ refurbishment of household toilets and water improvements at household level, etc. and loans up to a limit of Rs.10 crore per borrower for building health care facilities including under “Ayushman Bharat” in Tier II to Tier VI centres. In case of UCBs, the above limits are applicable only in centres having a population of less than one lakh.

- Bank loans to MFIs extended for on-lending to individuals and also to members of SHGs/JLGs for water and sanitation facilities. (not applicable to RRBs, UCBs and SFBs).

Renewable Energy

Bank loans up to a limit of Rs.30 crore to borrowers for purposes like solar based power generators, biomass-based power generators, wind mills, micro-hydel plants and for non-conventional energy based public utilities, viz., street lighting systems and remote village electrification etc., will be eligible for Priority Sector classification. For individual households, the loan limit will be Rs.10 lakh per borrower.

Others

- Loans provided directly by banks to individuals and individual members of SHG/JLG satisfying the prescribed criteria.

- Loan not exceeding Rs. 2 Lacs provided by banks to SHG/JLG for activities other than agriculture or MSME, viz, loan for meeting social needs, construction or repair of house, construction of toilets or any viable, common activity started by SHGs.

- Loans to distress persons [other than distressed farmers indebted to non-institutional lenders] not exceeding Rs.1.00 lakh per borrower to prepay their debt to non-institutional lenders.

- Loans sanctioned to State Sponsored Organisations for SC / ST for the specific purpose of purchase and supply of inputs and/or the marketing of the outputs of the beneficiaries of these organisations.

- Loans up to Rs.50 crore to Start-ups, as per definition of Ministry of Commerce and Industry, Govt. of India that are engaged in activities other than Agriculture or MSME.

Weaker Sections

Priority Sector Loans to the following borrowers will be considered under Weaker Sections Category

- Small and Marginal Farmers

- Artisans, village and cottage industries where individual credit limit do not exceed Rs 1 Lakh.

- Beneficiaries under Government Sponsored Schemes such as National Rural Livelihood Mission (NRLM), National Urban Livelihood Mission (NULM) and Self Employment Scheme for Rehabilitation of Manual Scavengers (SRMS).

- Scheduled Castes and Scheduled Tribes.

- Beneficiaries of Differential Rate of Interest (DRI) Scheme.

- Self-Help Groups.

- Distressed Farmers indebted to non-institutional lenders.

- Distressed persons others than farmers, with loan amount not exceeding Rs 1.00 Lakh per borrower to prepay their debt to non-institutional lenders.

- Individual Women Beneficiary up to Rs 1.00 Lakh per borrower.

- Persons with disabilties.

- Overdraft to Pradhan Mantri Jan Dhan Yojana (PMJDY) account holders as per limits and conditions prescribed by Department of Financial Services, Ministry of Finance from time to time.

- Minority Communities as may be notified by Government of India from time to time.

Investment by Banks in Securitized Assets

Investment by banks in securitized assets, representing loans to various categories of priority sector, except ‘other category’ are eligible for classification under of respective categories of priority sector depending on the underlying assets provided.

- The securitized assets are originated by banks and financial institutions and are eligible to be classified as priority sector advances prior to securitization and fulfil the Reserve Bank of India guidelines on securization.

- The all inclusive interest charged to the ultimate borrower by the originating entity should not exceed the investing bank’s MCLR plus 10 per cent or EBLR + 14 per cent annum.

- The investment in securitized assets originated by MFIs, which comply with the guidelines in the RBI Master Circular on PSL dated: 04th September, 2020 are exempted from this interest cap as there are separate caps on margin and interest rate.

- Investment made by banks in securitized assets originated by NBFCs, where the under lying assets are loans against gold jewellery are not eligible for priority sector status.

Transfer of Assets Through Direct Assignment/Outright Purchases

Assignment/Outright purchases of pool of assets by banks representing loans under various categories for priority sector, except the ‘others’ category, will be eligible for classification under respective categories of priority sector provided:

- The assets are originated by banks and financial institutions which are eligible to be classified as priority sector advances prior to the purchase and fulfill the Reserve Bank of India guidelines on outright purchase/assignment.

- The all-inclusive interest charged to the ultimate borrower by the originating entity should not be exceed the investing bank’s MCLR’s + 10% or EBLR + 14%.

- The assignment/outright purchases of eligible priority sector loans from MFI’s, which comply with the guidelines in the RBI Master Circular on PSL dated: 04th September, 2020 are exempted from this interest cap as there are separate caps on margin and interest rate for MFI’s.

- When the bank undertakes outright purchase of loan assets (eligible to classified under Priority Sector from banks/financial institutions) they must report the outstanding amount actually disbursed to priority sector borrowers and not the premium embedded amount paid to the seller.

- Purchase/Assignment/Investment transaction undertaken by banks with NBFCs where the underlying assets are loan against gold jewellery, are not eligible for priority sector status.

Types of Banker Customer Relationship – bankopedia

3 thoughts on “Priority Sector Lending – Complete Guidelines”