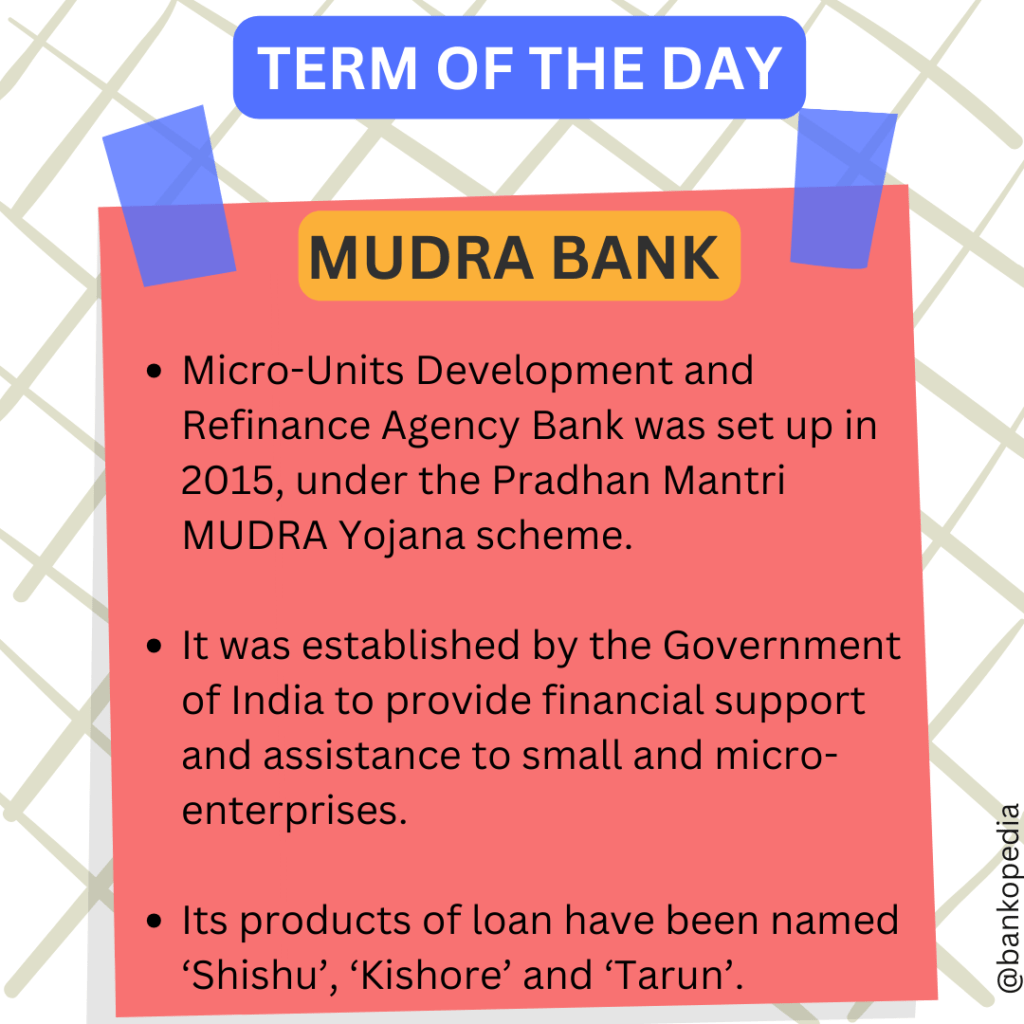

In India, the Micro Units Development and Refinance Agency Bank (Mudra Bank) is playing a pivotal role in empowering entrepreneurs and revolutionizing small business financing. As a public sector financial institution, Mudra Bank aims to provide financial support to micro and small enterprises, facilitating their growth and contributing to the overall development of the country’s economy. By offering accessible and affordable credit, Mudra Bank is creating opportunities for aspiring entrepreneurs to turn their business dreams into reality.

The Need for Small Business Financing

Small businesses are the backbone of any economy, providing employment opportunities and driving innovation. However, one of the major challenges faced by these enterprises is the lack of access to adequate financial resources. Traditional banks often hesitate to provide loans to small businesses due to perceived risks and collateral requirements. This financial gap hinders the growth and sustainability of many promising ventures. Recognizing this need, Mudra Bank was established to address the financing requirements of micro and small enterprises.

How Mudra Bank is Revolutionizing Small Business Financing

Mudra Bank has revolutionized small business financing in several ways. Firstly, it has simplified the loan application process, making it accessible to a larger number of entrepreneurs. By offering three different loan categories – Shishu, Kishor, and Tarun – Mudra Bank caters to the diverse needs of micro and small enterprises at different stages of their growth. The bank provides collateral-free loans, eliminating one of the major barriers faced by small businesses when seeking financing. Additionally, Mudra Bank offers competitive interest rates, making it more affordable for entrepreneurs to borrow and invest in their businesses.

Moreover, Mudra Bank has established a vast network of partner institutions, including commercial banks, regional rural banks, cooperative banks, and microfinance institutions. By partnering with these institutions, Mudra Bank is able to extend its reach and support entrepreneurs in every corner of the country. This collaborative approach ensures that entrepreneurs can access financing in their local communities, thereby fostering economic growth at the grassroots level.

Mudra Bank’s Role in Supporting Entrepreneurs

Mudra Bank plays a crucial role in supporting entrepreneurs by providing them with the necessary financial resources to start, expand, or diversify their businesses. Through its loan schemes, Mudra Bank aims to uplift individuals from marginalized sections of society, including women, scheduled castes, and tribes, who face additional challenges in accessing traditional financing. By empowering these entrepreneurs, Mudra Bank is not only improving their economic well-being but also promoting social inclusion and equality.

In addition to financial support, Mudra Bank also offers various capacity-building initiatives, including business development programs and financial literacy campaigns. These programs equip entrepreneurs with the knowledge and skills needed to manage their businesses effectively. By combining financial assistance with entrepreneurial training, Mudra Bank ensures that entrepreneurs have the tools they need to succeed in today’s competitive business environment.

Mudra Bank Loan Schemes and Eligibility Criteria

Mudra Bank offers three loan schemes – Shishu, Kishor, and Tarun – to cater to the diverse needs of micro and small enterprises. The Shishu scheme provides loans up to INR 50,000 for businesses in their early stages, while the Kishor scheme offers loans ranging from INR 50,000 to INR 5 lakh for businesses looking to expand. The Tarun scheme provides loans up to INR 10 lakh for established businesses seeking further growth and diversification.

To be eligible for a loan from Mudra Bank, an entrepreneur must be engaged in income-generating activities in the non-farm sector. The applicant’s business should fall under the defined category of micro or small enterprises, as per the criteria set by the Government of India. Additionally, the applicant should have a good credit history and a viable business plan. Meeting these criteria ensures that the loans are provided to deserving entrepreneurs who have the potential to contribute to the country’s economic growth.

Success Stories of Entrepreneurs Supported by Mudra Bank

Mudra Bank’s impact can be witnessed through the success stories of numerous entrepreneurs who have benefited from their financial support. One such inspiring story is that of Rani, a young woman from a rural village who dreamt of starting her own tailoring business. With the help of a Shishu loan from Mudra Bank, she purchased sewing machines, raw materials, and established her small enterprise. Today, Rani’s business has grown significantly, providing employment opportunities to other women in her village and contributing to the local economy.

Another remarkable success story is that of Rajesh, an aspiring entrepreneur who wanted to expand his small grocery store. With the support of a Kishor loan from Mudra Bank, he renovated his store, increased his inventory, and introduced new product lines. As a result, his business witnessed a substantial increase in sales, leading to higher profits and the ability to employ more staff. Rajesh’s success story demonstrates how Mudra Bank has not only empowered him but also created a positive ripple effect in his community.

Challenges and Limitations of Mudra Bank

While Mudra Bank has made significant strides in empowering entrepreneurs and revolutionizing small business financing, it also faces certain challenges and limitations. One of the primary challenges is the high incidence of loan defaults, particularly in the Shishu category. Due to the absence of collateral requirements, some borrowers fail to repay their loans, leading to increased non-performing assets for Mudra Bank. Addressing this challenge requires a comprehensive approach involving financial literacy programs, mentorship, and improved monitoring of loan utilization.

Another limitation faced by Mudra Bank is the limited awareness among entrepreneurs about its loan schemes and eligibility criteria. Many potential beneficiaries are unaware of the financial support available to them through Mudra Bank, leading to underutilization of its services. To overcome this limitation, targeted awareness campaigns and outreach programs need to be conducted to educate entrepreneurs about the benefits and requirements of Mudra Bank’s loan schemes.

Government Initiatives to Promote Entrepreneurship through Mudra Bank

Recognizing the importance of entrepreneurship in driving economic growth, the Government of India has taken several initiatives to promote entrepreneurship through Mudra Bank. These initiatives include providing refinancing assistance to partner institutions, ensuring the availability of adequate funds for lending to entrepreneurs. The government has also introduced policies to simplify the loan application process and reduce the turnaround time for loan approvals. Furthermore, various skill development programs have been launched to enhance the entrepreneurial capabilities of individuals, making them more eligible for Mudra Bank loans.

Additionally, the government has encouraged the banking sector to prioritize lending to micro and small enterprises through the Pradhan Mantri MUDRA Yojana. Under this scheme, banks are incentivized to increase their lending to entrepreneurs, thereby amplifying the impact of Mudra Bank in supporting small businesses. These government initiatives have played a crucial role in creating a favorable ecosystem for entrepreneurship and have significantly contributed to the success of Mudra Bank in empowering entrepreneurs across the country.

How to Apply for a Loan at Mudra Bank

Applying for a loan at Mudra Bank is a straightforward process. Entrepreneurs can approach any of the partner institutions, such as commercial banks, regional rural banks, cooperative banks, or microfinance institutions, to submit their loan application. The application form, available at these institutions, requires basic information about the entrepreneur and their business, along with details of the loan amount and purpose. The applicant should also provide supporting documents, such as identity proof, address proof, and business registration documents.

Once the application is submitted, the partner institution assesses the entrepreneur’s eligibility based on Mudra Bank’s loan schemes and criteria. If the application is approved, the loan amount is disbursed to the entrepreneur’s bank account, and they can start utilizing the funds for their business needs. It is important for entrepreneurs to maintain a good credit history and repay the loan on time to ensure their continued eligibility for future financing from Mudra Bank.

Conclusion: The Impact of Mudra Bank on Small Business Growth

Mudra Bank has emerged as a game-changer in the field of small business financing in India. By providing accessible and affordable credit to micro and small enterprises, Mudra Bank has empowered countless entrepreneurs to realize their business aspirations. Through its loan schemes, capacity-building initiatives, and collaborative approach with partner institutions, Mudra Bank has created an enabling environment for entrepreneurship and economic growth. Despite the challenges and limitations it faces, Mudra Bank continues to play a crucial role in fueling the growth of small businesses and contributing to the overall development of the country. As the government and Mudra Bank work hand in hand to promote entrepreneurship, the future holds great promise for aspiring entrepreneurs seeking financial support to turn their dreams into reality.

CTA: To explore the opportunities and benefits offered by Mudra Bank’s loan schemes, visit their official website or reach out to any of their partner institutions. Empower yourself and your business with the financial support you need to thrive in the competitive market.

1 thought on “Empowering Entrepreneurs: How Mudra Bank is Revolutionizing Small Business Financing”