Every nation’s financial pulse is often set by the levers of its central bank, guiding the country’s economic health. In the expansive framework of India’s monetary policy, the Reserve Bank of India (RBI) prominently uses the Repo Rate and Reverse Repo Rate. These interest rates influence everything from personal loans to business investments. This article delves into the intricacies of these rates and their impact on India’s economy.

1. The Repo Rate Explained

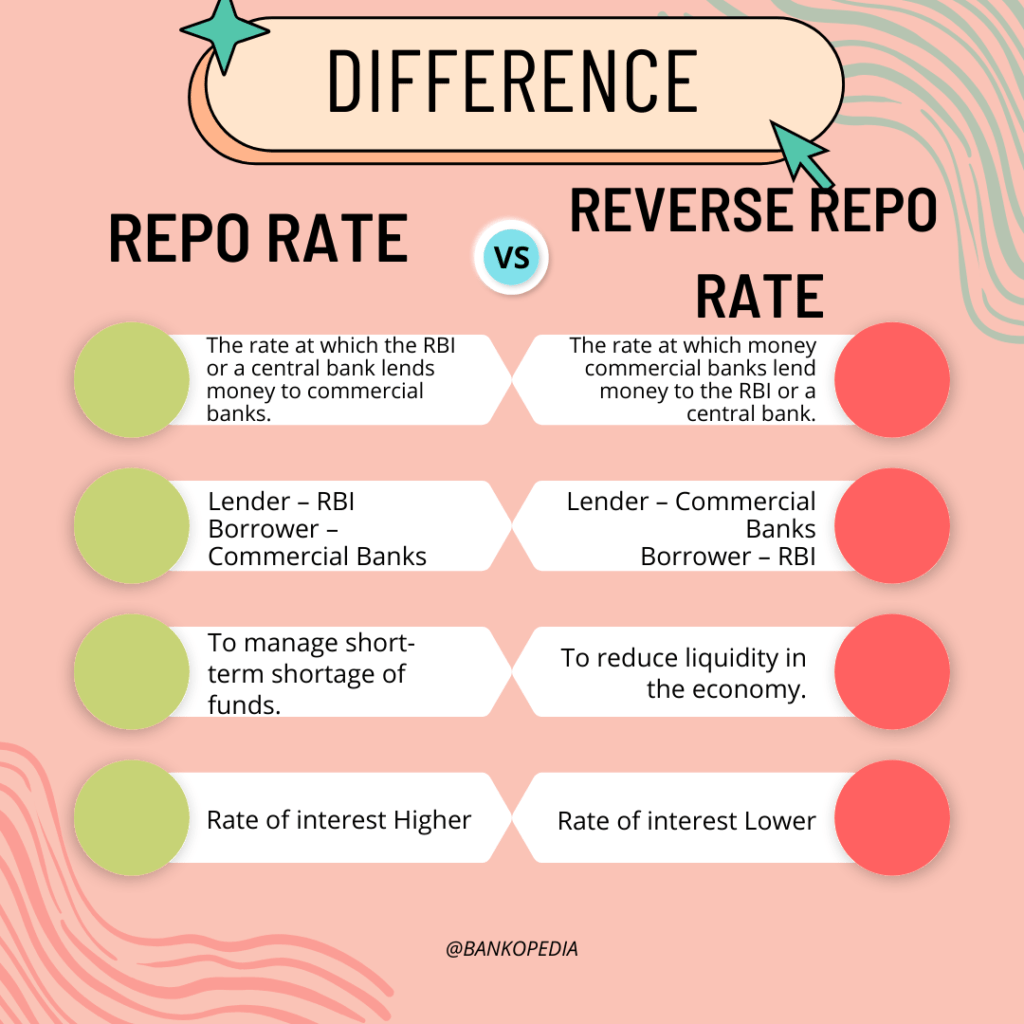

Definition: Often referred to as the repurchase rate, the repo rate represents the interest rate at which commercial banks borrow short-term funds from the RBI. This borrowing happens by selling their securities, primarily government bonds, to the RBI with a clear agreement to repurchase them on a predetermined date.

Purpose: The RBI’s overarching aim in adjusting the repo rate lies in its mandate to control inflation and regulate liquidity in the economy. When inflation rates rise beyond a comfortable threshold, the RBI may decide to increase the repo rate. By doing so, borrowing becomes more expensive for commercial banks, which often leads to a decreased money supply in the economy, thereby putting a downward pressure on inflation. Conversely, in times of economic slowdown, the RBI might reduce the repo rate to spur economic activity by making borrowing more affordable.

2. Decoding the Reverse Repo Rate

Definition: Standing in contrast to the repo rate, the reverse repo rate is the rate at which RBI borrows money from the commercial banks. It essentially signifies the return banks get when they park their excess funds with the central bank.

Purpose: The RBI utilizes the reverse repo rate to manage and absorb the excess liquidity in the banking system. If the RBI observes an excess money supply, it might choose to increase the reverse repo rate. By offering a higher return on funds parked with it, the RBI encourages banks to hold more funds, thereby reducing liquidity in the market.

Interrelation and Broader Economic Impacts

While they serve distinct purposes, the repo and reverse repo rates are inherently interlinked. Typically, an adjustment in the repo rate is accompanied by a proportional change in the reverse repo rate.

For instance:

- A decrease in the repo rate signifies the RBI’s intent to stimulate economic activity. With reduced borrowing costs, businesses can invest and expand, potentially leading to job creation and increased consumer spending.

- On the other hand, an upward adjustment in the reverse repo rate means the RBI is trying to absorb excess liquidity. By incentivizing banks to park more funds with it, the RBI can help curb inflationary pressures.

Ripple Effects on the Layman’s Life

These rates, while primarily technical tools for economic management, have palpable effects on everyday financial decisions:

- Loans: A drop in the repo rate can translate to reduced interest rates on home, car, or personal loans. This can be a boon for potential homeowners or consumers eyeing a new vehicle.

- Savings: When the reverse repo rate rises, banks might offer better interest rates on savings accounts or fixed deposits, benefiting those looking for safe investment avenues.

- Investments: Stock markets often react to interest rate changes. A lower repo rate can enhance business profitability prospects, driving up stock market indices. Conversely, high-interest rates might make debt instruments like bonds more attractive compared to equities.

The intricate dance between the Repo Rate and the Reverse Repo Rate, choreographed by the RBI, shapes the financial narrative of India. As instruments, while they primarily interact with banks and financial institutions, their reverberations touch various sectors of the economy, influencing the decisions of both businesses and individuals. Understanding these rates and their implications, therefore, is paramount for anyone engaged in the financial fabric of India, be it a casual investor, a business magnate, or an everyday consumer.